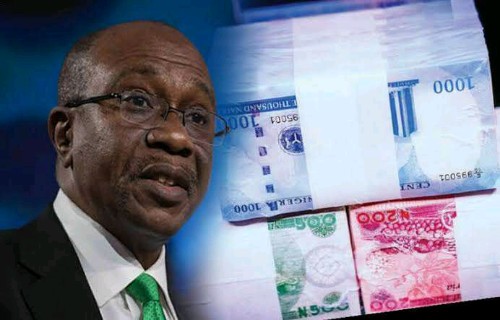

Godwin Emefiele, governor of the Central Bank of Nigeria (CBN), says N1.7 trillion worth of naira notes have been returned to banks so far — with N500 billion more to go.

He was silent on how much cash will be left outside the banking system with the naira redesign.

The bank on Sunday extended the deadline for the swap of the old notes for new ones at the commercial banks from January 31, 2023 to February 10.

Those who still have the old notes after February 10 will enjoy a seven-day “grace period” to deposit them directly with the CBN.

After February 17, the old notes will cease to be legal tender, the governor said.

In a press release on Sunday, Emefiele said: “Available data at the Central Bank of Nigeria has shown that in 2015, Currency in Circulation was only N1.4 trillion. As at October 2022, currency in circulation had risen to N3.23 trillion; out of which only N500 billion was within the Banking Industry and N2.7 trillion held permanently in people’s homes.

“Ordinarily, when CBN releases currency into circulation, it is meant to be used and after effluxion of time, it returns to the CBN thereby keeping the volume of currency in circulation under the firm control of the CBN.

“So far and since the commencement of this program, we have collected about N1.9 trillion; leaving us with about N900 billion.”

He said to achieve effective distribution of the new currency, the CBN has took a number of steps.

“We held several meetings with our Deposit Money Banks (DMBs) arid provided them with Guidance· Notes on processes they must adopt in the collection of old notes and distribution of the New Notes to all Nigerians. These includes specific directives to DMBs to load new notes into their ATMs nationwide to ensure an equitable/transparent mechanism for the distribution of the new notes to all Nigerians,” he said.

“We commenced a nationwide sensitization through the Print and electronic media to create an awareness on the redesigned notes to Nigerians including collaboration with the National Orientation agency to reach all Nigerians across multiple channels.

“We deployed 30,000 Super Agents nationwide to assist in our Cash Swap initiative in the hinterlands, rural areas, and regions underserved by banks in the Country to ensure that the weak and vulnerable ones amongst us can swap/ exchange their old notes.

“We deployed all our staff, particularly the Assistant Directors, Deputy Directors and Directors· in Abuja to proceed to all CBN branches Nationwide to join the mass mobilization campaign and monitoring programs, working with the Deposit Money Banks , agents and our Branch controllers across the 36 states of the Federation. This is meant to ensure compliance with all our guidelines already issued for smooth implementation of the program. Although we have received some reports of breaches by some bank branches, we have agreed with Executive Chairmen of the EFCC and ICPC to assist us, by sending their staff to all CBN and DMB branches nationwide to join in monitoring the implementation of these guidelines. The aim is to ensure compliance with the laid down guidelines.

“We are happy that so far, the exercise has achieved a success rate of over 75 percent of the N2.7 trillion held outside the banking system. Nigerians in the rural areas, villages, the aged and vulnerable have had the opportunity to swap their old notes; leveraging the Agent Naira Swap initiative as well as the CBN Senior staff nationwide sensitization team exercise.

“Aside from those holding illicit/ stolen Naira in their homes for speculative purposes, we do aim to give all Nigerians that have Naira legitimately earned and trapped, the opportunity to deposit their legitimately trapped monies at the CBN for exchange.”

Emefiele thanked President Muhammadu Buhari, who he described as an “incorruptible leader”, for approving the naira redesign programme.

“I’ve just ended a meeting with Mr President. The purpose of the meeting is to provide Mr President with updates about the implementation status of the CBN currency redesign program currently going on across the Federation,” he said.

“First, I’d like to continue to thank Mr President for giving the CBN the approval to embark on this ambitious program because, like I had said in the past, the Central Bank of Nigeria hasn’t had the opportunity to embark on such currency redesign program in last 19 years and indeed, let me emphasize that only an incorruptible leader of the President’s stature can give such approval to the CBN.

“From the on-set (outset) of this currency redesign program, we made it clear that for 19 years, the CBN hasn’t been able to conduct this important aspect of its mandate, whereas this should normally have been be done within a 5-8 years window.

“Our aim is mainly to make our Monetary Policy Decisions more efficacious and like you can see; we’ve started to see inflation trending downwards and exchange rates relatively stable. Secondly, we aim to support the efforts of our Security agencies in combating Banditry and Ransom taking in Nigeria through this program and we can see that the Military are making good progress in this important task in Nigeria.”

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY15 hours ago

BIG STORY15 hours ago

BIG STORY14 hours ago

BIG STORY14 hours ago

NEWS15 hours ago

NEWS15 hours ago

BIG STORY2 days ago

BIG STORY2 days ago

SPORT2 days ago

SPORT2 days ago