- /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 27

https://porscheclassy.com/wp-content/uploads/2016/07/Zenith-Bank-hq-e1547031761885.jpeg&description=Nigerian Banks And Security Control; My Zenith Experience —– Kweku Nkrumah', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

- Share

- Tweet /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 69

https://porscheclassy.com/wp-content/uploads/2016/07/Zenith-Bank-hq-e1547031761885.jpeg&description=Nigerian Banks And Security Control; My Zenith Experience —– Kweku Nkrumah', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

BUSINESS

Wema Bank Launches “Evolution of Love” Campaign For Valentine’s Day

BUSINESS

FIRST HOLDCO PLC – TAKING THE BULL BY THE HORN WITH A RECORD IMPAIRMENT CHARGE; GROWS GROSS EARNINGS TO N3.4 TRILLION FOR THE UNAUDITED FULL YEAR ENDED DECEMBER 31, 2025.

BUSINESS

Jide Sipe Named President, Abiodun Coker of UBA, Others Emerge As ACAMB Executives

-

BIG STORY5 days ago

BIG STORY5 days agoLagos Couple Stages Self-Kidnap To Raise Funds For Husband’s US Return Ticket, Arrested With N10m Ransom

-

BUSINESS3 days ago

BUSINESS3 days agoFIRST HOLDCO PLC – TAKING THE BULL BY THE HORN WITH A RECORD IMPAIRMENT CHARGE; GROWS GROSS EARNINGS TO N3.4 TRILLION FOR THE UNAUDITED FULL YEAR ENDED DECEMBER 31, 2025.

-

ENTERTAINMENT2 days ago

ENTERTAINMENT2 days agoBurna Boy, Davido, Wizkid, Ayra Starr Lose At 2026 Grammy Awards

-

ENTERTAINMENT2 days ago

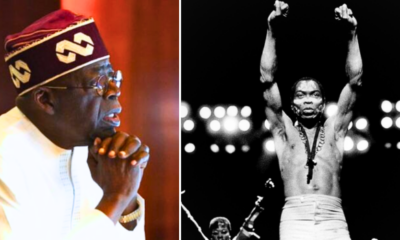

ENTERTAINMENT2 days agoTinubu Hails Fela’s Lifetime Grammy Achievement Award, Says He Was The ‘Fearless Voice Of The People’

-

BIG STORY23 hours ago

BIG STORY23 hours agoUS Set To Deport 79 Nigerians On ‘Worst-Of-The-Worst’ Criminal List [Names Attached]

-

BUSINESS3 days ago

BUSINESS3 days agoWema Bank Launches “Evolution of Love” Campaign For Valentine’s Day

-

POLITICS5 days ago

POLITICS5 days agoAPC Engaging Wike To Resolve Rivers Crisis, It Will Be Settled Amicably —– Ajibola Basiru

-

BIG STORY5 days ago

BIG STORY5 days agoResident Doctors Give Federal Government Four Weeks To Meet Demands

Pingback: Nigerian Banks And Security Control; My Nigerian Experience By A Ghanaian – 9jacable