BUSINESS

BAFI: Fidelity Bank Wins Commercial Bank of The Year as Nnamdi Okonkwo Bags CEO Of The Decade Award

- /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 27

https://porscheclassy.com/wp-content/uploads/2020/11/Okonkwo-702x600.jpg&description=BAFI: Fidelity Bank Wins Commercial Bank of The Year as Nnamdi Okonkwo Bags CEO Of The Decade Award', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

- Share

- Tweet /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 69

https://porscheclassy.com/wp-content/uploads/2020/11/Okonkwo-702x600.jpg&description=BAFI: Fidelity Bank Wins Commercial Bank of The Year as Nnamdi Okonkwo Bags CEO Of The Decade Award', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

-

BIG STORY2 days ago

BIG STORY2 days agoJUST IN: Defence Headquarters Finally Confirms Coup Attempt Against Tinubu, Indicted Officers To Face Military Trial

-

BIG STORY2 days ago

BIG STORY2 days agoNo Party Or Person Can Defeat President Tinubu In 2027, Atiku’s Son Declares

-

BIG STORY2 days ago

BIG STORY2 days agoBREAKING: Soludo Closes Onitsha Market For One Week Over Sit-At-Home Defiance

-

BIG STORY2 days ago

BIG STORY2 days agoJUST IN: NLC, FCTA Workers Protest At Industrial Court, Demand Wike’s Removal [PHOTOS]

-

BIG STORY2 days ago

BIG STORY2 days agoLeave Me Out of 2027 Running Mate Permutations, Tinubu Will Decide What’s Best —– Dogara

-

BIG STORY1 day ago

BIG STORY1 day agoAlaafin, Soun Absent As Makinde Kicks Off Oyo 50th Anniversary

-

POLITICS2 days ago

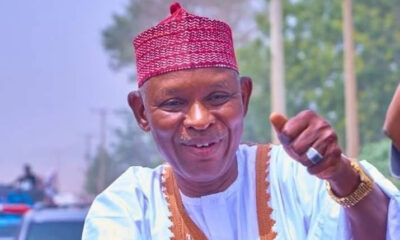

POLITICS2 days agoBREAKING: Kano Governor Abba Yusuf Officially Rejoins APC

-

POLITICS2 days ago

POLITICS2 days agoAPC Dismisses Claims Of Replacing Shettima As Tinubu’s 2027 Running Mate, Says It’s Utterly Baseless