BIG STORY

FirstBank Is Future-Proof And Remains Committed To The Gold Standard Of Excellence In Banking — Adeduntan

Published

2 years agoon

- With over 4.6 trillion-naira loans to customers in Q3 2023, FirstBank is committed to economic growth and transformation.

At the dawn of the new year, it is natural for the Nigerian banking sector operators to anticipate dynamic shifts in regulations, increased digital innovations, and a focused approach toward sustainable growth and financial inclusion, while both the government and private sector eagerly anticipate the banking industry’s pivotal role in driving economic resilience, fostering innovation, ensuring regulatory compliance, and spearheading inclusive financial initiatives to bolster national development.

As a mark of readiness for the 2024 journey, the Group Managing Director of FirstBank of Nigeria Limited, the premier bank in Africa, Dr. Sola Adeduntan, in this interview with Festus Akanbi speaks on wide-ranging issues including how to insulate the Nigerian economy from the fallouts of the current hostilities at the international scene, the prevailing operating environment in Nigeria and the First Bank’s blueprint for optimum performance in 2024.

The global community is yet to recover from the hostilities in Eastern Europe and the Middle East and the wars do not look as if they will end soon. How can Nigeria, a leading producer of oil, take advantage of the attendant disruptions to world order to reposition its economy instead of continuing to count the losses of the wars?

Since the emergence of the COVID-19 pandemic, global uncertainties have been on the rise; manifesting either as geo-political trade tensions or full-blown wars such as the ongoing Russia-Ukraine war and more recently, the Israeli-Hamas hostilities in Gaza. Despite concerted global efforts to resolve the conflict, the Russia-Ukraine war seems on track to mark its second anniversary in a few weeks from now. This has also led to significant disruptions to the global supply chain, especially in the commodities and energy space.

As a leading oil producer, one way Nigeria can take advantage of the disruptions caused by the wars is by positioning herself to fill the vacuums created by the breakdown in relationships among established trading partners and regions, e.g. the Russia – Europe gas supply deals. However, to do this, the right infrastructural enablers must be in place as well as a significant rise in volumes of daily crude oil outputs beyond current levels. Nigeria must position itself as a more reliable source of gas supply to Europe in the short to medium term.

On the flip side, Nigeria can take additional steps to further insulate her economy from external shocks by strengthening local manufacturing capabilities and improving agricultural production to reduce the Nation’s import dependency.

However, due to growing global interconnectedness, it is becoming more difficult for any nation to fully protect its economy from volatility on the global scene. Nonetheless, this period calls for a heightened sense of awareness among Nigerian policymakers to ensure minimal distortions to the Nation’s economic conditions.

Nigeria’s crude oil production benchmark in the 2024 budget has been pegged at 1.78 million bpd, whereas OPEC is proposing a cut that will leave Nigeria with 1.5 million bpd. How can Nigeria remedy this in a way that will not significantly jeopardise the implementation of the 2024 budget?

Traditionally, Nigeria has struggled to meet its OPEC output quota over the last couple of years. Although the Nation is currently recording some improvements in daily output volumes (largely due to the improving security situations), the country’s production volumes as of November 2023 stood at 1.25mbpd (excluding condensates), according to available official figures. This represents about 3 million barrels cumulative monthly reduction when compared with the average daily production output of 1.35mbpd recorded in October 2023.

In preparing the 2024 budget, the government has made some key assumptions around crude oil production outputs and price, that is, 1.78mbpd and $77.96/barrel respectively. Given the expectation that security around crude exploration will keep improving and crude oil theft will progressively reduce, these assumptions do not seem overly aggressive. Also, the Minister of State for Petroleum Resources recently expressed strong optimism about the country’s ability to achieve its crude oil production budget benchmark.

However, recent moves by OPEC to cut crude oil export to buoy global crude oil prices should not immediately be a challenge for the Nation seeing that our national daily crude production levels are still a bit far off from OPEC’s quota. Rather, we should focus on entrenching the improvements in crude oil production levels to make them sustainable. Where OPEC’s production cuts become inimical to economic growth, it is also possible to engage OPEC for exemptions from the production cuts given our current difficult economic situation. Nevertheless, the Nation also stands to benefit from the upsides of a higher crude oil price if OPEC’s production cuts are effective. This should offset the envisaged reduction in production volumes.

I would also like to note that the Nigerian authorities should enhance the ability of the non-oil sector of the economy to generate sizeable revenues to support the government’s expenditure. This will help to reduce the perennial over-reliance on crude oil revenues.

The Federal Government borrowing in the 2024 budget is to increase from N6.3 trillion in 2023 to N7.8 trillion in 2024, with much of it coming from Nigerian banks. How will you allay the fear of a possible crowding out of the private sector from banks in the coming year?

Given the government’s current preference for local borrowings, I can understand where the fear of a possible crowding out of the private sector is emanating from. However, this does not necessarily have to be the case.

Over the years, Nigerian banks have sufficiently demonstrated their commitment to supporting the real sector of the economy. For example, as of H1 2023, the value of loans disbursed to customers by just seven Nigerian banks stood at almost NGN23 trillion. As of September 2023, FirstBank alone has grown its loan book to customers by over N1 trillion over the December 2022 closing position. This is a clear testament to FirstBank’s ongoing commitment to the growth of the Nigerian economy.

As bankers, we fully understand and have embraced our catalytic role as agents of economic transformation. In addition, banks deliberately pursue a diversified earning asset portfolio strategy. As such, lending to the real sector will continue to offer much-needed diversification for banks’ overall portfolio health.

In summary, I do not think the private sector has any need to worry as we will continue to support all sectors of the economy (including government) to realize their objectives.

With the inflation rate trending at 26.72%, and its attendant strain on the economy, how realistic is the dream of the private sector for an affordable lending rate in 2024?

Interest rate remains inextricably linked to the inflation rate. To narrow the margin of negative returns (which usually happens when the inflation rate far exceeds the interest rate in an economy), monetary authorities like the Central Bank of Nigeria (CBN) move to restore the attractiveness of investments by raising interest rates to tame inflationary pressures.

The rise in interest rate also affects customers differently depending on which side of the divide they fall. For depositors, a rise in interest rate means they will earn more returns on their savings or investments, while borrowing customers may have to take on a higher lending rate as banks also try to adjust for the higher funding costs.

Nevertheless, it has also been proven that an unusually high-interest rate burden exerts considerable pressure on borrowers’ ability to repay their loans. Therefore, it is in the best interest of both the banks and their customers to collaborate in arriving at a lending rate that works for both parties. I do not believe that any bank will unreasonably raise its lending rate above its justifiable cost profile, given the elevated competition that exists in Nigeria’s financial services industry.

The current administration plans to grow the GDP to $1 trillion in 2026. Although the Central Bank Governor has directed banks to gear up for re-capitalisation to enable them to adequately lend to the economy, do you believe the nation’s capital market, largely dominated by local investors, is liquid enough to generate the needed capital for banks?

The Government’s aspiration for a $1 trillion economy in the next 8 years from 2023 seems well-anchored given the significant fiscal changes that have been implemented since the new administration came on board. If successfully implemented, these actions hold immense potential to unlock new growth opportunities within the economy.

As of 18th December 2023, the Nigerian Exchange All Share Index (NGX ASI) has grown by almost 45% from its closing position in December 2022. This suggests significant activity in the capital market within that period. Also, as the inflation rate tapers in advanced economies, we will begin to see normalization of interest rates in these jurisdictions. Given this trend, we expect to see a growing volume of Foreign Portfolio Investments (FPIs) into the Nation’s capital market as investors seek high-return jurisdictions and portfolios.

Therefore, given these tailwinds and other factors, I remain confident that the Nation’s capital market will be sufficiently liquid to support the potential re-capitalisation of banks.

The Bank recently took its culture of impressive performance higher with a 79 per cent increase in its gross earnings on a year-on-year basis as it declared N922.2 billion in its nine-month result for 2023. In terms of profitability, what should the Bank’s shareholders be expecting at the end of the 2023 financial year?

At FirstBank, we understand our responsibilities to all our various stakeholders, including customers, regulators, employees, and shareholders, and we remain fully aligned on discharging our obligations to all categories of stakeholders.

The Bank’s Q3 2023 financial performance underscores how dearly we strive to uphold our obligations to all our stakeholders: we supported our customers with additional loans by growing the loan book by 34% to N4.6 trillion; we guaranteed our staff’s employment by remaining profitable in the face of the harsh operating environment; the Bank maximized its shareholders’ wealth with a commendable growth in profitability.

Our stakeholders should expect to see a Bank that is future-proof and ready to provide best-in-class products and services that will meet and surpass their needs across all our channels and jurisdictions of operations.

FirstBank remains dependably dynamic and will ensure that the needs of all stakeholders are met:

to the customers, we will provide the best products and deliver exceptional customer experience,

to the shareholders, maximization of ‘Total Shareholders Return’

to employees, competitive emolument, and exciting career experience

to regulators, voluntary compliance with all rules and regulations

to communities, we will be good corporate citizens and give back to the society where we operate.

What is the current NPL ratio of FirstBank? What strategies have you adopted to significantly bring it to its current level?

As of Q3 2023, the Bank’s NPL ratio remains within the Central Bank of Nigeria’s regulatory threshold of 5%. It is also our expectation that the ratio will be maintained within the regulatory threshold by the end of FY2023.

FirstBank has built an enduring risk culture and governance system, strengthened the risk infrastructure through specialized training, digitization of credit processes, and imbibed a disciplined and pro-active portfolio management approach thereby ensuring strict regulatory compliance as well as maintaining the NPL ratio with the acceptable threshold.

In what ways will the planned re-capitalisation of banks affect the economy given our experience of 2005?

The planned re-capitalization of Nigerian banks should have several positive effects on the economy given the intermediation role that banks play. Some of them include:

Investment Stimulation: since banks may leverage the capital market to raise additional capital, the investing public will have more outlets for profitable investments. Given the relatively profitable nature of most banks, I expect that the appetite for the banking sector stocks will remain impressive, and this should significantly drive volumes on the Nigerian Exchange.

Enhanced Underwriting Capacity: For banks, additional capital will mean improved capacity to underwrite bigger transaction tickets that can further unlock economic growth and support the Nation’s aspirations for the real sector.

Higher Employment Rate: As banks become better capitalized and able to support the real sector on a bigger scale, this should translate to more employment opportunities as companies employ more people to support their expansion programmes. A higher employment rate will also result in a lower poverty rate for the country.

How true is the fear that the current state of the economy may not guarantee the raising of the needed funds from the capital market at the same time, unlike what was obtained in the last banking sector re-capitalisation? What are the options available to banks seeking to shore up their capital?

As I mentioned earlier, though we are in a high inflation era and investible funds for households and corporates might be repressed, given the anticipated tailwinds from interest rate normalization in advanced economies, I am of the view that the capital market will be adequately liquid to support the re-capitalization exercise.

I would like to note that, investors will always seek decent returns even in a repressed economy. Nigerian banks have remained quite profitable, and most investors would like to invest in profitable entities. Similarly, equities of Nigerian banks might offer some good growth prospects in the near to medium term, thus offering significant capital appreciation opportunities for discerning investors.

Nevertheless, where there is a need for some augmentation, there are several other capital-raising options available to banks. For example, banks can issue subordinated debt instruments or other forms of convertible bonds either locally or offshore.

Overall, depending on the eventual level of recapitalization mandated by the CBN, banks will pursue any or a combination of several options to meet the required capital base.

With the headline inflation rate at 26.72 per cent in September and the interest rate at 18.75 %, and with the removal of subsidy and the attendant high cost of living, running businesses in Nigeria is becoming a big risk. How will Nigerian banks assist operators of small and medium-scale enterprises which form the bulk of businesses in Nigeria?

SMEs remain the bedrock of any economy as they account for about 80% of employment on the continent. As such, it is extremely important to put measures in place to keep them thriving. In my view, the measures to make SMEs thrive in Nigeria can be broadly classified into two categories. These are fiscal and financing measures.

The fiscal measures relate to issues around ease of doing business, improving security for lives and property, tax efficiency, adequate power generation, and enforcement of law and order, amongst other things. I am sure you will agree with me that these matters largely fall on the part of the government across all levels.

On the financing part, although there is still a lot more room for improvement, banks have done quite well. For example, at FirstBank, through our SMEConnect hub, we offer much more than just financing to our SME clients. Through the platform, the Bank offers specialized business training to raise the skills level of our SME business owners, thereby equipping them to make better business decisions that will guarantee the success of their businesses. The platform also offers crucial networking and marketing opportunities for all our SME clients to exchange business ideas and contacts.

FirstBank also offers several lending products dedicated to SME clients operating in diverse economic sectors such as FirstEdu loan for those in the educational sector, First Traders Solution for those engaged in fast-moving consumer goods, Health Finance Facility for those operating in the health sector, and many more. The Bank also continually reviews the terms and conditions of these facilities to ensure that they remain market-relevant and reflect the current realities of SME clients.

FirstBank’s SME clients can continue to count on us to listen to them through this rough economic patch and offer necessary cushions that are within our control as a Bank. As a Bank that is woven into the fabric of society, we have no other option than this.

Given the naira devaluation this year, what is the fate of the largely US dollar-denominated nature of FirstBank’s lending to the oil and gas sectors?

As the foremost financial institution in Nigeria, FirstBank’s support for the Oil and gas sector is in tandem with our long-term views for the Nigerian market and our commitments to our clients.

Also, learning from previous experience, the current client composition of our Oil & Gas portfolio is quite healthy which is why there has been no material adverse effect on our operations as reflected in our most recent financial performance, despite the significant naira devaluations. In addition, some of these clients also have receivables in United States dollars which easily offsets their foreign currency-denominated obligations.

As a Bank, we remain committed to the highest standards of risk asset quality, and we will continue to work with our clients to ensure this is always achieved.

FirstBank was recently adjudged as the Best Corporate Bank in Nigeria by Euromoney. With the concentration of your bank’s lending activities in the energy and mining sectors. How do you measure the gains from the bank’s exposure to oil and gas which is put at 31% of net loans in 2022?

FirstBank’s emergence as the Best Corporate Bank in Nigeria by Euromoney represents a very significant external validation of the strides the Bank has made on the Nigerian corporate banking landscape. The goal for our Corporate Banking business has always been to be a “Trusted Advisor” to our clients and we are quite pleased that the market is beginning to acknowledge our impact in this area.

Also, beyond Oil and gas, the Bank is very supportive of other sectors of the Nigerian economy (such as Manufacturing, Services, Telecommunications, Construction, etc), and FirstBank’s emergence as the Best Corporate Bank in Nigeria by Euromoney represents a very significant external validation of the strides the Bank has made on the Nigerian corporate banking landscape. The goal for our Corporate Banking business has always been to be a “Trusted Advisor” to our clients and we are quite pleased that the market is beginning to acknowledge our impact in this area.

Also, beyond Oil and gas, the Bank is very supportive of other sectors of the Nigerian economy (such as Manufacturing, Services, Telecommunications, Construction, etc) and is also actively deploying its balance sheet to facilitate growth and development across these sectors.

As I mentioned earlier, our exposure to the Oil and gas sector reflects our strong commitment to building local content and capabilities required for sustainable national progress. In addition, the portfolio remains healthy with decent returns, and we expect this to continue.

As the foremost Bank in Nigeria, to what extent has FirstBank taken advantage of the gains of the African Continental Free Trade Area (AfCFTA) agreement, which is designed to create the largest free trade area in the world measured by the number of countries participating?

According to the World Bank, the African Continental Free Trade Agreement (AfCFTA) has the potential to boost Africa’s income by $450 billion by 2035 and lift 30 million people out of extreme poverty. As a pan-African bank with a vision to be “Africa’s Bank of First Choice”, AfCFTA presents a very important vehicle for us to serve the broader African market.

Therefore, the Bank has taken several measures to optimally exploit opportunities around AfCFTA. First, as a Bank, we have engaged in extensive export requirements and capabilities trainings for our customers to distill the significant export opportunities around the AfCFTA and help them identify suitable markets for their produce. These training programs will remain a recurring feature in the short to medium term.

Secondly, we have created and positioned a strong payments/remittance proposition (known as First Global Transfer) to support and facilitate payments for intra-African trade among both existing and prospective customers, while keeping in close step with developments around AfCFTA’s Pan-African Payment and Settlement System (PAPSS) for seamless integration.

Finally, in line with our vision, the Bank will ensure a strategic presence in critical trading corridors on the African continent to support the trade facilitation and other requirements of our clients, thereby giving them an unparalleled competitive advantage.

What are your plans to sustain the bank’s robust customer service network and digital banking architecture in 2024?

At FirstBank, our “You First” brand promise to our customers is not just a cliché. It encapsulates our firm commitment to making banking seamless, more accessible, and rewarding for our teeming customers. As an institution, we will continue to leverage both physical and digital channels to serve our customers effectively.

With almost 700 operational business locations, no other bank comes close in the branch network. This has enabled FirstBank to deliver banking services within proximity to our customers’ homes and offices. We have also supported our extensive branch network with a best-in-class agent banking network with over 220,000 FirstMonie Agents strategically located across the length and breadth of the country. These agents, in no small measure, have been critical to extending financial inclusion levels in their immediate localities.

With over 3,000 Automated Teller Machines (ATMs), FirstBank has one of the highest ATM spreads in the Nigerian financial services space which enables us to serve our customers round-the-clock. Also, the Bank’s digital and mobile channels (*894#, FirstMobile, FirstOnline & Lit App) have been very successful with our clients, enabling them to conclude both banking and non-banking transactions from the comfort of their homes and offices.

To cater to the needs of our wholesale clients, the Bank has positioned a robust transaction banking platform (FirstDirect) that enables us to service the transaction banking needs of our customers.

In a bid to improve overall customer experience, the Bank has also ensured that its service delivery channels have in-built complaint-handling and issue resolution mechanisms to give customers extra confidence to transact on any of these channels. This is in addition to our always-on, 24/7 interactive, and intelligent contact center, known as FirstContact.

At FirstBank, we remain committed to seeking innovative ways to serve our clients and we will leave no stone unturned to continue to deliver a wholesome customer experience.

As the first Nigerian bank to surpass 200,000 agent banking locations as an exceptional financial inclusion pioneer, what are the plans being put in place to maintain your dominance of agent banking in the coming year?

FirstBank’s feat in the Nation’s agent banking landscape is in tandem with our established pioneering status in Nigeria and the sense of partnership with which the bank operates towards achieving critical national developmental objectives. With over 220,000 agents on our FirstMonie Agent Network, FirstBank is a major partner in pushing the Central Bank of Nigeria’s (CBN) financial inclusion agenda.

The Bank’s FirstMonie Agent Network has processed over 1.4 billion unique transactions worth well over NGN32 trillion and has empowered numerous localities around the Nation’s 774 Local Government Areas (LGAs) with basic financial services that facilitate economic activities in these communities. This is in addition to the millions of direct and indirect employment opportunities that our agent banking network has created for local communities.

The Bank is constantly strengthening its value propositions to the FirstMonie agents in several ways. For example, through our Agent Credit product, the Bank supports agents to bridge intra-day liquidity shortfalls, thus enabling them to better serve their clients. Also, beyond basic offerings (such as cash-in-cash-out, transfers, and bill payments), the bank has empowered its agents to render more financial services such as account opening for customers. We are also continuously fine-tuning our agents’ support structure to ensure our agents obtain prompt resolution for any service hitch experienced.

As a Bank, we view our FirstMonie Agents as partners and we remain committed to making the necessary investments to make the partnership a win-win for all parties involved.

Another game-changer in the story of the transformation of FirstBank was the conscious attempt of the board and management to make the bank a transaction-led institution. How does the bank intend to continue from this threshold as a way of drawing from the gains of its investment in Technology Academy in Nigeria?

One of the Bank’s strategic priorities in the current strategic cycle is to build a world-class (customer-first) service organization. As such, as an institution, we no longer view Technology as a business enabler but as a business.

Also, when you consider that over 90% of the Bank’s customer-induced transactions now happen on digital platforms, it becomes clearer why we have made (and will continue to make) sizeable investments to overhaul our Information Technology (IT) architecture and infrastructures to guarantee IT platform availability and security to support the overall business aspirations.

The FirstBank Technology Academy is one of the Bank’s creative solutions to addressing the emerging shortage of skilled IT talents in the country in the wake of the increasing migration rate (commonly known as Japa). It is a one-of-a-kind intervention where the Bank engages available graduates with a STEM background and offers them bespoke IT training in line with our business needs. This is FirstBank’s way of growing its IT talents and boosting the national supply of critical IT talents as we cannot afford to use a shortage of talents as an excuse for not meeting up to the high standards to which our customers hold us. The program has also proven to be highly successful, and we will intensify our efforts in this regard.

As a foremost financial institution in Nigeria and on the continent, we are keenly aware of the role technology will continue to play in our ability to serve our clients, and we are poised to make necessary investments at the right scale and on an ongoing basis to guarantee the security, availability, and relevance of our digital assets.

Is acquisition one of the plans being put in place by FirstBank in preparation for the new threshold of capital base to be announced soon by the Central Bank of Nigeria? We note that the bank already has a capital base of N1.287 trillion.

As you also noted, FirstBank has been very intentional in ensuring that it maintains a strong capital base given the scope of the Bank’s operations and in line with regulatory requirements. This has informed the deliberate measures the Bank has taken to shore up its capital base over the past few years.

Depending on where the pendulum finally settles when the CBN unveils the new minimum capital requirements for banks, as a compliant and socially responsible institution, we will explore all options available to us to ensure full compliance and maintain our competitive advantage over other players in our industry.

At FirstBank, we leverage both organic and inorganic growth strategies to achieve scale and deliver improved shareholder value.

FirstBank’s plan to rejuvenate its workforce was recently underscored by the employment of more than 700 fresh graduates. Can you start to count the gains of this decision?

The Bank’s Graduate Trainees programme is a highly competitive process through which the Bank identifies and selects young and dynamic individuals for proper grooming to occupy future leadership roles within the organization. Aside from this, FirstBank has several other talent development initiatives such as the FirstBank Management Associate Programme (FMAP), Leadership Acceleration Programme (LAP), and Senior Management Development Programme (SMDP) which are targeted at employees at different strata within the workforce to build a sustainable pipeline of dependable leaders for the institution.

I am glad to note that as an equal-opportunity employer, we offer very compelling employee value propositions that set us apart in the industry. This is in line with our belief that our employees are not just our greatest asset, but they represent the greatest source of strategic advantage for the Bank’s long-term success.

In 2015, FirstBank initiated a development plan that allows most vacancies in the bank to be filled internally. What is the update on this employee-friendly policy of the bank?

At FirstBank, we maintain an end-to-end view of the employee lifecycle which ensures that we focus on offering every employee a fair chance of having meaningful work experience with us. This approach ensures continuous improvements across every stage of the employee experience from recruitment to development and deployment on an ongoing basis.

Since implementing the policy on internal recruitment for vacant roles, the Bank has witnessed a significant uptick in the employees’ mobility index as most vacancies now get filled from existing employee pools. To achieve this, several initiatives such as the FirstBank Job Shadow Programme and the FirstBank Mentoring Programme enable current employees to acquire new skills even while still in their current roles. This makes them ready to take on future opportunities within the Bank.

Secondly, the Bank has acquired a world-class people management system that supports seamless management of job vacancies, competency assessments, and the entire employee lifecycle management process. This provides the necessary visibility into various aspects of our employee management process.

While the Bank still conducts some external recruitments to infuse external perspectives into some functions, the proportion of external recruitments in the overall recruitments has reduced over the last few years.

The bank recently pioneered the deployment of humanoid robots in three of its branches as a demonstration of its commitment to fully adopt technology-led banking services. What is the initial feedback from customers and what are the implications of the adoption of technology on the employees’ job security?

FirstBank’s Digital Xperience Centre (DXC)is Nigeria’s first ever fully digitized bank branch employing the latest technologies such as humanoid robots and artificial intelligence to enable customers to perform self-service banking transactions. The DXCs reflect the Bank’s views on the near-future possibilities in financial services delivery, given recent technological advancements. It also underscores the central role modern technology now plays in the Bank’s operations and overall service delivery strategy.

The DXC is a fully automated interactive digital branch that was first launched in Lagos in 2021 and has since then, redefined customers’ banking experience through a world of digitised self-service. We have thereafter rolled out the DXC at the University of Ibadan, Oyo State, and more recently, at our branch in Wuse Abuja. Since these rollouts, the Bank has received commendable feedback from customers (especially customers in the retail segments) which has validated our investments in these modern technologies. There are already plans in place for more rollouts of the DXCs across all our operating jurisdictions.

I would like to note that the DXC is not a trade-off for our employees, but an enabler to free up our staff’s productive time to take on more complex and rewarding tasks within the Bank. Also, given our several laudable employee initiatives (some of which I had earlier mentioned), we are well-equipped to empower our employees to take on any other role they may desire within the larger FirstBank Group.

Sir, can you give further explanation on the recently announced phased corporate name change for FirstBank’s subsidiaries in the United Kingdom and Sub-Saharan Africa?

The Bank’s decision to adopt a monolithic brand name across all operating jurisdictions is borne out of the need to ensure we leverage the rich heritage behind the FirstBank name, and the goodwill garnered in almost 130 years of operations across all the markets where we operate.

Also, as we follow our clients across geographies, it becomes increasingly important to maintain consistency in the brand name to improve overall client affinity and guarantee similar standards in service delivery across all operating jurisdictions. In addition, the name change across all our subsidiaries will enable us to take advantage of available synergistic opportunities in both our marketing efforts and budgets.

Finally, a uniform brand name (across our market) helps the Bank to avoid needless identity crises and is best aligned with our vision of becoming “Africa’s Bank of First Choice”

FirstBank has consistently been recognized as a market leader in the sustainability/ESG space in Nigeria and Africa. This recognition has come from different organisations such as Global Banking and Finance, International Business Magazine, Euromoney Market, Great Place to Work, etc. And these mostly happened under your leadership. Congratulations sir.

Please what is FirstBank doing in the ESG and the broader sustainable development space to achieve these recognitions and how do you intend to ensure this is strengthened to enhance your market leadership considering that ESG/sustainability space is very dynamic, fluid, and always evolving?

At FirstBank, we value our relationships with all our stakeholders, especially the communities where our businesses operate. Therefore, we are very deliberate in how we engage our host communities to guarantee shared prosperity and the long-term sustainability of the environment. The Bank also ensures its Corporate Responsibility and Sustainability (CR&S) approach is well aligned with both local and international best practices as advised by the Nigeria Sustainable Banking Principles (NSBPs), International Finance Corporation Performance Standards (IFC PS), and the Equator Principles (EPs).

To this end, FirstBank’s CR&S Framework is hinged on three strategic pillars, namely: Education, Health & Welfare; Diversity & Inclusion; and Responsible Lending, Procurement & Climate Initiatives.

Each pillar is operationalized through the implementation of well-coordinated programmes and initiatives that enable the Bank to fulfill its sustainability agenda and priorities. For example, some of the initiatives include:

SPARK: SPARK (an acronym for Start Performing Acts of Random Kindness) is a values-based initiative designed to continuously reignite the Bank’s cherished moral values of compassion, civility, and charity. Since its inception, the SPARK initiative has impacted over 150,000 people and 100 charities / NGOs across 8 countries where FirstBank currently operates.

FutureFirst Programme: In partnership with Junior Achievement Nigeria (JAN), this programme is FirstBank’s vehicle for promoting the triple benefits of financial literacy, career counseling, and entrepreneurship among the younger generation. Over 1 million people across Nigeria have benefitted from this financial advocacy effort.

Partnership with Nigeria Conservation Foundation (NCF): Through the Green Recovery Nigeria (GRN) Initiative, the Bank aims to plant 50,000 trees in 2024 towards the reduction of carbon dioxide gas emissions.

In addition, the Bank has fully embedded an Environmental, Social, and Governance Risk Management System (ESGMS) into its credit decision processes as well as adopted sustainability reporting to measure progress on its sustainability journey. The Bank is also committed to decarbonizing its operations, including those of its value chain, in a bid to accelerate its transition to a net-zero carbon emission status. This is being done in line with the standards of the Partnership for Carbon Accounting Financials (PCAF) and other international agencies such as the British International Investment (BII) and Proparco.

Finally, to ensure issues about sustainability are continuously given the highest visibility and consideration in all our business pursuits, FirstBank has constituted a Corporate Responsibility & Sustainability Committee that is chaired by our Executive Director / Chief Risk Officer, thereby guaranteeing the right “tone at the top” in the execution of our broad ESG agenda.

Culled from ThisDay

You may like

-

Road To 2027: David Mark Cautions Atiku, Obi As Federal Government Slams Coalition Chiefs

-

JUST IN: UAE Bans Transit Visas, Imposes Stricter Entry Rules For Nigerians

-

Dangote Refinery To End Crude Imports By December — Bloomberg Report

-

LG Polls: Speaker Obasa Charges Lagos West APC Candidates To Intensify Campaigns, Assures Of The Assembly’s Support

-

Atiku Denies Report Of Stepping Down For Southern Candidate, Blames APC For Fake Story

-

Igbo Criminals, Not Fulani Herdsmen, Behind South-East Killings — Soludo

BIG STORY

Road To 2027: David Mark Cautions Atiku, Obi As Federal Government Slams Coalition Chiefs

Published

44 minutes agoon

July 9, 2025

Interim National Chairman of the African Democratic Congress, Senator David Mark, said in a statement on Tuesday that the new coalition had no “favourite presidential candidate” amid reports that former Vice President Atiku Abubakar, 2023 presidential candidate Peter Obi, former Minister of Transport, Rotimi Amechi, and others were “frontrunners” for the party’s ticket in the 2027 election.

In the statement issued by his media team in Abuja, Mark stressed that all party members were “equal stakeholders.”

ADC’s 2023 presidential candidate, Dumebi Kachikwu, had accused the Mark-led interim leadership of the party of being biased toward Atiku, with concerns mounting that the ambitions of the three contenders could “divide the party.”

In response, Mark assured Nigerians that the party would operate with “complete transparency” under his leadership.

Mark said the ADC had “no preferred or favourite presidential aspirant” but was focused on “putting out a platform that would be attractive and acceptable to majority of Nigerians.”

He added, “We are doing this because we do not want this great ship called Nigeria to sink because if we do not rise up, and now, they will sink all of us.”

“I don’t own this party more than any of our members and I urge all members to prepare to show Nigerians that ADC is a different party.

“A different party that is ready to properly run democracy in our country. All Nigerians must come together and take ownership of the ADC.”

But President Bola Tinubu’s Special Adviser on Information and Strategy, Bayo Onanuga, on Tuesday claimed that opponents of Nigeria’s development are conspiring to oust the President.

Onanuga stated this in a post on X on Tuesday, which was later deleted.

He described the Tinubu administration as “the most focused and transformative in Nigeria’s history.”

He referenced a 2022 warning by the Emir of Kano, Muhammad Sanusi II, who cautioned that any leader promising effortless prosperity was being dishonest.

Quoting Sanusi, Onanuga wrote, “Emir Sanusi warned Nigerians what to expect from President Tinubu’s reforms. ‘It’s not going to be easy.’ If anybody tells you it would be easy, don’t vote for him.”

The presidential aide then alleged that “haters of Nigeria’s progress are banding together to overthrow an administration that has been the most focused, most transformative in our history.”

This comes as more members of the opposition and even the ruling APC pledged loyalty to the coalition on Tuesday.

The fresh wave of defections swept across Borno, Gombe, Jigawa, Ondo and other states, with notable politicians abandoning their former parties to join the ADC ahead of the 2027 general elections.

In Borno State, home of Vice President Kashim Shettima, the ADC witnessed a mass influx of former PDP and APC stalwarts.

Among them are the PDP Borno Central Senatorial candidate in the 2023 election, Mohammed Kumalia; Deputy Governorship candidate, Saleh Kida; and former PDP national treasurer, Ali Wurge.

Others are House of Representatives candidate in Maiduguri Metropolitan Council, Babakura Yusuf; PDP candidate for Bama, Ngala, Kala Balge federal constituency, Abdulrazaq Zanna and other House of Representatives candidates.

A former governorship aspirant, Idris Durkwa, and a youth mobiliser, Sheriff Banki, also defected to the coalition.

Speaking on Tuesday, Banki attributed the defections to the failure of the APC under President Bola Tinubu and the compromised leadership of the PDP.

He said, “I am happy to inform you that the massive defections and resignations by prominent members of opposition parties, including the ruling APC, as recently witnessed in Borno State, mark the beginning of better things in the state’s political landscape and the country at large.

“Nigerians, especially at the grassroots level, were promised a Renewed Hope Agenda by President Tinubu. Unfortunately, two years into the APC-led administration, the reverse is the case. People can no longer sleep with both eyes closed, and they are grappling with economic hardship due to poor policies and programmes.”

In Gombe, Abdullahi Ataka, a former APC State Organising Secretary and youth mobiliser, explained that his decision to join the ADC came after months of reflection and engagement with stakeholders.

Ataka spoke on the heels of an expanded caucus meeting in Gombe on Tuesday.

Ataka said, “The decision wasn’t made lightly. It followed extensive consultations across political and civic platforms.

“We see, in the ADC, a fresh energy, a sense of direction, and an openness that is lacking in the current system. We’re not just coming with numbers; we’re coming with structure, strategy, and a clear sense of purpose.”

He expressed confidence that the new coalition has the momentum to disrupt the status quo.

“This is the movement the people have been waiting for. The ADC represents that new voice – the voice of ordinary Nigerians,” he stated.

Speaking during the expanded caucus meeting, the ADC state chairman, Auwal Barde, described the coalition as “a timely alliance driven by the need to offer Nigerians a credible alternative.”

“This is not just a merger of political interests. It’s the beginning of a genuine movement to rescue Gombe State and Nigeria at large from political stagnation,” Barde said.

“We have officially opened our party registers in all 114 wards and across the 11 LGAs of the state to welcome new members who believe in change rooted in accountability and inclusiveness.”

He called on citizens disillusioned by the current political establishment to find a home in the ADC.

“We are calling on those who have been politically displaced or discouraged — youth, professionals, and interest groups — to come on board. ADC is a platform for real transformation,” he added.

The gathering also featured members of the coalition, including a former minister, Abdullahi Umar, who emphasised that the alliance was not just about defeating the APC, but about providing solutions to Nigeria’s growing challenges.

“This coalition is not built on bitterness or ambition alone. We are uniting to tackle the economic hardship and leadership failure affecting ordinary Nigerians,” Umar explained. “It’s about rebuilding institutions and restoring hope. We’re inviting all well-meaning citizens to be part of this mission.”

In Jigawa, the ADC dissolved its executive council and inaugurated a new state exco led by former Deputy Governor in the state, Ahmed Gumel.

This comes on the back of former Jigawa Governor Sule Lamido, a PDP chieftain, recently joining the coalition.

In his inaugural speech on Monday at the ADC Jigawa headquarters in Dutse, Gumel said, “The coalition aims to reshape Nigeria’s political landscape and provide an alternative to the APC-led government.”

A meeting of the ADC also held in Akure, the Ondo State capital, on Tuesday, where the state coordinator of the coalition and former member of the House of Representatives, Prof. Bode Ayorinde, state that several chieftains of the PDP in the state were already part of the coalition.

Ayorinde, a former PDP chieftain, claimed that governorship candidates of the party in the 2020 and 2024 elections in the state, Eyitayo Jegede and Agboola Ajayi, were part of the coalition.

He added that the senator who represented Ondo South, Nicholas Tofowomo, a former chairman of PDP, Tola Alabere, and former spokesman of the party, Kennedy Peretei, were already part of the coalition in the state.

Ayorinde stated, “I’m happy that our number is increasing; we must work together. Ondo State will first take advantage of the ADC in the next governorship election. Let all leaders at the ward levels play politics of inclusion.

“We started with 25 members at our first meeting, but now we are over 300. It shows the failure of the ruling party. Eyitayo Jegede and Agboola Ajayi are also part of us. It is a state coalition, we are united.”

Also speaking, Peretei said, “You heard Prof. Ayorinde. He mentioned names – big names. But it’s not even about the big names. It’s about the situation that we find ourselves in. Initially, there were people who were saying that the national problem does not affect, does not translate to collapsing party structures, the PDP structures, into the ADC.

“In Ondo State, I know two local governments that have already collapsed their structures into the ADC. So, PDP doesn’t exist anymore. It’s the ADC that exists. And you see it here.

“The biggest fear that was expressed in the last two months in the country was that Nigeria was going to be a one-party state? Nobody’s talking about that now. And those that are in the villa are attacking us, attacking personalities. That will tell you how much heat is on the APC in one week. So, what happens if it becomes six weeks?

“In those states, after today, I’m sure there will be ripples. There will be a lot of ripples.”

PDP kicks

But speaking with The PUNCH, PDP National Vice Chairman (South-West), Kamorudeen Ajisafe, said he was not aware of the purported defection of Jegede and Ajayi.

Ajisafe said, “I am yet to confirm the said exits of Eyitayo Jegede and Agboola Ajayi. Have you seen their resignation letters online? They have not resigned to the best of my knowledge. I don’t know the source; it might be hearsay. I will have to do my verification; other than that, it is still under the realm of hearsay. It is not verifiable by me. And, the chairman of the party in Ondo State has not called me to tell me such.”

Ajisafe, however, said the PDP South West had scheduled a zonal caucus meeting to boost the confidence of members in the party and halt any defection amid the current ADC momentum.

“The South West Zonal Caucus meeting on Friday is to boost the morale of members amid events ongoing and developments in the polity.

“The ADC is gaining momentum because it’s a new movement, but not at the detriment of the PDP in the South West. You might have pockets of defections here and there, but PDP remains very strong in the South West,” Ajisafe added.

The Gombe State Publicity Secretary of the PDP Abdulkadir Dukku, sais members who joined the coalition didn’t resign formally.

He said, “Our party is not threatened. We equally had a meeting with our leader asking us to remain in the PDP and we have accepted to remain in the party. You know politics is a matter of choice, wherever you chose to stay is okay.

“There are rules guiding every party, at least you need to tender your resignation before switching to the other political party, those who didn’t tender resignations are not going to represent the PDP, they are on their own. Most of them we didn’t see their resignations formally, whosoever goes there went on his own.”

The PDP also expressed strong optimism about winning the February 2026 Area Council elections in the Federal Capital Territory, claiming there was no coalition in the FCT.

The party stated this on Tuesday during the issuance of certificates to the party’s chairmanship and councillorship candidates in Abuja.

Represented by the PDP National Vice Chairman (North Central), Abdulrahman Mohammed, the party’s acting National Chairman, Umar Damagum, emphasised that the PDP was not part of any coalition and continues to maintain a solid political presence throughout the FCT.

“There is nothing like a coalition in the FCT, and there is no attempt by anyone to defect to another political party. Our structure is intact,” he said.

“We know the FCT is the home of PDP, and PDP belongs to the FCT, in shaa Allah.”

Damagum urged party officials at all levels from ward to state to recommit to the party’s mission, emphasising that there was no longer room for political complacency.

“It is no longer business as usual,” he warned.

“We have disciplinary committees at both state and local government levels. Any executive found engaging in anti-party activities will be disciplined. If you’re not ready to work for the party, kindly step aside so the vacuum can be filled immediately,” he said.

He warned PDP members against associating with opposition parties, labeling such behavior as an act of betrayal.

“It is shameful for any executive to be seen campaigning for or collaborating with other political parties. That is anti-party, and I will not allow it in the FCT anymore,” he said.

Damagum pledged that the national secretariat would offer complete backing for the elections and promised to safeguard the credibility of the results.

‘Tinubu not distracted’

Meanwhile, the Federal Government has reaffirmed President Tinubu’s commitment to his administration’s reform agenda, stating that he remined focused on delivering economic transformation and national development, despite mounting political discourse ahead of the 2027 general elections.

This was contained in a statement issued by the Minister of Information and National Orientation, Mohammed Idris, on Tuesday.

“Amid ongoing political discourse and increasing media speculation regarding the 2027 elections, it is necessary to reaffirm that the administration of President Bola Tinubu remains firmly committed to its core mandate: delivering meaningful reforms and real economic growth for the Nigerian people.

“Even as we affirm the right of all Nigerians to freely exercise their constitutionally guaranteed freedoms of association and of speech, it is also important to underscore that President Tinubu’s administration will not be sidetracked by politicking or political distractions,” Idris said.

The minister was responding to media reports and political commentary concerning the formation of a new opposition coalition.

He insisted that such developments would not derail the government from pursuing its “bold and transformative mandate,” anchored in the Renewed Hope Agenda.

“The clamour in the media about the emergence of a new political ‘coalition’ is understandable, but Nigerians entrusted President Tinubu with a bold and transformative mandate, anchored in the Renewed Hope agenda,” Idris said.

According to the minister, the administration’s reform agenda is already producing tangible outcomes across various sectors.

He cited progress in tackling crude oil theft, restoring investor confidence, stabilizing the naira, and easing inflation. He also pointed to several initiatives designed to support ordinary Nigerians.

“Millions of Nigerians — households, students, artisans, small business owners—are benefitting from initiatives such as student loans, access to consumer credit, CNG vehicle conversions, and improved government services and infrastructure,” Idris stated.

The statement also highlighted the President’s recent policy actions, including the signing of four tax reform bills into law. The laws, set to take effect in 2026, are part of what the government calls one of the most ambitious fiscal overhauls in the country’s history.

“These reforms are expected to significantly boost prosperity for households and businesses nationwide” Idris said.

On agricultural development, the minister noted the recent launch of the Renewed Hope Agricultural Mechanisation Programme, which he described as “the single largest mechanisation drive ever undertaken in Nigeria’s history.”

“This is just one of several high-impact agricultural mechanisation programs being undertaken to guarantee food security,” he added.

Addressing the growing political opposition and speculation surrounding the next election, Idris said, “It is not surprisingly, emerging coalitions and opposition political groupings do not want a sustained focus on the progress Nigeria is making. The administration however refuses to be drawn into distractions engineered by those who would prefer stagnation over reform.”

He concluded by reaffirming the government’s focus, “The Tinubu administration remains undeterred, focused, and committed to building a more prosperous Nigeria for all.”

‘ADC chasing shadows’

Meanwhile, the APC accused the ADC of chasing shadows and spreading falsehoods through its coalition efforts to challenge President Bola Tinubu in the 2027 election.

In a statement on Tuesday, APC National Publicity Secretary, Felix Morka, called on the ADC to provide evidence of its claim that the Federal Government officials held a secret meeting with the party’s North East and North West leaders to destabilise it.

On Monday, the ADC alleged that President Tinubu was working to undermine opposition parties in a bid to create a one-party state.

In a statement by its National Publicity Secretary, Bolaji Abdullahi, the ADC claimed that the Tinubu administration was deliberately targeting its leaders in the North East and North West to weaken the newly formed opposition coalition.

In response, the APC stated that neither President Tinubu nor the ruling party has any reason to waste time or effort creating confusion in the ADC, which is already deeply troubled by internal chaos caused by those who have taken over the party.

Morka stated, “Days after its dreary unveiling, the African Democratic Congress is, unsurprisingly, already trudging the beaten path of lies and deception like its opposition counterparts, the Peoples Democratic Party and Labour Party.

“Beyond the rash of poorly imagined accusations, the statement did not offer substantiation of any kind. Its vague reference to officials of the Federal Government only belies the mischievous intent of its makers to whip up sentiments, manipulate public opinion, and distract Nigerians from the patent hopelessness of their political phishing expedition.

“Otherwise, why is it so impossible for ADC to provide Nigerians the details of the alleged “secret meeting at which its senior party officers were coerced and intimidated. Rather, the party cites nonsensical credible intelligence as basis for its devious allegations.

“Clearly, there was no such meeting, and certainly, no one could have been coerced or intimidated at a meeting that never was. This could have happened only in the warped imagination of masters of deception and marauding invaders of the ADC.”

The APC said the ADC offers no real alternative for Nigerians, adding that it was only driven by bitterness and excessive presidential ambition.

Morka added, “There is no reason for Mr. President or APC to expend valuable time and energy trying to sow confusion within ADC that is already mortally wounded by confusion delivered by its invaders.

“The ADC needs no help from our great party to unravel as it must from its own internal dissonance, contradictions and discord of self-serving and vainglorious personalities that executed a gestapo-like takeover of the party to the chagrin of bonafide leaders and members of the party.

“The ADC’s statement is just a calculated preemptive excuse for its evident ill-fated future of disintegration, like Humpty Dumpty whose great fall could not be put back together again. It has placed on public display the incompetence and inability of its leadership to manage its impending internal crisis, in the same way they proved incapable of managing the internal affairs of opposition parties they have plundered serially before the ADC.

“And what good can possibly come out of a coalition of our country’s most inept politicians and architects of misrule, corruption, poverty and underdevelopment who are now congregated in ADC? What else can be expected from a coalition of failed and restless presidential contenders determined to bring down the roof on the altar of their inordinate ambitions?”

Morka said the ADC’s only strategy seems to be attacking the APC and discrediting President Tinubu’s unmatched record of economic recovery and national transformation.

The statement read in part, “The ADC and its leaders may be convinced of their ability to lie their way to presidential victory but they have a highly intelligent and discerning Nigerian electorate to contend with.

“They say one thing, mean another and do yet another. From Mr. Peter Obi’s desperate vow to serve a single term of four years if elected as President, and his pledge to fly only commercial airlines as President, even though he campaigned with opulence in private jets throughout the 2023 election season; to Mallam El-Rufai who failed spectacularly in comparison to mind-blowing transformation of Abuja by the award-wining incumbent Minister of the Federal Capital Territory, Nyesom Wike; to Ogbeni Rauf Aregbesola, whose lacklustre performance as Minister of Interior is now so glaring in the face of the innovation and super efficiency introduced by the current minister, Olubunmi Tunji-Ojo.

“None of the proponents of the coalition has the vision, the courage, competence, credibility, track record, zeal and patriotism to serve Nigeria better than President Bola Tinubu is already doing.

“While the opposition wallows in self-inflicted confusion, the Tinubu-administration and our great Party remain undistracted and will continue to build a virile and vibrant country for this and future generations of Nigerians.”

97 lawyers

Meanwhile, the ADC has announced that at least 97 lawyers are ready to represent the party in the ongoing court case.

In a statement issued by its media unit on Tuesday, the party accused the APC of sponsoring a lawsuit using the names of individuals who are not members of the ADC to challenge the party and its interim leadership.

On Monday, three members of the ADC – Adeyemi Emmanuel, Ayodeji Victor Tolu, and Haruna Ismaila –filed a suit at the Federal High Court in Abuja, seeking the removal of Senator David Mark as the party’s interim leader.

They contested the legitimacy of Mark and others serving as interim leaders, arguing that the transfer of the party’s leadership to those involved in the coalition arrangement may have violated an existing court judgment.

In the case marked FHC/ABJ/CS/1328, the ADC is listed as the 1st defendant, with the Independent National Electoral Commission and the party’s immediate past National Chairman, Ralph Nwosu, named as the 2nd and 3rd defendants.

Senator Mark (Interim National Chairman), former Osun State Governor Rauf Aregbesola (Interim National Secretary), and ex-Minister of Sports Bolaji Abdullahi (Interim National Publicity Secretary) are listed as the 4th, 5th, and 6th defendants, respectively.

In response, the ADC claimed that the individuals whose names were used by the APC to file the suit are not listed in the party’s physical or digital membership records in either Kogi or Nasarawa State.

The statement read in part, “The ADC accused the APC of deceiving Nigerians by using the names of non-ADC members to file a suit against the party and its interim leadership.

“The party alleged that the names which the APC used to file their suit were neither in the ADC physical nor does digital register in Kogi or Nasarawa states.

“It smacks of desperation that a party elected in charge of the lives of no fewer than 200 million people can engage in shopping for the names of its citizens in pursuit of Machiavellian politics.”

Also, the National Legal Support Group for ADC has expressed its readiness to represent the ADC in the courts over the matter filed against the party and its interim officers.

Making this revelation in Abuja, the leader of the group, Mohammed Sheriff, said “no fewer than 97 Lawyers have indicated their preparedness to stand for the party.”

Credit: The Punch

BIG STORY

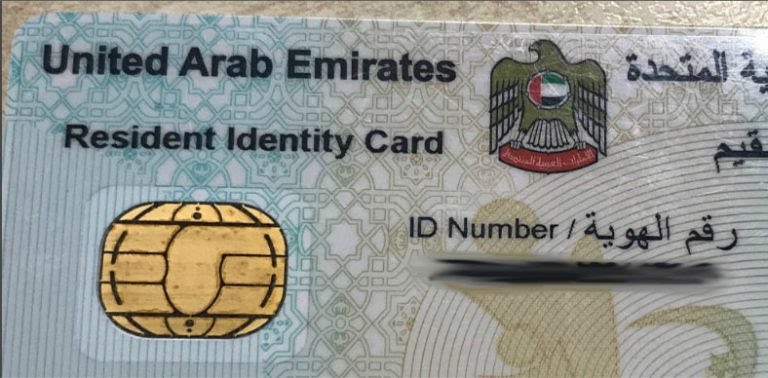

JUST IN: UAE Bans Transit Visas, Imposes Stricter Entry Rules For Nigerians

Published

2 hours agoon

July 9, 2025

The United Arab Emirates has implemented more stringent entry requirements for Nigerian travellers and has fully stopped accepting transit visa applications.

This was confirmed by travel agents on Tuesday.

As stated in the latest directives from Dubai immigration, Nigerians between the ages of 18 and 45 are now ineligible for tourist visas unless accompanied.

Applicants who are 45 years old or older must provide a personal six-month bank statement showing a minimum ending balance of $10,000 (or the equivalent in naira) each month.

Travel agents noted that this policy is expected to significantly decrease the number of Nigerians travelling to Dubai, a major hub for tourism and business.

The notification stated, “For Nigerian nationals, please bear in mind that an applicant aged 18 to 45 years travelling alone is not eligible for the TOURIST VISA CATEGORY.

“An applicant who is 45 years or above must provide a Single Nigerian personal bank statement for a period of the last six months, with each month’s end balance reflecting a minimum ending balance of USD 10,000 or its naira equivalent.

“Kindly note that the above points must be taken into consideration before sending your applications with other existing documents such as hotel reservation, data page, etc.”

BIG STORY

Dangote Refinery To End Crude Imports By December — Bloomberg Report

Published

3 hours agoon

July 9, 2025

The Dangote Petroleum Refinery plans to stop importing crude oil by December 2025, aiming to replace hundreds of thousands of barrels per day of imported crude with domestic supply.

A Bloomberg report quoted Devakumar Edwin, Vice President at Dangote Industries, who oversees the 650,000-barrel-per-day facility in Lagos, saying that contracts with foreign crude suppliers will expire, allowing the refinery to shift to sourcing feedstock locally.

Edwin stated that the refinery had previously imported crude from Brazil, Angola, Ghana, and Equatorial Guinea. However, he explained that “improved relations between the refinery, local oil traders and the government will result in a steady supply of Nigerian crude.”

The report noted that in June, the plant received about half of its crude from local producers, who will be able to supply more as their foreign commitments wind down.

Edwin said, “We expect some of the long-term contracts will expire. Personally, and as a company, we expect that before the end of the year, we can transition 100 per cent to local crude.”

Data compiled by Bloomberg revealed that in June, the refinery sourced 53 per cent of its crude from domestic producers and 47 per cent from the United States.

Edwin added that the plant is currently processing 550,000 barrels of crude per day.

According to cargo allocations seen by Bloomberg News, Dangote was scheduled to receive five cargoes from the Nigerian National Petroleum Company Limited in July, with the same amount set for August. Each cargo contains nearly one million barrels of crude.

Aliko Dangote constructed the $20 billion refinery to end the export of Nigerian crude for refining abroad and the subsequent importation of refined products.

The gradual ramp-up of the refinery has already enabled Nigeria to become a net exporter of petroleum products, despite initial challenges in securing adequate domestic crude to reach its full capacity of 650,000 barrels per day. This led to the refinery relying heavily on foreign crude.

Dangote recently stated that despite a naira-for-crude deal, the refinery had been largely dependent on crude from the United States.

The refinery expects a notable increase in local crude supply over the coming months.

Most Popular

-

BIG STORY5 days ago

BIG STORY5 days agoCOALITION: We’ll Register New Party As Backup To ADC — El-Rufai

-

BIG STORY1 day ago

BIG STORY1 day agoJUST IN: ASUU Suspends Strike As Federal Government Pays June Salaries

-

BIG STORY4 days ago

BIG STORY4 days agoUBA, Wema, GTB Resume International Transactions On Naira Cards After Years Of Suspension

-

BIG STORY2 days ago

BIG STORY2 days agoJUST IN: Several Passengers Injured As Commercial Bus Somersaults On Lagos Third Mainland Bridge [PHOTOS]

-

BIG STORY1 day ago

BIG STORY1 day agoJUST IN: JAMB Sets 150 As Cut-Off Mark For Universities

-

BIG STORY1 day ago

BIG STORY1 day ago“JAPA”: US Embassy Begins Screening Nigerian Students’ Social Media Accounts

-

BIG STORY5 days ago

BIG STORY5 days agoBREAKING: Court Finds Natasha Guilty Of Contempt, Fines Her N5 million

-

BIG STORY2 days ago

BIG STORY2 days agoBREAKING: Olubadan Of Ibadan Oba Olakulehin Joins His Ancestors