· To mark International Women’s Day this year, on March 8, 2022, Prime Minister Boris Johnson launched a new global partnership with 11 global businesses to improve girls’ access to education and employment in developing countries.

· The UK Government will contribute an initial £9m, with the partners providing an additional £11m.

· The program aims to provide high-quality skills training to around 1 million girls around the world.

· Improving girls’ access to education is a key part of the UK’s foreign policy, to ensure the build back from the pandemic and prevent a lost generation. Investing in education helps lift communities out of poverty and protects girls from early marriage, forced labor, and gender-based violence.

As part of activities to mark this year’s edition of the International Women’s Day (IWD), the United Kingdom Prime Minister, Boris Johnson has launched a new global partnership with UBA Foundation and 10 other organizations, to improve girls’ access to education and employment in developing countries.

To this end, the UBA Foundation, together with 10 other global businesses that have come together with the UK government will be working in partnership with UNICEF’s Generation Unlimited (GenU) to fund this very crucial program that aims to provide high-quality skills training to around one million girls around the world.

The UBA Foundation, other private sector players, and global businesses who are partnering to fund and resource the initiative to the tune of £9m are Accenture, Standard Chartered, Unilever, Microsoft, Pearson, PwC, Coursera, Vodafone, BP, and Cognizant. The UK government has contributed an initial £9m to the initiative called the Girls’ Education Skills Partnership program.

Explaining its drive to undertake this project which is expected to have far-reaching positive effects for the girl-child across the world, the UK Government pointed out that even before the Covid pandemic, millions of children did not have any access to school – and girls from disadvantaged families are particularly vulnerable to missing out on education, whether through poverty or prejudice. The pandemic has created even more barriers to education, with a peak of 1.6 billion children around the world who have faced school closures.

Prime Minister Boris Johnson, who pointed out that this is the UK’s first education partnership of its kind where the UK Government is joining forces with the private sector to boost girls’ access to education in developing countries, said, “The United Kingdom has long been a proud and mighty champion of this fundamental cause and today we take one leap further through our first Global Partnership of its kind – opening up opportunities for one million girls across the developing world to have access to high-quality skills training.

Continuing, Boris said, “Ensuring every girl and young woman across the globe receives 12 years of quality education is the greatest tool in our armory to end the world’s great injustices. “Delivering on this mission will be one of the best defenses against ignorance, ensure the greatest protection from prejudice and put a rocket booster behind our hopes and dreams for global development in the years to come.”

In his speech, Mr. Johnson noted that some of the businesses involved will be contributing a range of resources including books, computers and other technology, mentoring, advice, and access to their networks, skills, and training programs just as the private sector involvement will help ensure that education and learning opportunities provide girls with the skills for the future that employers need.

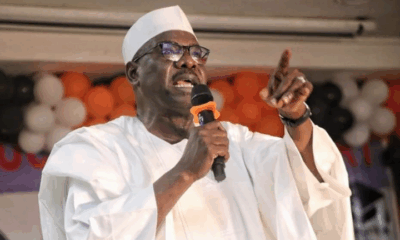

The Group Chairman, United Bank for Africa(UBA), Mr. Tony O. Elumelu, CON, who was in attendance at the event reiterated the importance of educating the girl child and giving back always as we strive towards sustainable development. “We understand first hand, the need to empower young women in African communities to catalyze sustainable socio-economic development. At the UBA Group, we are committed to women empowerment and we continue to champion women’s causes in our business and through our work in philanthropy. Working together, we must ensure that our girls are properly educated and attain the necessary skills that allow them to effectively compete as the world becomes increasingly global,” He added.

Mr. Elumelu thanked the Prime Minister and the UK Special Envoy, Helen Grant, for the laudable initiative that will see more girls globally, being educated.

The UBA Foundation is the Corporate Social Responsibility arm of the United Bank for Africa group. The Foundation is focused on initiatives that support Education, Empowerment and the Environment in the African country. For over 2 decades, the UBA Foundation has been giving back and changing lives on the continent.

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY20 hours ago

BIG STORY20 hours ago

BIG STORY19 hours ago

BIG STORY19 hours ago