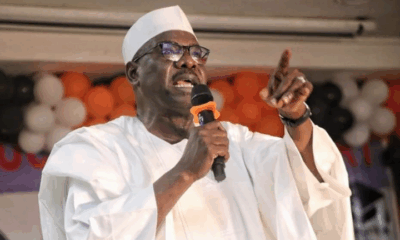

Former Attorney General of the Federation, Abubakar Malami (SAN), might spend a longer time in the custody of the Department of State Services, according to reports.

Multiple security sources reported that Malami faces prolonged detention, as the DSS is already working to obtain a court order to keep him in custody until the investigations are concluded.

Malami’s latest ordeal began on Monday when DSS operatives took him into custody shortly after he perfected his bail and was released from the Kuje Correctional Centre in Abuja. His arrest came barely minutes after he stepped out of the facility, where he had been detained since early December over allegations brought against him by the Economic and Financial Crimes Commission. Security sources indicate that the DSS is seeking a court order to prolong his detention, citing the sensitive and complex nature of the investigations, which are expected to take months.

The former AGF had initially been arrested by the EFCC following allegations that he conspired with his wife, Asabe, and their son to conceal proceeds of unlawful activities valued at about N8.7bn. According to the anti-graft agency, the alleged offences involved the use of multiple corporate entities, bank accounts, and high-value real estate transactions in Abuja and other parts of the country.

The trio was arraigned on December 29, 2025, before a Federal High Court in Abuja on 16 counts bordering on money laundering and conspiracy. They all pleaded not guilty to the charges.

Before their arraignment, Malami had been unable to meet the bail conditions earlier granted to him, leading to his continued detention from December 8. On December 18, a Federal Capital Territory High Court presided over by Justice Babangida Hassan upheld his detention, ruling that it was lawful under the circumstances. It was not until January 7 that Justice Emeka Nwite of the Federal High Court granted Malami, his wife and son bail in the sum of N500m each, with stringent conditions.

In the charges preferred against them, the EFCC alleged that the defendants conspired to conceal proceeds of unlawful activities through multiple corporate entities, bank accounts and high-value real estate transactions in Abuja and other parts of the country to the tune of N8.7bn. They pleaded not guilty to the 16 charges.

However, Justice Emeka Nwite of the Federal High Court in Abuja on January 7 granted Malami, his wife and son bail in the sum of N500 million each.

Justice Nwite ordered that each defendant produce two sureties with verifiable landed property within Asokoro, Maitama or Gwarimpa areas of Abuja.

The court also directed that the title documents of the properties be deposited with the court for verification by the Deputy Chief Registrar, while the sureties were to depose to affidavits of means.

Twelve days after he was granted bail, Malami perfected his bail and was leaving the correctional centre when the DSS picked him up.

Report says the ex-AGF might not be released anytime soon, as investigations may take months.

According to sources familiar with the matter, Malami is being grilled over his handling of the list of Nigerian terror financiers released by the United Arab Emirates.

A source familiar with the matter told The PUNCH, “The investigation is likely going to take a long time. This is why we are working to get a court order on Wednesday (today) to detain him further.

“There are several issues he is being questioned on. One of them is the handling of the terrorism financiers list released by the UAE in 2021 and some terror financiers during his term as the AGF. So, this investigation will take a very long time. I am not sure he will be released anytime soon.”

In 2021, authorities in the United Arab Emirates named six Nigerians with ties to the insurgent group, Boko Haram, as terrorist financiers.

The UAE Cabinet issued Resolution No. 83 of 2021, designating a total of 38 individuals and 15 entities on its approved list of persons and organisations supporting Boko Haram and other terrorist causes.

The individuals listed by the UAE authorities included Abdurrahaman Ado Musa, Salihu Yusuf Adamu, Bashir Ali Yusuf, Muhammed Ibrahim Isa, Ibrahim Ali Alhassan and Surajo Abubakar Muhammad. At the time, the release of the list sparked widespread controversy within Nigeria, raising questions about how suspected terror financiers were able to operate within the country and whether Nigerian authorities had acted decisively on intelligence shared by foreign governments.

Ironically, Malami had, during his tenure as Attorney General, repeatedly vowed that the government would not shield any individual linked to terrorism or its financing. He publicly maintained that no matter how highly placed, anyone found culpable would be prosecuted in line with the law. Investigators are said to be revisiting those declarations in the light of the allegations now levelled against him.

Political analysts note that Malami’s case reflects a broader pattern of post-tenure scrutiny of former top officials, particularly those who wielded enormous influence during the Muhammadu Buhari administration. As AGF and Minister of Justice from 2015 to 2023, Malami was involved in several high-profile cases, including asset recoveries, prosecutions of corruption suspects, and controversial legal opinions that often generated public debate.

Another source said Malami is also being questioned over an arms cache allegedly found in his Kebbi home, as well as terrorism and terrorism financing petitions against him.

“He will also be probed on the arms cache found in his Kebbi home. Beyond this, there are several petitions against him bordering on alleged terrorism financing. Terrorism and terrorism financing are serious offences globally. You’ll recall that when Abubakar Malami, SAN, was the Attorney General of the Federation and Minister of Justice, he vowed that the government of the day would not shield any person or persons linked to terrorism or terrorism financing.

“No responsible government would, in the same vein, fold its hands or turn a blind eye to weighty allegations of terrorism financing levelled against any individual, no matter how highly placed, in this case, Malami, SAN.

“In the course of investigations, we have what is called inter-agency cooperation. It is not uncommon for one security agency to hand over a person under investigation to another sister security agency. In Nigeria, the DSS is the sole security agency tasked with the responsibility of investigating such allegations. It’ll be best to allow them do their job,” the source said.

SPORT2 days ago

SPORT2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

POLITICS2 days ago

POLITICS2 days ago

BUSINESS2 days ago

BUSINESS2 days ago

NEWS2 days ago

NEWS2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

NEWS8 hours ago

NEWS8 hours ago

BIG STORY1 day ago

BIG STORY1 day ago