The Obidient Peoples Party and the Advanced Democratic Alliance (ADA) are part of 110 groups that have submitted applications to the Independent National Electoral Commission (INEC) to be registered as political parties.

The Obidient Peoples Party, led by Mr. Barry Avotu Johnson as “protem national chairman”, is one of two applications referencing the “Obidient movement”, a political trend linked to former Labour Party presidential candidate, Peter Obi.

The other application bears the name “Progressive Obedients Party”.

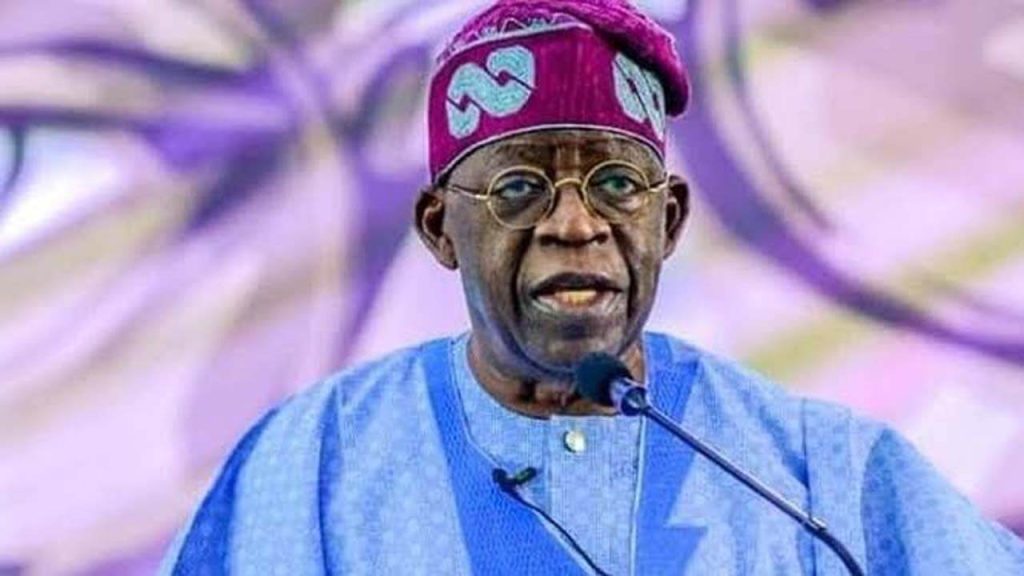

ADA is being positioned as the political platform for the anti-Tinubu coalition, which includes former Vice President Atiku Abubakar, former Rivers State governor Mr. Rotimi Amaechi, former Kaduna State governor Nasir El-Rufai, Dr. Umar Ardo—convener of the League of Northern Democrats—and several others.

INEC Chairman, Prof. Mahmood Yakubu, revealed the list of applicants on Wednesday during the commission’s second quarterly consultative meeting with media executives in Abuja. He confirmed that all applications are being reviewed in line with legal requirements and assured that none of the groups will receive “preferential treatment”.

Full list of associations applying for INEC registration as political parties:

1. Key of Freedom Party

2. Absolute Congress

3. All Grassroots Party

4. Congress Action Party

5. United Social Democrats Party

6. National Action Congress Party

7. Great Alliance Party

8. New Nigeria Congress

9. United Peoples Victory Party

10. Allied Conservative Congress

11. Peoples Freedom Party

12. All Nigerians’ Party

13. Abundant Social Party

14. Citizens Party of Nigeria

15. National Freedom Party

16. Patriots Party

17. Movement of the People

18. Peoples National Congress

19. African Union Congress

20. Alliance of Patriots

21. Socialist Equality Party

22. About Nigeria Party

23. African Reformation Party

24. Accelerated African Development Association

25. Obidient Peoples Party

26. Zonal Rescue Movement

27. Zuma Reform

28. Party for Socialist Transformation

29. Liberation People’s Party

30. Progressive Obedients Party

31. Great Nigeria Party

32. National Youth Alliance

33. National Reform Party

34. Patriotic Congress Party

35. Community Alliance Party

36. Grassroot Alliance Party

37. Advance Nigeria Congress

38. All Nigerians Alliance

39. Team New Nigeria

40. All Labour’s Party

41. New Green Generation Coalition Pary

42. New Green Congress

43. New Green Coalition Party

44. About All (Nigerian)

45. Nigerian Liberty Movement

46. National Democratic Party

47. Citizen United Congress

48. All Gender Party

49. Polling Unit Ambassadors of Nigeria

50. Village Intelligence Party

51. Great Transformation Party

52. Alliance Social Party

53. Nigeria Democratic Alliance

54. New National Democratic Party

55. Obedients Peoples Party

56. Nourish Democratic People’s Congress

57. All Youth Reclaim Party

58. LA RIBA Multipurpose Cooperative Society

59. Alliance Youth Party of Nigeria

60. The True Democrats

61. Democratic Peoples Congress

62. National Democratic Movement

63. Economic Liberation Party

64. Grassroot Ambassador’s Party

65. All For All Congress

66. People Democratic Alliance

67. United National Youths Party of Nigeria

68. Peoples Liberation Party

69. Democratic Union for Progress

70. Citizen Democratic Alliance

71. African Action Group

72. Patriots Alliance Network

73. Democratic Leadership Party

74. Pink Political Party

75. Young Motivation & Awareness for Development Forum

76. Access Party

77. Youth Progressive Empowerment Initiative

78. Grassroot Ambassadors’ Party

79. Republican Party of Nigeria

80. Sceptre Influence Party

81. Young Democratic Congress

82. Patriotic Nigerians Party

83. Far-Right Party

84. Democratic People’s Party

85. United Citizens Congress

86. Reset Nigeria

87. New Nigeria Democratic Party

88. Save Nigeria People Party

89. Above All

90. Alliance for Youth and Women Party

91. Rebuild Nigeria Group

92. Citizen Progressive Part

93. Good Guardian Party

94. Abiding Greatness Party

95. Patriotic Peoples’ Party

96. Development & Freedom Party

97. Peace, Unity & Prosperity Culture

98. The Populist Party

99. New Nigeria Leadership Party

100. All Allies Alliance

101. National Action Network

102. Coalition for Nigerian Democrats

103. Republican Party of Nigeria

104. Abundance Africa Alliance

105. Freewill Humanitarian Party

106. Peoples Emancipation Party

107. Peoples Liberation Congress Party

108. Peoples Democratic Congress

109. All Democratic Alliance

110. Advanced Democratic Alliance (ADA)

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY3 hours ago

BIG STORY3 hours ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY2 days ago

BIG STORY2 days ago