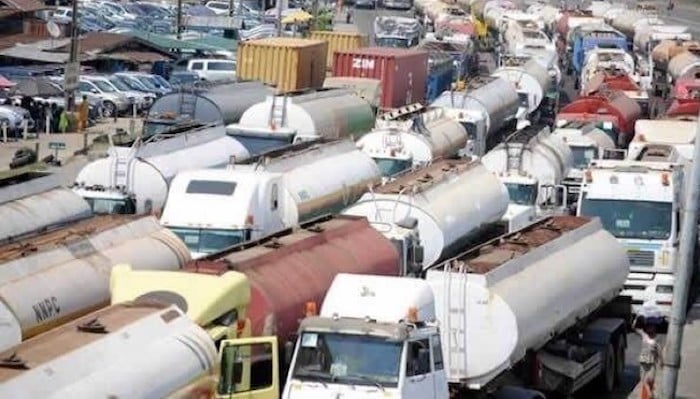

Despite the commencement of operations at the 650,000-barrel-per-day Dangote Refinery, Nigeria remains heavily dependent on imported petrol, with new data showing that imports accounted for 72.64 per cent of total national consumption in the last nine months.

According to figures released by the Federation Account Allocation Committee (FAAC), the country consumed about 12.5 billion litres of petrol between October 2024 and July 2025. Of this figure, 9.08 billion litres were imported, while 3.5 billion litres came from domestic supply, mainly from the Dangote Refinery.

The report revealed that despite earlier hopes of achieving energy self-sufficiency through local refining, Nigeria continues to rely significantly on foreign supply. In October 2024, for example, the nation imported 40.43 million litres per day, amounting to 1.253 billion litres that month, while the Dangote Refinery supplied only 7.09 million litres daily, representing 14.9 per cent of total consumption.

Although domestic production briefly increased early in 2025, the gains were short-lived as operational disruptions caused local output to decline again. In January 2025, import dependence dropped to 56.3 per cent, with Dangote supplying 592.1 million litres, its best performance so far. February and March recorded similar improvements, with domestic output maintaining an average of 45 per cent of national consumption.

However, production faltered from May 2025, when the Dangote plant’s supply fell to 472 million litres, pushing import reliance back up to nearly 72 per cent. By July, the refinery’s contribution had dropped to 31.5 per cent, following a labour dispute that temporarily halted operations.

The report noted that despite being Africa’s largest oil producer, Nigeria still struggles to provide local refineries with sufficient crude feedstock. The Dangote Refinery, for instance, imported nearly 20 per cent of its crude from the United States in 2024 due to local production constraints.

Energy experts have continued to stress that without adequate crude availability and pipeline security, achieving self-sufficiency in fuel production will remain difficult.

Chairman of the African Energy Chamber (AEC), NJ Ayuk, said the continent faces a $15.7 billion shortfall in energy infrastructure investment. He warned that regulatory hurdles across African countries were worsening the situation. “You can send crude and LPG across borders, but an African holding an African passport can’t move freely,” Ayuk stated.

The Guardian reports that several African nations have intensified efforts to construct or rehabilitate refineries to reduce import dependence — a development that could heighten competition for Nigeria’s refining ambitions.

According to recent announcements, Ethiopia, Senegal, Angola, Mozambique, Djibouti, Cameroon, Ghana, South Africa and Uganda are all advancing refinery projects that could collectively add over one million barrels per day of capacity, potentially rivaling Nigeria’s Dangote and NNPC refineries.

In Ethiopia, work is progressing on the Gode refinery, a 70,000-barrel-per-day facility being developed with China’s Golden Concord Group (GCL). Senegal has also unveiled plans for a second national refinery costing between $2 billion and $5 billion, targeted for completion by 2029.

Angola’s Cabinda refinery is set to begin production in the second half of 2025, starting at 30,000 barrels per day and expanding to 60,000 barrels in subsequent phases. The country’s Sonaref project, with a planned capacity of 425,000 barrels per day by 2027, ranks among Africa’s most ambitious. Similarly, Uganda’s Hoima refinery, which recently secured an implementation agreement, is progressing toward construction, though its first phase may not commence before 2028.

Other ongoing efforts include Ghana’s 45,000 barrels-per-day Tema refinery, which resumed operations in 2024, and Egypt’s Midor expansion, which increased capacity from 100,000 to 160,000 barrels per day.

Meanwhile, several countries are focusing on restoring damaged or dormant plants. In Cameroon, reconstruction work continues on the Limbe refinery, which has been inactive since a 2019 fire. Ghana’s Tema refinery is also undergoing full maintenance for an imminent restart.

In Libya, the Ras Lanuf refinery (220,000 barrels per day) remains pending restart, while in South Africa, the Engen refinery is being converted for new use, and Sapref, the country’s largest plant, remains mothballed. The Ivory Coast is building a new diesel unit to boost both domestic and regional supply.

Experts say these developments represent a turning point in Africa’s refining history — a mix of large-scale new construction and recovery from years of industrial neglect.

The African Refiners and Distributors Association (ARDA) estimates that Africa needs at least six refineries of Dangote’s scale to meet its rising demand and achieve energy independence. ARDA’s Executive Secretary, Anibor Kragha, cautioned that the continent still faces a wide refining deficit, worsened by weak regulation and limited financing. “Africa’s vulnerability to fuel price shocks will persist until refining investment matches consumption growth,” he warned.

Population growth and economic expansion are expected to intensify demand for fuel, deepening the economic and security implications of the refining shortfall.

The Organisation of Petroleum Exporting Countries (OPEC) projects that Africa faces a $100 billion refining investment gap over the next 25 years. Of this, $40 billion will be required by 2030 for new refineries, while $60 billion will be needed for upgrades and expansions thereafter.

OPEC also forecasts that Africa’s domestic oil consumption will rise from 1.8 million barrels per day in 2024 to 4.5 million barrels per day by 2050, a shift that could reduce the continent’s crude exports by over one million barrels daily and alter global trade dynamics, especially for European refiners reliant on African crude.

BIG STORY20 hours ago

BIG STORY20 hours ago

BIG STORY20 hours ago

BIG STORY20 hours ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY15 hours ago

BIG STORY15 hours ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago