Access Bank PLC and KCB Group PLC (“KCB”) have today signed a binding agreement to acquire 100 percent shareholding in National Bank of Kenya Limited (“NBK”) from KCB.

The successful completion of the transaction is subject to conditions that are customary for transactions of this nature including receipt all regulatory approvals from, amongst others, the Central Bank of Kenya, the Central Bank of Nigeria, the COMESA Competition Commission, and notifications to other relevant regulators.

For Access Bank, this move underscores its commitment to bolstering its presence in Kenya and the broader East African region. Furthermore, the acquisition builds on the Bank’s growing operations in the Democratic Republic of Congo, Rwanda, as well as its impending acquisitions of a majority stake in Uganda’s Finance Trust Bank Limited, the acquisition of majority equity stake in African Banking Corporation (Tanzania) Limited (“BancABC Tanzania”), and Standard Chartered Bank’s Consumer, Private & Business Banking business in Tanzania.

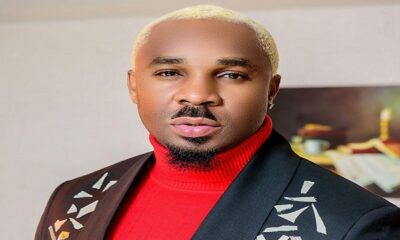

Commenting on the transaction, Roosevelt Ogbonna, Managing Director/Chief Executive of Access Bank Plc said:

“The transaction represents an important milestone for the Bank as it moves us closer to the achievement of our five-year strategic plan through increased scale in the Kenyan market. We are building a strong and sustainable franchise to support economic prosperity, encourage Africa trade, advance financial inclusion thereby empowering many to achieve their financial dreams.

“Trade flows in East Africa revolve around key trade corridors, with Kenya being a key player in the region. With the African Continental Free Trade Agreement, these corridors will continue to expand and by deploying our best-in-class financial solutions, we are strategically positioned to deliver sustainable value for our stakeholders. The consolidation in Kenya will support the realisation of our aspiration to be Africa’s Payment Gateway to the World. Subsequent to the completion of the transaction, NBK would be combined with Access Bank Kenya Plc to create an enlarged franchise in the pursuit of our strategic objective for the Kenyan and East African markets.”

KCB Group CEO Paul Russo said: “This transaction represents what we believe is a great opportunity to maximise value for our shareholders while strengthening the competitive position for the Group. The past four years have been defining for NBK as a KCB Group subsidiary and this step marks the opening of new opportunities.”

“During the period, we have made progressive investments in the Bank, and we believe that this is in the best interest of the Group and its sustainability. Our growth strategy is premised on both organic and inorganic plans, and we shall continue to seek opportunities that increase our shareholder’s value,” said Mr Russo.

All parties will be working together in the coming months to fulfil the conditions precedent relating to the proposed acquisition, which include the regulatory approvals of the Central Bank of Nigeria and the Central Bank of Kenya. Access Bank will continue to provide a full range of banking services and continuity for its stakeholders including employees and customers in Kenya.

In the meantime, NBK customers will continue to access seamless services across various touchpoints including through the branch network and mobile banking platforms.

Upon conclusion, stakeholders will benefit from the from an enlarged franchise, with best-in-class customer service and governance structures committed to empowering the communities wherein the Bank operates. The combined entity will leverage Access Bank’s dedication to economic development by extending financial services to the unbanked, thereby deepening financial inclusion across the region.

In recent months, Access Bank has embarked on a strategic expansion drive, marked by significant acquisitions. In January, the Bank completed its acquisition of Atlas Mara Zambia, thereby becoming one of Zambia’s top five banks by revenue with prospects to be in the top three by 2027.

Access Bank, a wholly owned subsidiary of Access Holdings Plc, is a leading full-service commercial bank operating through a network of more than 700 branches and service outlets spanning 3 continents, 21 countries and 60+ million customers. The Bank employs over 28,000 thousand people in its operations in Africa and Europe, with representative offices in China, Lebanon, India, and the UAE.

Access Bank’s parent company, Access Holdings Plc, is listed on the Nigerian Exchange as Access Corporation. The Bank is a diversified financial institution which combines a strong retail customer franchise and digital platform with deep corporate banking expertise, proven risk management and capital management capabilities. The Bank services its various markets through four business segments: Corporate and Investment Banking; Commercial Banking; Business Banking, and Personal & Private Banking. The Bank has enjoyed what is arguably Africa’s most successful banking growth trajectory in the last 22 years, becoming one of the continent’s largest retail banks.

As part of its continued growth strategy, Access Bank is focused on mainstreaming sustainable business practices into its operations. The Bank strives to deliver sustainable economic growth that is profitable, environmentally responsible, and socially relevant, helping customers to access more and achieve their dreams. For more information about Access Bank PLC, please visit www.accessbankplc.com.

KCB Group Plc is East Africa’s largest commercial Bank that was established in 1896. The Group is headquartered in Kenya, with the country serving as the lead market with two banking subsidiaries namely KCB Bank Kenya and National Bank of Kenya. Over the years, the Bank has grown and spread its wings into Tanzania, South Sudan, Uganda, Rwanda, Burundi, the Democratic Republic of Congo and Ethiopia (Rep). Additionally, KCB Group owns KCB Bancassurance Intermediary Limited, KCB Capital Limited, KCB Foundation and Kencom House Limited as non-banking businesses. Today KCB has the largest branch network in the region with 603 branches, 1,270 ATMs and over 28,800 merchants and agents offering banking services on a 24/7 basis in East Africa. This is complemented by mobile banking and internet banking services with 24-hour contact center services for our customers to get in touch with the Bank. KCB has a vast network of correspondent relationships totaling over 200 banks across the globe, and our customers are assured of a seamless facilitation of their international trade requirements wherever they are.

- About National Bank of Kenya Limited

The National Bank of Kenya Limited is a commercial bank licensed and regulated by the CBK providing an array of banking services to individuals and enterprises since 1968. NBK is a subsidiary of KCB Group Plc. after a successful acquisition in 2019 and has been running an agency banking model. Its network of 77 branches (including outlets) is complemented by various digital banking channels, including a vast ATM network of 98 ATMs, National Bank Agents and E-Pay – a fully integrated online banking platform for corporate and retail clients. The Bank renders solutions to corporates, institutions, micro and macro businesses, as well as retail customers and can customise products and services to meet the needs of specific clients through several channels. The wide spectrum of products provided by the bank includes financing, trade services, mortgages, account services, card services, Islamic banking, and more.

NBK is regarded as the best bank for customer service in Kenya, having received an award for its first-rate standard of service. Additionally, it is the leading bank for Islamic banking in the East Africa region, which has won customers’ loyalty and enabled the bank to maintain and boost market share in the Kenyan banking sector. The Bank is a major player in Kenya’s banking sector and one of the largest banks in the country, providing financial services to all sectors of the Kenyan economy, while consistently meeting the needs of its customers and shareholders.

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY20 hours ago

BIG STORY20 hours ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY5 days ago

BIG STORY5 days ago