BIG STORY

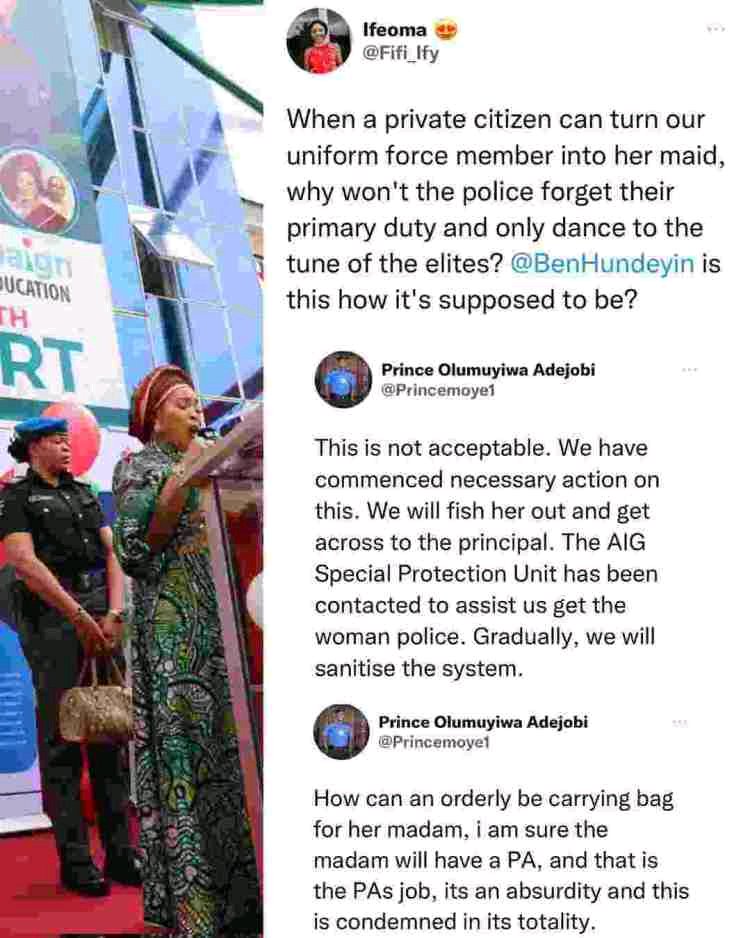

Police To Sanction Atiku Wife’s Orderly For Carrying Her Bag At Event

BIG STORY

FULL LIST: Tinubu Appoints IBB’s Son, Muhammad Babangida Chairman Bank Of Agriculture, Others As Heads Of Govt Agencies

BIG STORY

Buhari Never Wanted To Congratulate Saraki, Dogara After Emerging Senate President, Speaker — Femi Adesina

BIG STORY

Road To 2027: Everyone Afraid Of Atiku — Dele Momodu Claims As He Joins ADC

-

BIG STORY4 days ago

BIG STORY4 days agoBREAKING: Federal Government Declares Tuesday Public Holiday To Honour Buhari

-

BIG STORY5 days ago

BIG STORY5 days agoOsun 2026: Aregbesola Vows To Unseat Adeleke, Says ADC Will Win Guber Election

-

BIG STORY1 day ago

BIG STORY1 day agoRCCG Pastor Absconds With $8000 Church Money, Abandons Wife, Marries New One

-

BIG STORY3 days ago

BIG STORY3 days agoAmaechi Wears Turban To Buhari’s Burial In Daura

-

BIG STORY4 days ago

BIG STORY4 days agoECOWAS Caravan 2025 Highlights Barriers, Builds Support For Women In Cross-Border Trade

-

BIG STORY3 days ago

BIG STORY3 days agoAliko Dangote Submits Paperwork To Build Biggest Seaport In Nigeria

-

BIG STORY2 days ago

BIG STORY2 days agoKeyamo Faults Atiku’s Use Of Coat Of Arms In PDP Resignation Letter, Says “You Left Office 18 Years Ago”

-

BIG STORY3 days ago

BIG STORY3 days agoWhat Buhari Told Me About President Tinubu After Fuel Subsidy Removal — Katsina Governor Radda