BIG STORY

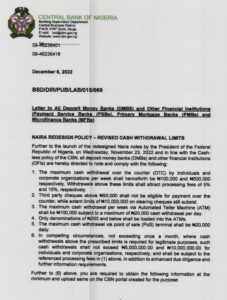

BREAKING: CBN Announces Fresh Cash Withdrawal Limits, ₦100,000 For Individual, ₦500,000 For Cooperate

-

BIG STORY4 days ago

BIG STORY4 days agoBREAKING: Reps Suspend Implementation Of Cybersecurity Levy

-

BIG STORY2 hours ago

BIG STORY2 hours agoBREAKING: Customs Chief Abdullahi Magaji Shoots Self Dead In Kano

-

BIG STORY3 days ago

BIG STORY3 days agoPrince Harry, Wife Meghan Arrive In Nigeria To Promote The Invictus Games [PHOTOS]

-

BIG STORY4 days ago

BIG STORY4 days agoSenate Passes Bill Seeking To Impose Death Penalty On Drug Traffickers

-

BIG STORY5 days ago

BIG STORY5 days agoBREAKING: EFCC To Arraign Sirika, Daughter, Two Others On Thursday Over Alleged N2.7bn Fraud

-

BIG STORY3 days ago

BIG STORY3 days agoLawyer Begs Court For More Time To Produce Yahaya Bello, Says “We Don’t Know Where He Is”

-

BIG STORY4 days ago

BIG STORY4 days agoAlleged Fraud: Court Grants Sirika, Daughter, Two Others N100m Bail Each

-

BIG STORY7 hours ago

BIG STORY7 hours agoTijani Babangida’s One-Yr-Old Son Dies As Wife ‘Loses Eye’ In Auto Crash