Africa’s leading financial institution, the United Bank for Africa (UBA) Plc has announced its audited half-year financial results for the half-year ended June 30, 2021, showing impressive growth across all major income lines and performance indicators.

The pan African financial institution delivered a 33.4 percent appreciation in its profit before tax which rose to N76.2 billion as of June 2021, up from the N57.1 billion recorded in the same period of 2020. This translated to an annualized Return on Average Equity (RoAE) of 17.5 percent as against 14.4 percent a year earlier. This feat was recorded despite the challenging business and economic environment that emerged from the slow pace of activities following the global lockdown occasioned by the Covid-19 pandemic.

The results submitted to the Nigerian Exchange Limited showed that the group’s profit after tax stood at N60.6 billion, representing a significant rise by 36.3 percent, compared with the N44.4 billion recorded in the half-year of 2020.

Similarly, gross earnings grew to N316 billion, which was a five percent increase, from the N300.6 billion recorded as of June 2020.

According to the results, at June 30, 2021, the group’s total assets crossed the N8 trillion mark as it increased to N8.3 trillion, up from N7.7 trillion at the end of the 2020 financial year. Its customer deposit also crossed the N6 trillion mark, growing by 7.4 percent to N6.1 trillion in the period under review, compared with N5.7 trillion as of December 2020.

Furthermore, the group’s Shareholders’ Funds remained robust at N752.5 billion, up from N724.1 billion in December 2020, reflecting its strong capacity for internal capital generation.

In line with the bank’s culture of paying both interim and final cash dividends, the Board of Directors of UBA declared an interim dividend of 20 kobo per share for every ordinary share of 50 kobo each, held by its shareholders.

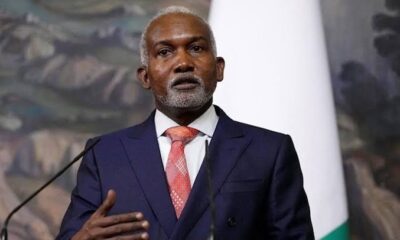

Commenting on the results, UBA’s Group Managing Director/Chief Executive Officer, Mr. Kennedy Uzoka, expressed delight over the bank’s performance in the first half of the year.

He added: “This has been a strong first half for us, as global economic recovery exceeded expectations, creating a positive rub-off on consumer and corporate confidence, savings, and investment activities.

“We saw this positively impact our business, as we continued to leverage our key strategic levers – People, Process and Technology, and our Customer-first philosophy, to revolutionize customer experience at UBA.”

He added that the bank’s investment in the Rest of Africa (excluding Nigeria) continues to yield good results for the group.

Uzoka added: “The benefits of pan-African business diversification accruing to the Group is once again evident, with gross earnings and interest income growth of 5.1 percent and 8.3 percent respectively, despite the low yield environment in our largest market, Nigeria.

“We are making remarkable progress on our strategy that is progressively positioning UBA as the bank of choice on the continent, driven by our emphasis on tech-led innovation and best customer experience.”

Continuing, the GMD pointed out that the bank recognizes the far-reaching effects of the pandemic on businesses globally, and remains focused on its promise to always provide our customers with the best banking experiences possible.

“Our first half 2021 (H1 2021) performance reflects our progressive efforts in building on the strong momentum that we started the year with. As a purpose-driven organization, we remain resolute in our drive for sustained growth in customer acquisition, transaction volumes, and balance sheet, as we consolidate our ‘Africa’s Global Bank’ market position in the years ahead, uplifting livelihoods across the continent,” Uzoka explained.

UBA’s Group Chief Financial Officer (GCFO), Ugo Nwaghodoh, on his part, noted that the bank’s goal was to achieve a marked improvement in earnings quality whilst maintaining positive operating leverage as well as top-notch asset quality.

“The Group recorded RoAE of 17.5 percent (from 15.1% in 2020H1) and a Net-Interest-Margin of 5.8 percent (from 5.4% in H12020) as we played the volatile yield environment diligently for the best return on our interest-earning assets.

“Capital position remained strong, with capital adequacy and liquidity ratios of 23.9 percent (22.4% in 2020H1) and 58.3 percent (58.2% in 2020H1) respectively. This is robust enough to support our growth ambitions,” he said.

The GCFO pointed out that even while the operating environment remains largely uncertain and volatile, despite marked improvement from Covid-19 induced macroeconomic stress, UBA will continue to build resilience through its geographically diversified business model to support headline earnings growth for the Group.

“We remain committed to our 18 percent and 15 percent respective RoAE and deposit growth guidance for FY 2021, as we continue to invest in growth opportunities across our geographies of operation, whilst managing capital and balance sheet prudently,” Nwaghodoh stated.

UBA offers banking services to more than twenty-five million customers, across over 1,000 business offices and customer touchpoints, in 20 African countries.

With a presence in the United States of America, the United Kingdom, and France, UBA is connecting people and businesses across Africa through retail; commercial and corporate banking; innovative cross-border payments and remittances; trade finance, and ancillary banking services.

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY5 days ago

BIG STORY5 days ago