BIG STORY

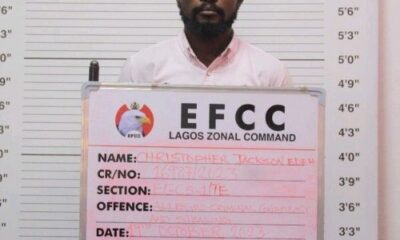

N80bn Fraud: EFCC Uncovers 17 Properties Linked To Accountant-General

-

BIG STORY2 days ago

BIG STORY2 days agoBREAKING: Sanwo-Olu Receives 60th Birthday Special Publication From Lanre Alfred At Lagos House [PHOTOS]

-

BIG STORY4 days ago

BIG STORY4 days agoUS To Revoke Citizenship Of 25 Million Naturalised Immigrant

-

BIG STORY2 days ago

BIG STORY2 days agoBREAKING: Liverpool Star Diogo Jota Dies In Car Crash At 28

-

BIG STORY3 days ago

BIG STORY3 days agoIbadan Poly Students Shut Down School Gates, Block Road Over Renaming to Olunloyo Polytechnic

-

BIG STORY2 days ago

BIG STORY2 days agoJUST IN: Atiku, Obi, El-Rufai, Opposition Coalition Leaders Arrive For ADC Unveiling

-

BIG STORY3 days ago

BIG STORY3 days agoJUST IN: NAPTIP Adds Speed Darlington On International Watchlist, Alerts Interpol

-

BIG STORY3 days ago

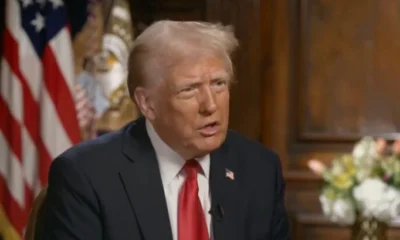

BIG STORY3 days agoWithout US Subsidies, Elon Musk Would Have To Return To South Africa — Donald Trump

-

BIG STORY2 days ago

BIG STORY2 days agoLagos Assembly Commemorates World Parliamentary Day, Summons State Attorney-General, Others Over Executive Order