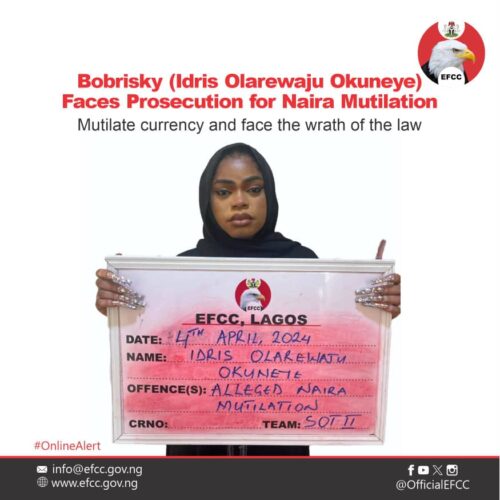

The Economic and Financial Crimes Commission (EFCC) will Friday, 5 April, arraign popular cross-dresser, Idris Okuneye aka Bobrisky, at the Federal High Court (FHC) in Lagos over naira abuse and failure to declare his firm’s activities involving the sum of N180.7million.

The anti-graft agency filed the charge against the social media celebrity on Thursday, April 4, 2024, through Senior Advocate of Nigeria (SAN), Rotimi Oyedepo.

It followed a statement on Thursday by the commission announcing Bobrisky’s arrest a day earlier for alleged Naira abuse.

In the charge marked FHC/L/244c/2024, the EFCC listed six counts against the defendant.

In the first four counts, the defendant was accused of naira abuse. While the 5th and 6th counts accused him of offences connected with his company, Bob Express.

The six counts read in part: “That you, Okuneye Idris Olanrewaju, on the 24th day of March 2024, at Imax Circle Mall, Jakande, Lekki, whilst dancing during a social event tampered with the total sum of N400,000 notes by spraying same.

“That you, OKUNEYE IDRIS OLANREWAJU, between July and August 2023 at Aja Junction, Ikorodu, whilst dancing during a social event tampered with the sum N50,000, by spraying the same

“That you, OKUNEYE IDRIS OLANREWAJU, sometime in December 2023 at White Stone Event Hall, Ikeja, during a social event tampered with the sum N20,000 by spraying same.

“That you, OKUNEYE IDRIS OLANREWAJU, sometimes in 2022 at Event Hall, Oniru, Victory Island, within the jurisdiction of this Honourable Court whilst dancing during a social event tampered with the sum N20,000 by spraying same…”

The four counts were said to have contravened Section 21(1) of the Central Bank of Nigeria (CBN) Act, 2007.

Counts 5 and 6 read: “That you OKUNEYE IDRIS OLANREWAJU trading under the name and style of BOB EXPRESS, between 1st September 2021 to 4th April 2024 in Lagos, failed to submit to the Special Control Unit Against Money Laundering a declaration of your activities of the said company within which period the total sum of N127,780,877.98 was paid into the company’s account number 2830002929, domiciled in Ecobank Plc….

“That you, OKUNEYE IDRIS OLANREWAJU trading under the name and style of BOB EXPRESS between 1st September 2021 to 4th April 2024 in Lagos, failed to submit to the Special Control Unit Against Money Laundering a declaration of your activities of the said company within which period the total sum of N53,000,000 was paid into the company’s account number 2830016041, domiciled in Ecobank Plc…”

Both alleged offences contravened sections 6(1)(a), 19(1)(f) of the Money Laundering (Prevention and Prohibition) Act, 2022 and section 19 (2)(b) of the same Act.

The EFCC arrested and detained the controversial cross-dresser, in Lagos on Wednesday night.

In a statement titled “EFCC Grills Bobrisky for Naira Abuse” posted on its social media handle later, the EFCC wrote, “Operatives of the Lagos Zonal Command of the Economic and Financial Crimes Commission, EFCC, have commenced investigation of Idris Okuneye, a.k.a Bobrisky, for allegedly spraying Naira notes.

The EFCC had invited the 31-year-old following a video report of spraying and flaunting wads of new Naira notes at the premiere of a movie, Ajakaju, produced by Eniola Ajao, a Nollywood actress and producer, at Film One Circle Mall, Lekki, Lagos on March 24, 2024.

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY2 days ago

BIG STORY2 days ago