Technology has been a veritable gift to mankind, and over the years, it has been responsible for creating amazingly useful resources that put all the information individuals need at their fingertips. The development of technology has also led to so many mind-blowing discoveries, better facilities, and better luxuries, which has, in turn, helped to improve lifestyle and standard of living.

For instance, through relevant technological development, the average individual has been empowered to shop online and carry out seamless transactions any time of the day or night from the comfort of his own home or business place.

To this end, forward-thinking companies and financial institutions with eyes in the future who have been conversant with the new trend in customer behavior, have painstakingly designed new products and services tailor-made to meet the growing needs of customers anytime anywhere.

It is bearing this in mind that Pan-African Financial Institution, United Bank for Africa (UBA) Plc, changed the face of e-banking in the African continent for the first time with the introduction of Leo – UBA’s Chat Banker. The idea of Leo, which was birthed in 2018, was to enable customers to make use of their social media accounts to carry out key banking transactions with ease.

This is the first time ever that a financial institution in Africa evolved a one-stop solution to simplify the way customers transact, a key essential in today’s fast-paced world with demands for quick-time transactions and response.

With Leo’s help, customers have been able to open new accounts with ease, receive instant transaction notifications, check their balances on the go, transfer funds, and airtime top-up. Cheque confirmation, bill payments, loan application, account freezing, request for mini statements, flight bookings, airtime, and data purchases, are some other services that the chat banking BOT has been helping customers to carry out since 2018.

And Leo, the Artificial Intelligent Bot which carries out seamless conversations with his customers – who he calls his friends by the way- has achieved this and more in its three-year existence; allowing users to carry out a quick, fast, and recurring transaction with ease from their popular social media accounts such as Facebook and Whatsapp.

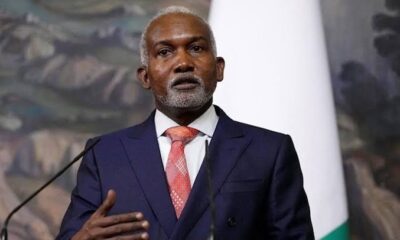

No wonder the bank has earned a lot of laurels and accolades in the last three years confirming Leo’s global acceptance and recognitions, as pointed out by UBA’s Group Managing Director, Mr. Kennedy Uzoka, some of which are:

‘Africa’s Best Digital Bank of the year’ by Euromoney; The Most; Innovative Bank of the Year’ by International Finance; ‘Best Customer Engagement Tool’ by Africa Fintech; Pulse magazine rated Leo on WhatsApp as ‘The best WhatsApp Banking App’; ‘The Best Social Banking platform’ in Uganda; ‘Excellence in Automated Chatbot Initiative’ by Finnovex Awards; ‘Next Generation Class of 2019’ by CIBN; ‘Best Automated Chatbot Initiative, Application or Programme’ by The Asian Banker. The list is endless.

“The formulation of this product, is consistent with UBA’s Customer 1st philosophy, where we have been doing things not the way we like, but focusing on what the customers want, where they want it, and in the exact platform they want it; Uzoka explained. “At UBA, we have been continuously working with technology giants that have the global capacity to ensure not only seamless but also effortless banking for the millions of our customers across Africa; as all the bank’s subsidiaries in Africa have activated Leo to perform financial services for customers.

Continuing, he said, “Since 2018, Leo has been helping with most transactions and to deliver any form of banking services. And this has been highlighted more especially during the lockdown occasioned by the COvid-19 virus, as Leo assisted all its users on all major social media platforms to carry out all their banking activities without having to physically visit a branch. This, to us, remains an admirable feat because, with Leo, the banking needs of our customers have become easy and simple – as simple as chatting”; Uzoka pointed out.

Within three years of operations, UBA’s Leo has recorded a number of milestones including opened a total of 390,756 accounts; achieving 2,169,384 subscribers; conducting a total of 9,605,703 transaction count worth a value of N81,530,918,868. Leo which has over 2.1m unique users has also generated over 20 million conversations and over 85 million engagements; with such impressive feedback and usage and remains the only AI BoT showcased at the F8 in Mark Zuckerberg’s opening remarks.

UBA’s Group Head, Digital Banking, Sampson Aneke, reiterated that Leo is not just a chat machine, but an artificial intelligence personality meant to address any type of banking concerns raised by customers.

“Leo has been operating a secure lifestyle banking platform on Facebook Messenger, WhatsApp and IOS and Andriod to assist customers with their transactions while chatting with your friends and business partners. The security with this platform has been that for every transaction, a One Time Password (OTP) is generated to the phone number that is registered on your account,” he explained and added that the bank is working tirelessly to improve LEO’s services to the customers in the coming weeks.

United Bank for Africa Plc is a leading Pan-African financial institution, offering banking services to more than twenty-one million customers, across over 1,000 business offices and customer touchpoints, in 20 African countries. With its presence in the United States of America, the United Kingdom, and France, UBA is connecting people and businesses across Africa through retail; commercial and corporate banking; innovative cross-border payments and remittances; trade finance, and ancillary banking services.

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago