- /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 27

https://porscheclassy.com/wp-content/uploads/2017/04/UBA-House-2-1-e1495552980863.jpg&description=UBA Puts Customers First, Introduces World Class Mobile Banking App', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

- Share

- Tweet /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 69

https://porscheclassy.com/wp-content/uploads/2017/04/UBA-House-2-1-e1495552980863.jpg&description=UBA Puts Customers First, Introduces World Class Mobile Banking App', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

-

BIG STORY4 days ago

BIG STORY4 days agoPressure Mounts on Omooba Abimbola Onabanjo To Step Down But He Refuses As Political Plot To Capture Awujale Stool Falters

-

BIG STORY4 days ago

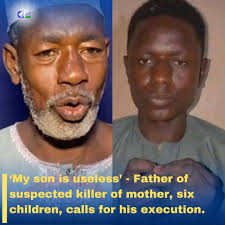

BIG STORY4 days agoFather Of Man Who Killed Mother, Six Children Wants Him Killed Without Trial

-

BIG STORY3 days ago

BIG STORY3 days agoAwujale Stool: Protest Rocks Ijebu Ode Over Imposition Plot

-

NEWS5 days ago

NEWS5 days agoSuccession Tension In Ijebu Land As Alleged Smear Campaign Targets Omooba Abimbola Onabanjo

-

BIG STORY4 days ago

BIG STORY4 days agoICPC To Arraign Ozekhome Monday Over UK Property As Immigration Provides More Forgery Evidence

-

BIG STORY5 days ago

BIG STORY5 days agoADC Will Bleed After Convention, Mass Exit Likely To Happen If Atiku Emerges Flagbearer —- Hakeem Baba-Ahmed

-

BIG STORY3 days ago

BIG STORY3 days agoFubara Is APC Leader In Rivers, Wike Has Been Compensated —– Bwala

-

NEWS3 days ago

NEWS3 days agoLagos Assembly Steps Down LASPA GM Nominee, Confirms Others