BIG STORY

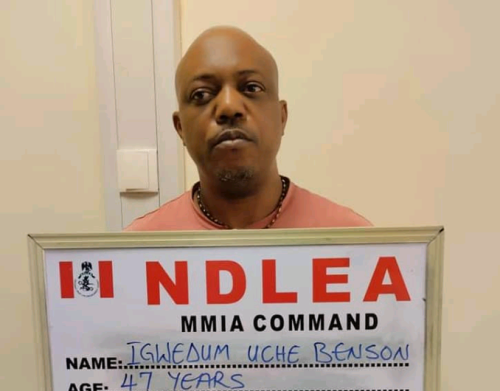

NDLEA Nabs 47-Yrs-Old Brazilian Returnee With ‘Cocaine Concealed In Private Part’

-

BIG STORY5 days ago

BIG STORY5 days agoBREAKING: Court Sentences Abuja Gospel Musician To Death By Hanging For Killing NYSC Member

-

BIG STORY5 days ago

BIG STORY5 days agoAkeredolu’s Widow Betty Calls Olowo Of Owo ‘Baby Oba’

-

BIG STORY3 days ago

BIG STORY3 days agoNigerian Households Earning N250,000 Will Not Pay Tax, They Are Poor — Reforms Committee Chairman Taiwo Oyedele

-

BIG STORY4 days ago

BIG STORY4 days agoHow Zacch Adedeji Revolutionized Tax Reform — By Seun Oloketuyi

-

BIG STORY3 days ago

BIG STORY3 days agoBREAKING: Ganduje Resigns As APC National Chairman

-

BIG STORY4 days ago

BIG STORY4 days agoFederal Revenue Agencies Face Shake-Up As President Tinubu Signs Tax Bills

-

BIG STORY4 days ago

BIG STORY4 days agoNew Tax Laws To Take Effect In Seven Months — Zacch Adedeji

-

BIG STORY3 days ago

BIG STORY3 days ago13.6% Of Lagos Secondary Students Have Tried Drugs, 6.9% Are Active Users — NDLEA