BUSINESS

FCMB Supports 2016 Ojude Oba Festival To Boost Tourism, Felicitates With Ijebuland

- /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 27

https://porscheclassy.com/wp-content/uploads/2016/08/IMG_9021FCMB-004-e1472637070344.jpg&description=FCMB Supports 2016 Ojude Oba Festival To Boost Tourism, Felicitates With Ijebuland', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

- Share

- Tweet /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 69

https://porscheclassy.com/wp-content/uploads/2016/08/IMG_9021FCMB-004-e1472637070344.jpg&description=FCMB Supports 2016 Ojude Oba Festival To Boost Tourism, Felicitates With Ijebuland', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

BUSINESS

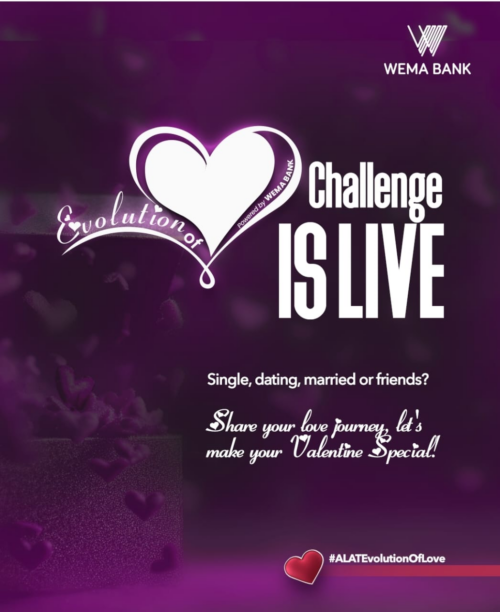

Wema Bank Launches “Evolution of Love” Campaign For Valentine’s Day

BUSINESS

FIRST HOLDCO PLC – TAKING THE BULL BY THE HORN WITH A RECORD IMPAIRMENT CHARGE; GROWS GROSS EARNINGS TO N3.4 TRILLION FOR THE UNAUDITED FULL YEAR ENDED DECEMBER 31, 2025.

BUSINESS

Jide Sipe Named President, Abiodun Coker of UBA, Others Emerge As ACAMB Executives

-

BIG STORY3 days ago

BIG STORY3 days agoLagos Couple Stages Self-Kidnap To Raise Funds For Husband’s US Return Ticket, Arrested With N10m Ransom

-

NEWS4 days ago

NEWS4 days agoReimagining Urban Spaces: The Forward-Thinking Public-Private Collaboration in Obalende’s Transformation By Babajide Fadoju

-

NEWS4 days ago

NEWS4 days agoAdron Homes Unveils “Love for Love” Valentine Promo with Exciting Discounts, Luxury Gifts, and Travel Rewards

-

BIG STORY4 days ago

BIG STORY4 days agoPolice Arrest Six For ‘Hacking Telecoms Firm To Divert N7.7bn Airtime’, Recover 400 Laptops, 1000 Mobile Phones

-

BUSINESS2 days ago

BUSINESS2 days agoFIRST HOLDCO PLC – TAKING THE BULL BY THE HORN WITH A RECORD IMPAIRMENT CHARGE; GROWS GROSS EARNINGS TO N3.4 TRILLION FOR THE UNAUDITED FULL YEAR ENDED DECEMBER 31, 2025.

-

NEWS4 days ago

NEWS4 days agoSanwo-Olu’s Tough Actions, Soft Power By Tunji Bamishigbin

-

ENTERTAINMENT7 hours ago

ENTERTAINMENT7 hours agoBurna Boy, Davido, Wizkid, Ayra Starr Lose At 2026 Grammy Awards

-

BIG STORY3 days ago

BIG STORY3 days agoResident Doctors Give Federal Government Four Weeks To Meet Demands