BIG STORY

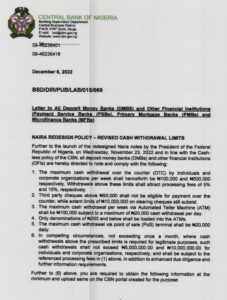

BREAKING: CBN Announces Fresh Cash Withdrawal Limits, ₦100,000 For Individual, ₦500,000 For Cooperate

-

BIG STORY3 days ago

BIG STORY3 days agoJUST IN: US Clarifies New Visa Rule For Nigerians, Cites Global Security Standards

-

BIG STORY3 days ago

BIG STORY3 days agoREVEALED: Trump’s Visa Clampdown Linked To Nigeria’s Refusal To House Asylum Seekers — TheCable Report

-

BIG STORY4 days ago

BIG STORY4 days agoTunji-Ojo Meets US Envoy Over New Visa Policy, Says FG Will Curb Overstay By Nigerians

-

BIG STORY5 days ago

BIG STORY5 days ago“JAPA”: Canada Increases Minimum Proof Of Funds To N17m For Immigrants

-

BIG STORY5 days ago

BIG STORY5 days agoUK Introduces eVisas For Nigerian Study, Work Visa Applicants

-

BIG STORY3 days ago

BIG STORY3 days agoLagos Steps Up: Wahab’s Cleanup Blitz And Plastic Ban Herald A New Environmental Era — By Babajide Fadoju

-

BIG STORY3 days ago

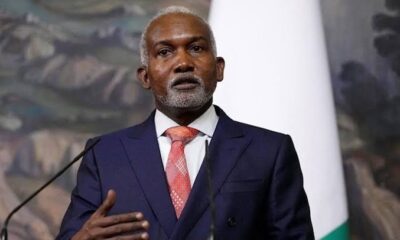

BIG STORY3 days agoNigeria Won’t Bow To US Pressure To Accept Venezuelan Deportees — Foreign Affairs Minister Tuggar

-

BIG STORY5 days ago

BIG STORY5 days agoLG Polls: Speaker Obasa Charges Lagos West APC Candidates To Intensify Campaigns, Assures Of The Assembly’s Support