- IPMAN, PETROAN Eye Refinery’s 500m Petrol Reserves, Queues In Abuja After NNPCL’s Price Hike

Oil marketers have reaffirmed their commitment to purchasing refined petroleum products from the Dangote Petroleum Refinery.

This comes in response to comments made by Aliko Dangote, President of the Dangote Group, who expressed disappointment over the lack of interest from marketers in the refinery’s products.

Dangote had criticized the continued importation of petrol by oil marketers and the Nigerian National Petroleum Company Limited (NNPCL), despite the local production capabilities of his refinery.

He raised these concerns during a meeting with President Bola Tinubu on Tuesday.

“I have a refinery. I’m not in the business of retail. If I’m in the business of retail then you can hold me responsible. But what I’m saying is that the retailers should please come forward and pick. If they don’t come forward and pick, what do you want me to do?

“So, I am expecting either the NNPCL or the marketers to stop importing; they should come and pick because we have what they need. And as they move, I will be pumping,” Dangote stated after the meeting with the President in Abuja.

Responding to this on Wednesday, oil dealers under the aegis of the Petroleum Retail Outlet Owners Association of Nigeria and their counterparts in the Independent Petroleum Marketers Association of Nigeria said they were willing to buy petrol from Dangote.

They specifically stated that they had approached the refinery a couple of times to express the interest of their members in lifting refined products from the plant.

“We have listened to him (Dangote) and as far as I’m concerned what he said is very strange to my hearing. PETROAN had written to him since 2022, we wanted to have a business meeting with him and understand the business dynamics,” PETROAN President, Billy Gillis-Harry, said.

He added, “I sent the same letter to him (Dangote) today (Wednesday) to ask for a meeting, so, we can determine the modality of business. We cannot drive our tankers into the Dangote refinery to start buying products just like that. We must have a business meeting to determine the modalities, make our inputs and compare notes.

“We are willing to patronise Dangote but cannot do it in the air. We have to sit down and have a productive business meeting with him that is transparent enough. That is the challenge. So, we are willing but we can’t just fly into the plant and start loading products.”

Asked what was the response of the refinery, Gillis-Harry replied, “Up till this moment, there has never been any positive response, rather, all we get from them is that they repeatedly say to us that ‘we will meet.’ But we never met. So, at what point are we going to meet and conclude the business? Let Nigerians know that PETROAN is willing to buy from him.

“If he has 500 million litres, we are willing to be one of the off-takers, for with the size of our membership and retailers scattered across the country, we are a very productive business mix that should be good for him. So, he also has the job to woo us and to get us to work with him.”

Gillis-Harry said petrol retailers were awaiting the plant to fix a date for both parties to meet.

Also, speaking on the matter, the National President of IPMAN, Abubakar Maigandi, raised concerns over difficulties faced by IPMAN members in accessing fuel at the Dangote refinery despite a N40bn payment made through NNPCL.

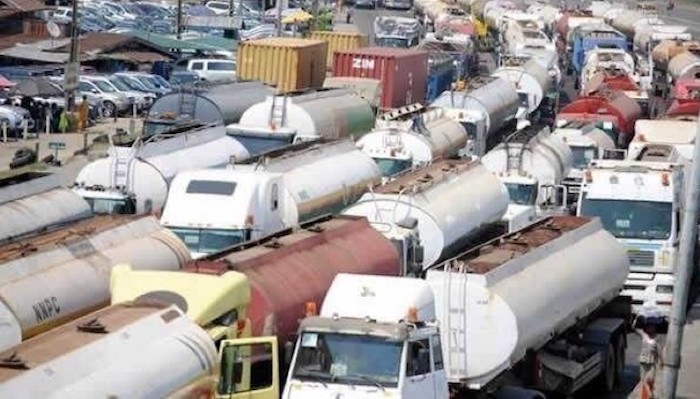

Maigandi stated that despite NNPCL’s directive that IPMAN members pick up fuel at the Lagos-based refinery, some marketers waited with their trucks for four days without being able to load any product.

He expressed surprise at Dangote’s statement on Tuesday, claiming the refinery had 500 million litres of petrol in stock and ready to supply the nation.

“If the refinery truly has 500 million litres, then there should be no reason our members couldn’t load after four days. We are willing to buy the product directly if the refinery is ready to sell to us, but for now, our members can’t access, it even after paying,” Maigandi said while speaking on Channels TV’s Sunrise Daily on Wednesday.

The refinery, touted as Africa’s largest, reportedly can produce over 30 million litres of fuel daily at full capacity.

Dangote, during Tuesday’s visit to Tinubu, reassured that the facility was prepared to meet local demands,emphasising that the stock in reserve could sustain the country for over 12 days without imports.

However, Maigandi countered Dangote’s claims, pointing out that IPMAN members were yet to successfully load fuel from the refinery through the NNPCL arrangement, despite their readiness to purchase directly.

He added, “Instead of routing through NNPCL, Dangote should consider registering independent marketers directly. This would simplify the process and prevent such delays in accessing the product.”

Meanwhile, some marketers revealed on Wednesday that Dangote refinery was currently selling its petrol to dealers with import licences.

The marketers said that the refinery, situated at the free trade zone in Lekki, Lagos State, is currently prioritising marketers with valid import licences even as plans were underway to start selling to other marketers soon.

After battling crude shortages for months, the refinery unveiled its petrol in early September and began selling to the NNPCL on September 15 as its sole off-taker.

However, following the Federal Government’s directive that all marketers could approach the refinery for PMS lifting without waiting for the NNPC, willing marketers said they had indicated interest in buying petrol from the $20bn refinery.

Officials of the refinery told one of our correspondents that the direct sale of PMS had begun without recourse to the Nigerian National Petroleum Company Limited.

This came barely a week after some marketers said their demand to lift fuel was halted by the existing agreement between the refinery and the NNPCL.

Speaking with our correspondent, some operators, who were yet to start business with the refinery, said officials had assured them of their cooperation.

The sources said the supply of PMS was being done in different categories, and those who had licences from the Nigerian Midstream and Downstream Petroleum Regulatory Authority to import petrol were the first set of marketers that were being attended to.

“Dangote refinery is selling to those who have import licences. They are the first set of customers. We don’t know the reason, but it may be because the refinery is in a free trade zone,” a marketer, who spoke on condition of anonymity because he was not authorised to speak on the matter, stated.

Earlier in an interview (with The Punch), the National Vice President of IPMAN, Hammed Fashola, said this explained why IPMAN was making efforts to get its import licence from the Nigerian Midstream and Downstream Petroleum Regulatory Authority.

He also alluded to the opinion that this might be because the refinery was located in a free trade zone.

“Yes, I heard it too, they (Dangote) have started selling to some marketers. They categorised it. There are some marketers with import licences. Those are the people that they are attending to right now.

“And that’s why we are trying as much as possible to get our import licence too. So, I think very soon they will start dealing with the small ones. I don’t know how they came about that idea. I think it depends on the directive given to them, according to them. And we believe that they will soon start with the other marketers. Maybe it’s because that place is a free trade zone,” he said.

Fashola said he could not confirm whether or not the product was being sold in naira to those with import licences.

“I don’t want to say something that I cannot really confirm or that I’m not sure of,” he added.

Fashola disclosed that the association’s application for an import licence was still being processed by the NMDPRA.

“We are still on the import licence. We are seriously working on that. There is no way that it will not take the official time. There are things that we had to submit. You have to meet some terms and conditions to have it granted. So, we are trying to do that,” he said.

However, Fashola refused to state some of the conditions.

“I don’t need to mention that to the media,” he insisted.

For importation, Fashola said the association had enough storage capacity with tank farms in Calabar and Lagos.

“We have enough storage capacity. You know, I said the other time that I don’t want to discuss our capacity. But all those documents related to capacity have been submitted. And when we get what we want, we will disclose everything to the public,” he stated.

An energy expert, Professor Emeritus, Wumi Iledare, said though he would not know whether or not the refinery was selling to marketers with import licenses, this could be because of the location of the facility.

However, he advised that the government should give a waiver to Dangote so that the refinery would be able to sell to local marketers without, hindrance if that was the case.

“We recognise Dangote is in a free trade zone. So, if you want to buy something like that, unless there is a waiver, it is going to be like an import. But because of the arrangement with the Federal Government, this may be different. The Petroleum Industry Act allows for willing-buyer, willing-seller arrangements.

“As the marketers are seeking Dangote out, Dangote should be seeking them out too. The marketers know the landing cost and this will allow them to negotiate with Dangote. Import is the alternative, otherwise, Dangote will become a monopoly,” Iledare stated.

The Don maintained that the Dangote refinery was not a domestic refinery but an offshore refinery in the sense that it was located in a free trade zone.

“That is why Ghana, Senegal, Cameroon, and others are eager to buy from Dangote. The Nigerian marketers are actually competing with other other countries looking to buy from Dangote. The government has to grant a waiver to Dangote to sell to the domestic market. That is why NNPC should have taken an equity whereby products from Dangote will be for their domestic market, but they didn’t do that.

“Dangote should be granted waivers to sell to the domestic market if that is the issue. The government should look at this from the consumers’ point of view without jeopardising the investors from making money,” he noted.

The Nigerian Ports Authority said two vessels carrying a total of 41,705,100 litres of petrol arrived in Lagos through the Tincan Island Ports on Wednesday.

According to The Punch, the NPA disclosed this in the Wednesday edition of its ‘Daily Shipping Position’.

Earlier report had it that a vessel with 20,115,000 litres of PMS was discharging at the Kirikiri Lighter Ports Phase 2 on Wednesday but a second check at the report showed that another vessel with 21,590,100 litres of the product was discharging at the Kirikiri Phase 3, Tincan Island Port the same day.

The document also showed that a vessel carrying 20,000 metric tonnes of AGO (diesel), discharged at the same terminal on Tuesday.

According to the document, aside from the vessel coming with 250 units of used vehicles on Saturday at Five Star Logistics, another vessel with 500 units of used vehicles would also be berthing at the Tincan Island Container Terminal the same day.

The document showed that a total of 12 vessels carrying different consignments, including butane gas, AGO and containers among others, are expected to berth between Monday, October 28, and Friday, November 8, 2024.

Meanwhile, it was recently reported that the Dangote refinery was not able to meet its commitment to the NNPC in the supply of PMS.

There were claims in the media that out of the 400 million litres of petrol that the refinery ought to supply in September, only 103 million litres were delivered.

It was also claimed that in October, Dangote supplied 214 million litres to the NNPC instead of 665 million litres, resulting in a shortfall of 78 percent.

The reports added that from September 15 to October 20, only 317 million litres of PMS had been supplied out of a total commitment of 1.065 billion litres of petrol.

Meanwhile, following the NNPCL’s increase of petrol across the country on Tuesday, long queues were seen at its retail outlets in Lagos and Abuja on Wednesday.

The national oil firm raised the retail price of petrol in Abuja to N1,060 from N1,030 per litre, while in Lagos, it increased the unit price of the commodity from N998 to N1,025 per litre, which received widespread criticisms from the Organised Private Sector, Civil Society Organisations and Nigerians in general.

Experts and key followers of the Nigerian oil and gas sector fear inflation in the country may further skyrocket following the latest hike, after it rose to a 28-year high (34.2 per cent) in June, which could compound the hardship in the country.

Credit: The Punch

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY2 days ago

BIG STORY2 days ago

NEWS3 days ago

NEWS3 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago