- /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 27

https://porscheclassy.com/wp-content/uploads/2017/06/GTPatriot-Social_Media-e1497538548810.jpg&description=GTBank Launches GTPatriot, A Subsidized Banking Package for Nigeria’s Military and Paramilitary Personnel', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

- Share

- Tweet /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 69

https://porscheclassy.com/wp-content/uploads/2017/06/GTPatriot-Social_Media-e1497538548810.jpg&description=GTBank Launches GTPatriot, A Subsidized Banking Package for Nigeria’s Military and Paramilitary Personnel', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

-

BIG STORY4 days ago

BIG STORY4 days agoPressure Mounts on Omooba Abimbola Onabanjo To Step Down But He Refuses As Political Plot To Capture Awujale Stool Falters

-

BIG STORY4 days ago

BIG STORY4 days agoFather Of Man Who Killed Mother, Six Children Wants Him Killed Without Trial

-

BIG STORY3 days ago

BIG STORY3 days agoAwujale Stool: Protest Rocks Ijebu Ode Over Imposition Plot

-

BIG STORY4 days ago

BIG STORY4 days agoICPC To Arraign Ozekhome Monday Over UK Property As Immigration Provides More Forgery Evidence

-

BIG STORY3 days ago

BIG STORY3 days agoFubara Is APC Leader In Rivers, Wike Has Been Compensated —– Bwala

-

NEWS3 days ago

NEWS3 days agoLagos Assembly Steps Down LASPA GM Nominee, Confirms Others

-

POLITICS3 days ago

POLITICS3 days agoBREAKING: Kano Gov Dumps NNPP With 21 Lawmakers, LG Chairmen

-

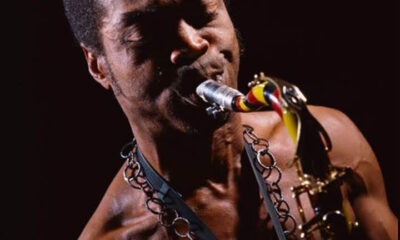

ENTERTAINMENT3 days ago

ENTERTAINMENT3 days agoFela Aníkúlápó Kuti and His Crowned Princes —– By Prince Adeyemi Shonibare