It will come to many as a surprise how GTBank has been making wonderful exploits over the years. This is because the bank has been ably managed by men of impeccable corporate pedigree.

What is now being said in many quarters is the input of the present MD/CEO, who has taken up the gauntlet from his predecessors.

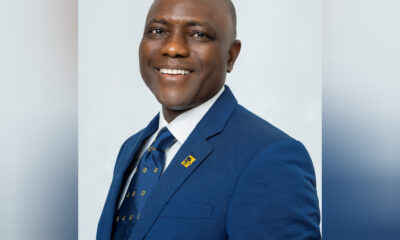

GTBank has many things to be proud of and will always be the leader in the pack. The industry is replete with many gurus, and one of them is the quintessential Segun Agbaje, who has been managing Guarantee Trust Bank with his managerial capability.

In this report, AIRWAVES REPORT team looks into the good world of banking, focusing on what GTBank has achieved in 2017. In today’s banking, innovation and customer’s satisfaction are very key.

Every bank wants to keep and grow its customers’ base by keeping to the ideals of responsive banking and making profits in the long run. Even when a clientele base is large, and the bank is not able to match up to its growing demands, efforts have to be made to ensure the clients are satisfied.

With the increasing demands of Digital Banking, a lot of banks, both old and new generation, have struggled with meeting the needs and upgrading its backbone technology infrastructure for off-line and real time banking. Guarantee Trust Bank, through its innovative style and leadership, has ensured its Flashmob 737 to make banking easy and simple at touch the of your GSM phone.

These giant strides have helped the bank in no small measure, to allow clients be able to transfer, check their credit balances and other services by just pressing 737. This has enabled the forward- looking bank to garner many awards via the Flashmob that other banks have cued behind, to have a simple code that will make banking easy and affordable. Let’s take a run-down their achievements in 2017, in the following order.

GTBank ‘737’ Generated N1trilion In One Year!

In April 2017, it was widely-reported that Guaranty Trust Bank Plc recorded over N1 trillion transactions via the bank’s 737 payment and service delivery platform. Mr Segun Agbaje, the bank’s managing director, said this at the bank’s 27th Annual General Meeting (AGM) in Lagos. Agbaje said that the bank was leading the future of payments and service delivery with the 737 platform it introduced a year ago.

The bank’s 737 platform is a USSD-based service delivery channel that provides simple banking for every Nigerian through mobile phones. The bank’s boss said “within a year of the introduction of the service, the bank recorded an uptake of over three million customers, with over N1 trillion in transactions on the platform.”

He added that the platform had gained ubiquitous acceptance and global recognition. GT Bank indeed is one of the banks that take their corporate social responsibility CSR serious. The management led by its CEO, Mr Segun Agbaje, has made CSRs an investment into critical sectors that employ one of the highest numbers of people.

GTBank Celebrated 10th Year On London Stock Exchange Listing

Last year, champagne bottles were popped in celebration of the anniversary of the bank being listed at the London Stock Exchange. This has further boosted the international clientele and wider reach of the bank, making it a bank worthy of banking with, and improving in no small terms its brand value.

Corporate Social Responsibilities idealized through GTBank Fashion Weekend

The Nigerian fashion industry has grown in leaps and bounds. With the Bank of Industry and Bank of Agriculture helping to make professionals access loans into growing their fashion companies and accessing textile credits, the industry has supported the entertainment industry in bringing out the colours and final products- clothing creatively our celebrities who strode the red carpet and paparazzi take them on.

In helping to deepen the growth of the multi million naira industry, GT Bank in 2016 decided to host a two-day fashion weekend that attracts thousands of people, vendors, couture and young make-up artistes learning from the experiences of experts in a Master Class.

The 2017 GT Fashion Weekend, held in November, will continue to linger in the memories of those that stormed the The Arena, at Water Corporation area of Victoria Island, in Lagos. Over 90 fashion retailers were at the stand to showcase their products. Hundreds of young and upcoming designers, as well as make-up artistes, gleaned from the wealth and experience of fashion experts in a Master Class.

The weekend had nine fashion runways, which showcased global designers, as models strutted the runway glamorously and stylishly. The fashion weekend has assumed a global event status where tourists visit the country to see creativity at its best.

GTBank Food and Drink Fair

Apart from the GT fashion weekend, the Food and Drink fair hosted by the bank, is another event that is gathering momentum on the national space because of its encompassing capacity to bring professionals in the food and drink subsector together in one space. Held in April 2017, the Food & Drinks festival was a forum to examine the growth and relevance of the sector and how much it had contributed to the hospitality industry. Over 100 food retailers gathered in one place at he Arena. The food fair had ten international chefs who tutored young and established cooks who desired to break into the international limelight in some years to come. The fair attracted a record, 120, 000 visitors.

The Social Media Week

In February of the same year under review, the bank sponsored the annual and engaging Social Media Week which has been the hotbed of many discussions and trends that the social media interacts with for the larger part of the year. The SMW brings Social media influencers, bloggers, experts and writers together to discuss on their relevance and how to galvanize change in the polity.

Segun Agbaje Speaks At London Business School

True to type, the visionary and exemplary leadership of the CEO of GTBank, Mr. Segun Agbaje, came to the fore in April 2017, when he was a guest speaker at the prestigious London Business School. Also, Stanford Business School hosted the banking guru and benefitted from the wealth of knowledge of the CEO extra-ordinaire.

The bank also celebrated the children who are the future of tomorrow on Children’s Day. In a carnival-like atmosphere, the event attracted thousands of children and their parents, who came to have fun, just as A-list comedians and musicians entertained.

GTBank Principal’s Cup

When it comes to School Sports, the bank has contributed immensely in the development of school sports in almost a decade. In partnership with the state of excellence, Lagos State, the GT Principal’s Cup annually engages scores of secondary schools in a football tournament. This has helped in no small measure to act as a pool where Under-17 footballers are being found and honed; to compete and bring honour and glory to the country.

GTBank Masters Cup, Season 6

One of the golf tournaments that the high-flying bank also sponsors is the GT Bank Masters Cup. Now in its seventh season, the tournament has added to the growing list of golf tournaments in the country and this is about improving the sport.

Ndani TV

The highly creative and interactive TV program, is part of the ways, the bank has supported the entertainment and media industry. Ndani TV, an online TV show, which creates content and markets them, once hosted an entrepreneurship reality show.

Tagged ‘The African Dream,’ the reality TV show hosted Ethiopian award-winning fashion entrepreneur, who deals in making of shoe wears and other products. A business reality show which is in its 2nd Season, was solely sponsored by the bank in August of this same year under review.

Tagged CAMPO RealTalk GTBank 2017, the business reality show was to create and train the next big young entrepreneurs in the ideals of starting and growing a business from the scratch. Other initiatives the bank embarked on in 2017 were the Digital Skill Training for SMEs and a Staff Health Week Walk.

In July 2017, a new library was built in Yaba area of Lagos State, to boost the intellectual and academic field. The initiative was part of the GT Bank Coronation Cup. Also, the bank, through its CSR initiative, supported the 7th edition of Annual Autism Program. An online gallery named Art635, engaged over 57 artistes and showcased 553 pieces of artwork in an exhibition sponsored by GT Bank.

2017: Harvest of Awards for GTBank

For 2017, GT Bank excelled on all fronts, carting away with most of the awards available. The list includes but not limited to: Boardroom Corporate Award 2017: Best Corporate Governance Financial Services Africa 2017.

African Investor Award: best performing Ai 100 Company and Segun Agbaje was the Ai 100 CEO of the Year. Euromoney Award For Excellence 2017: Nigeria’s best bank and best bank for SMEs in Africa. Euromoney Private Banking Survey 2017: Best private banking services overall and Net-worth-specific services, commercial banking capabilities

Emeafinance African Banking Awards 2017: Best Bank In Nigeria, Best Bank for CSR in Africa and CEO of the year. World Finance banker of the year Africa 2017, Segun Agbaje, Bank Banking Group Nigeria and Best Retail Bank. African Banker awards 2017: African bank of the year. AABLA company of the year, 2017. Excellence in retail finance services convention 2017: best deposit service, best retail payment in Nigeria

The Banker Awards 2017: 2017 Bank of year in Nigeria CEO Awards: 2017 CEO of the year, Segun Agbaje; AI International Finance Awards: Digital Bank Efficiency Award 2017: Best Customer Experience Award – electronic platform experience); Instant payments transaction efficiency Cashless Driver: card usage on point of sale terminals; Cashless driver: real time payments.

Point of sale card transaction efficiency award; Electronic data rendition compliance and integrity award etc. All of these have culminated into making GTBank the bank of the moment and the Segun Agabje-led team is still not relenting in their resounding service provision to all their customers.

—- Bolatito Adebola

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY3 days ago

BIG STORY3 days ago