Confidence and excitement bubbled in the camp of the All Progressives Congress (APC) last night as results of the presidential and National Assembly elections began to trickle into the public domain and the collation centres of the Independent National Electoral Commission (INEC) nationwide.

Early returns from polling units in the six South West states of Lagos, Ekiti, Ogun, Ondo, Osun and Oyo showed that the APC presidential candidate was ahead of the pack while Labour Party’s Peter Obi was dominant in the South East.

Obi also made some inroads in Lagos State and former strongholds of the PDP in Edo and Delta.

At press time yesterday, the Labour Party presidential candidate had also won nine of the 13 polling units at the Aso Rock Presidential Villa in Abuja.

But his performance in the North was abysmal where the APC and the PDP were sharing the votes in the three geo-political zones in the North. The APC was doing well in Yobe and Sokoto State at press time.

Some of the results yet to be confirmed by INEC are as follows:

Lagos State

Ajeromi/Ifelodun LGA

APC – 21,102

LP – 12,417

PDP – 3,750

Amuwo-Odofin LGA

APC – 21,387

LP – 12,583

PDP – 3,836

Alimosho LGA

APC – 56,172

LP – 32,992

PDP – 10,071

Ikeja LGA

APC – 45,586

LP – 26,725

PDP – 7,847

Ikorodu LGA

APC – 64,956

LP – 38118

PDP – 11,057

Yobe State:

Potiskum LGA

APC – 25,845 PDP – 6,787 LP – 0

Yunusari LGA

APC – 15,177 PDP – 3,839 LP – 0

Nguru LGA

APC – 15,962 PDP – 4,033 LP – 0

Yusufari LGA

APC – 14,197 PDP – 3,591 LP – 0

Bade LGA

APC -7,667 PDP – 1,982 LP – 0

Bursari LGA:

APC – 3,815 PDP – 986 LP – 0

Damaturu LG

APC- 8,957 PDP – 2,316 LP – 0

Fika LGA:

APC – 9470 PDP – 2,432 LP – 0

Fune LGA:

APC – 10, 677 PDP – 2,760 LP – 0

Geidam LGA:

APC – 6,601 PDP – 1,709 LP – 0

Sokoto State:

Shagari LGA APC – 8,869

NNPP – 2,995 PDP – 7,891

LP – 0

Sokoto North LGA

APC – 21,239 NNPP – 7,167

PDP – 18,886

Sokoto South LGA

APC – 23,637 NNPP – 7,971

PDP – 21,020

Result from Sen. Kashim Shettima’s Lamisula/Jabbamari polling unit 023, Maiduguri

APC = 126 votes

PDP = 23 votes

Labour Party = 0 vote

Mallam Nuhu Ribadu’s Polling Unit 022 Aliyu Mustapha College Yola, Adamawa

APC: 140 PDP: 68 LP: 11

The elections were generally peaceful although INEC and the security agencies reported violence and disruptions in some states.

The commission said fresh elections would be held where necessary while the police arrested some people said to have breached the peace.

Five persons were confirmed dead before and during the exercise.

The APC flag bearer said after voting in Ikeja, Lagos that he was “too confident” of victory.

President Muhammadu Buhari, First Lady Aisha, Tinubu’s running mate Kashim Shettima, Senate President Ahmad Lawan and Kaduna State Governor Nasir El-Rufai were no less confident.

Buhari declared in his home town, Daura, Katsina State after casting his vote that the “APC will win from Daura to Lagos.”

Aisha said: “We are certain by God’s grace that APC will win,” while Lawan said: “Here, the President will win, the Senatorial candidate, that’s myself, will win, the member of the House of Representatives by the grace of God will also win.”

El-Rufai said his prayer was for Tinubu to emerge victorious.

Buhari said: “I am very impressed because I have seen how the people turned out. I am very impressed and very happy. Well, the candidate I voted for I have already mentioned him in many states in Nasarawa, Katsina and Sokoto.

“All over the places I mentioned my favourite candidate, Asiwaju Tinubu, and I believe my constituency will elect him 100 per cent.”

Asked how he felt that for the first time since 2003, he was not on the ballot paper, the President said: “It is very exciting. I look at those who are competing and some of them are so agitated that they didn’t know that I tried three times and ended up in the Supreme Court three times.

“The fourth time I said ‘God dey’ and God sent technology, Permanent Voters Card. So, no fraudulent person can claim anything.”

Mrs. Buhari said she voted for the candidates of the APC, expressing optimism that the party would win the presidential and legislative elections.

We’ll recalibrate economy, says Tinubu

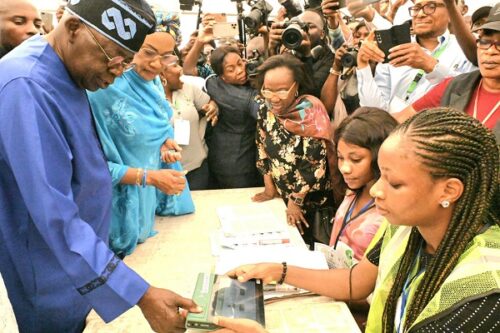

Soon after casting his vote at Unit 085, Ward 3, Ikeja Local Government Area before a large gathering of journalists and observers, Tinubu said he would recalibrate the economy if he won the election.

His words: “Economic problem is not peculiar to Nigeria. We will recalibrate the system and set Nigeria on the path of recovery.”

He lauded Buhari for laying a foundation that could be built upon.

Tinubu described the President as a dedicated and committed leader who has tried his best for the country.

He said: “My vision; you could see Lagos, the infrastructural development, taming of the Atlantic Ocean. You bring the private sector for collaboration.

“I have articulated my agenda. I am striving to become a leader of APC through this election. I will change the APC philosophy.”

Tinubu described himself as the best candidate, adding that he has demonstrated uncanny courage and never allowed social media abuses to distract him.

He said: “I will dance again. I have visited more states and held more rallies and town hall meetings than others.

“Talking is a display of energy. I have done more talking to the people and answered more questions than any candidate.

“I disclosed that I had a knee injury. I am fitter than most of them. I trek kilometres in a day. I don’t sleep until 2.30 am, 3.00am, reading. What do you do to be well? Keeping fit; keep your brain alert; be aware of what is happening around the world.”

Tinubu added:”When they have nothing to say; they lack knowledge and exposure. I have proved them wrong. I keep dancing as a therapy.”

We’ll win, unite the nation – Shettima

His running mate, Shettima, also spoke to reporters after voting at polling unit 023, Lawan Bukar, Lamisula Ward, Maiduguri, expressing optimism about APC’s victory.

He said: “I believe by the Grace of God, the candidate that will emerge as president is Asiwaju Bola Ahmed Tinubu. But winning is one part of the job; the longer journey is foundational unity and progress for our country.

“God will grant him the wisdom and the courage to unite this nation. This is our wish. These are our prayers.”

Speaking on the delay that preceded his voting, Shettima said: “I do not want to pass judgment because it is too early, and as a political leader, I must have the patience…

“I do not believe in such. To administer 176,000 polling units is not an easy task. We have to give INEC the benefit of the doubt. We believe it is too early to start saying things that would create panic.

“Nigerians are essentially one people with a commanding destiny. They need a leader like Asiwaju Bola Ahmed who has the generosity of spirit, maturity, exposure and experience to lead the country.

“We are democrats. We believe in democracy and we are going to win this election.”

Lawan: These elections are significant

Senator Lawan said the Ninth National Assembly contributed largely to the success of the elections with the amendment of the Electoral Law that “gives INEC sufficient latitude to introduce more technology for the election process.”

He added: “It is one of our legacies that the ninth National Assembly will really be proud of and Mr. President himself will be proud that here we are at this juncture in our democracy journey that we have an Electoral Act that has all the safeguards so far that will make the vote of every citizen who cast his vote to count.

“This election, for me, will be the fifth election consecutively into the Senate by the grace of God, and I am very confident we will win this election.

“Here, the President will win; the Senatorial candidate, that’s myself, will win; the member of the House of Representatives, by the grace of God, will also win.

“And we are going to continue to work with our President by the time Asiwaju Ahmed Bola Tinubu becomes the President. He will inherit the ninth National Assembly. He will work with us for at least two weeks because our tenure ends on the 11th of June, 2023.

“I want to say that we are going to give him full cooperation like we have given President Buhari over the last three and a half years. And when the 10th National Assembly will be in place and the President, Bola Ahmed Tinubu will be in office.

“I want to believe that he will have a National Assembly that will be fully, totally and completely supportive to the cause of building Nigeria for Nigerians.”

My prayer is that Tinubu is declared President-elect in couple of days – El-Rufai

Governor El-Rufai of Kaduna State said his prayer was for Tinubu to come out victorious despite attempts in some quarters to scuttle the elections.

He said: “So far, as at the time I came here, everything has been going on smoothly. There have only been three incidents. Last night a rice mill was attacked by people suspected to be PDP thugs. The Police is investigating.

“This morning, we got a report of one incident in Southern Kaduna where BVAS and ballot boxes were snatched, and in Soba where two ballot boxes were also snatched.

“Of course, these are no incidents at all because whether you snatch ballot boxes or BVAS or not, it doesn’t matter; the technology has gone beyond the primitive rigging system that political actors are used to.

“So, I must commend INEC for this improvement. So far, everything appears orderly across the state. All the reports we are getting are positive.

“My only concern is low voter turnout. People are not coming out to vote. And I want to appeal to everyone to please come out and vote because you have once in four years opportunity to pick your leaders and you should take it seriously.”

I’ll win, says Atiku

The PPP flag bearer Atiku Abubakar was equally optimistic about his chances.

Shortly after voting at Ajiya 02, in Gwadabawa Ward, Yola North Local Government of Adamawa State, he told reporters that the process was seamless and he was sure of succeeding Buhari on May 29.

Kwankwaso: I’ll Accept the Outcome of Election

Dr. Rabiu Kwankwaso of the NNPP said he was willing to accept the outcome of the result.

He said: “I will win the election by the special Grace of Allah. We must demonstrate a high sense of political tolerance to ensure peaceful conduct of the future exercise.

“I’m satisfied with INEC and the voting exercise and am positive to win my unit and LG. I’ll accept the final result of the election.”

Best elections I’ve ever witnessed – IGP

Inspector General of Police Usman Baba described yesterday’s elections as the best he has ever witnessed in the country.

Baba who spoke while monitoring the elections in Abuja said the polls were generally peaceful and “the response of the people has been encouraging. “

He added: “The provision of security is good. This is one of the best electoral processes I have ever seen.

“We have done well so far and we are waiting for INEC officials to move to the collation centre. We are on top of the situation.

“It is not true that we have blast in Maiduguri, we have blast in Borno State. We have made adequate security arrangements over there. We have five injured and small damages.”

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY5 hours ago

BIG STORY5 hours ago