Petroleum marketers have begun registering with the Dangote Petrochemical Refinery prior to loading the product, as Nigerians anticipate premium motor spirit from the refinery this month.

The marketers are applying to receive direct fuel supply from the oil refinery by registering as individual business owners.

The Independent Petroleum Marketers Association of Nigeria, which represents its members who might not be able to purchase a significant amount of petrol from the refinery, announced that it would carry on negotiations with the company in order to secure bulk supply.

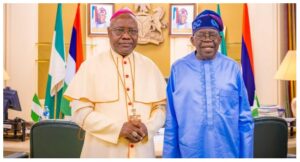

Aliko Dangote, the president of the Dangote Group, announced last month that his refinery would stop importing petrol into Nigeria and that the company would start selling PMS in June.

At the recent Africa CEO Forum Annual Summit in Kigali, Rwanda, Dangote gave a speech in which he expressed optimism about the continent’s energy landscape changing.

“Right now, Nigeria has no cause to import anything apart from gasoline and by sometime in June, within the next four or five weeks, Nigeria shouldn’t import anything like gasoline; not one drop of a litre,” he declared

“We have enough gasoline to give to at least the entire West Africa, diesel to give to West Africa and Central Africa. We have enough aviation fuel to give to the entire continent and also export some to Brazil and Mexico.”

“We have started producing jet fuel, we are producing diesel, and by next month, we’ll be producing gasoline. What that will do, it will be able to take most African crude,” Dangote told the panel.

The words of Dangote appeared to have come as a soothing balm to marketers who have not been able to import fuel for a long time.

To independent marketers, the news is heart-warming because they have hitherto depended on third parties to get petrol at a higher cost for their filling stations scattered across the country.

When he was speaking with our correspondent in May, the National Vice President of IPMAN, Hammed Fashola, expressed happiness, saying “the Dangote refinery can satisfy our needs as far as petroleum products are concerned, especially petrol”.

The IPMAN leader expressed the eagerness of marketers to start lifting fuel from the refinery, saying, “We are all waiting, we are eager for the commencement of the lifting on petroleum products from Dangote refinery, especially petrol”.

The marketer stressed that the private refinery would put an end to fuel scarcity in Nigeria as the product would no longer be imported.

Meanwhile, Fashola explained that IPMAN as a body is yet to have an agreement with the Dangote refinery on the supply of premium motor spirit, calling on the company to consider working directly with the association instead of individuals.

He noted that IPMAN should be a beautiful bride before Dangote for being in control of over 80 per cent of the filling stations in Nigeria.

Fashola said plans had been concluded to meet Dangote for discussions on possible price cuts. He told The PUNCH that they would meet with Dangote to negotiate a discount through bulk purchases.

The IPMAN leader said, “We have our letter with them, we are expecting their response, and we will surely do a follow-up. The letter was sent about a month ago and we are going to follow up. We are just like a ready-made market for Dangote. It is an advantage for him to have us in his programme. I believe that he would like to have us.”

He added that the association would request a discount during the meeting with Dangote.“You know when you come together as a group, you have that negotiating power on your strength. There is no way we will not negotiate for a discount. That is why we don’t encourage individual company participation,” he stated.

While it appears the proposed meeting with Dangote has yet to materialise, Fashola informed our correspondent on Sunday that individual marketers are already applying for the product.

Asked if IPMAN had met with Dangote, he replied, “No, but we have started registering individually with the company.”

Replying to whether the marketers were no longer interested in meeting the company’s president, he said, “Discussion is still going on it.”

Contacted, the Executive Secretary of the Major Energies Marketers Association of Nigeria, Clement Isong, said he would not know whether or not members of the association were already registering with Dangote.

“I have to ask, I am not sure. I don’t know. I don’t have any information,” Isong tersely retorted.

There are speculations that the refinery might choose to sell its petrol through a major marketer.

The company is currently selling its diesel through MRS, one of the energy firms making up MEMAN.

“I can confirm to you that Dangote Petroleum Refinery has entered a strategic partnership with MRS oil and gas stations to ensure that consumers get to buy fuel at affordable prices in all their stations, be it Lagos or Maiduguri,” the company’s spokesperson, Anthony Chiejina, said in April.

When the Dangote refinery announced the commencement of operations in January, the Executive Secretary of MEMAN, Isong, said that its members had registered with the refinery.

“We have all registered with Dangote so that we can buy and sell. All my members are registered with Dangote. Whenever the product is ready and starts coming out, you will see it in our filling stations.

“I confirm that my members have registered with them. We were waiting for the production to start and now it has started and they will start discussing the commercial terms.

“So now, the commercial terms will be agreed with each marketer and then they will buy from them,” Isong stated.

In January, the Dabgote Group, owners of the 650,000 barrels per day capacity refinery confirmed the registration of oil marketers as its distributors, stating, “Three prominent associations, that constitute 75 per cent of the total market in Nigeria have been registered. The Depot and Petroleum Products Marketers Association of Nigeria, the Independent Petroleum Marketers Association of Nigeria, and the Major Energies Marketers Association of Nigeria.”

Meanwhile, Nigerians are eagerly waiting to start having the Dangote petrol in circulation, hoping that it would crash the current pump price of the fuel which the masses majorly depend on for transportation and individual power generation.

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY3 days ago

BIG STORY3 days ago