Nigerians have been reassured by the Nigerian National Petroleum Company Limited (NNPCL) that the current fuel shortage and lines will end by Wednesday, April 31.

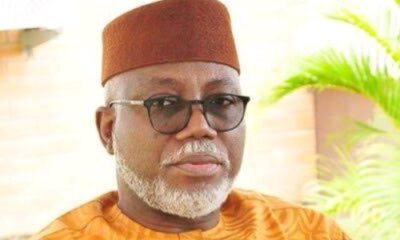

According to the News Agency of Nigeria (NAN), Mr. Olufemi Soneye, Chief Communications Officer of NNPCL, on Tuesday in Lagos.

Soneye claims that the company can currently supply more than 1.5 billion litres of products, enough to last for at least 30 days.

“Unfortunately, we experienced a three-day disruption in distribution due to logistical issues, which has since been resolved.

“However, as you know, overcoming such disruptions typically requires double the amount of time to return to normal operations,” he said.

He said, “Some folks are taking advantage of this situation to maximize profits.

“Thankfully, product scarcity has been minimal lately, but these folks might be exploiting the situation for unwarranted gain.

“The lines will be cleared out between today and tomorrow,” Soneye assured.

Similarly, Mr Hammed Fashola, the National Vice President of the Independent Petroleum Marketers Association of Nigeria (lPMAN), expressed hope that the queues in Lagos and Ogun would ease off this week, relying on the words of the NNPCL.

Fashola, however, stated that the queues in Abuja might tarry a bit due to the distance to Lagos.

“The information available to us from the NNPCL was that there was a logistics problem, and when that happens, it will disrupt the supply chain.

“That might be a delay in the movement of ships from the mother vessel to the daughter vessel before it gets to the depot tanks.

“Before we can correct that, surely it will take some days. I think by Tuesday or Wednesday, there will be more products available for lifting by marketers.

“It might take time before it can ease off in Abuja, considering the distance to Lagos and the bad roads; Lagos might be calm this new week,” Fashola assured.

It was gathered that stranded motorists and commuters have expressed concern over frequent fuel scarcity in Lagos metropolis.

This has resulted in a few commercial vehicles, which led to a hike in fares.

The situation within Lagos metropolis showed that only a few filling stations were selling, with long queues in most parts.

This was also the same situation within Abule-Egba and environs: Abbatoir Road in Agege, Akowonjo Road, Bariga, Fola-Agoro, and the popular Lasu-Igando Road.

The few filling stations that dispensed petrol had long queues of vehicles stretching some meters.

Across the metropolis on Monday, petrol queues were seen at filling stations like Mobil, NIPCO, TotalEnergies, Forte Oil, and ConOil along Ikorodu Road.

North West at Maryland, Gbagada, NIPCO along Ijede road, Ikorodu, and TotalEnergies at the NNPC bus stop in Ejigbo stretched to about 500 metres from the pumps.

Credit: NAN

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY2 days ago

BIG STORY2 days ago