Before the advent of unicorn fintech and banks, people entrusted their savings with thrift collectors. One of them stood out in Lagos and the areas that now constitute the South West of Nigeria: Taiwo Olunaike Alphaeus.

But that name may not ring a bell until one says “Alajọ Ṣomolu”, literally meaning the thrift collector of Ṣomolu.

He had no computer knowledge, not to talk of using a balance sheet or running an excel file, but he was good with counting and keeping money.

His fame embodies honesty, faithfulness, and the true Nigerian spirit of industry.

This explains why his name was likened to success and smartness in the track “Alajọ Ṣomolu” by Afrobeat singer, Olawale Ashimi, popularly known as Brymo.

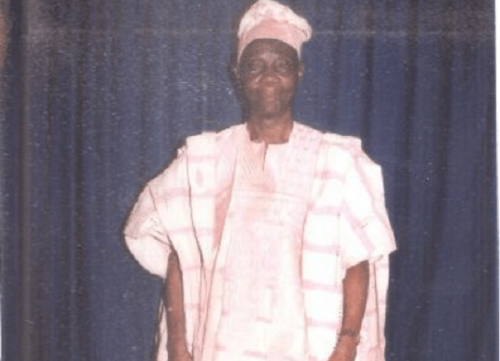

Born on September 16, 1915, in Isonyin, a small town eight kilometers from Ijebu-Ode in Ogun State, Alphaeus, also called Sir Alphaeus, was one of the surviving duo of a triplet birth at a time multiple births was a taboo because it was believed to bring misfortune to the land.

One of the triplets was sacrificed to the gods and another died at infancy. Their father too died three years after their birth.

Baby Taiwo’s close shave with infanticide was rewarded with longevity as he lived for 96 years. Born a year after Britain amalgamated the northern and southern protectorates of Nigeria, he witnessed the country’s independence 45 years later and the 50th anniversary of independence in 2010.

If his name is mistaken as a myth or legend, that is because he is linked to many wise sayings and anecdotes.

Tailor turned thrift collector

At 12, Sir Alphaeus moved to Lagos in 1927 where he was first enrolled at St. John’s School, Aroloya, and then at Christ Church Cathedral School, where he took his first school leaving certificate in 1934.

Two years later in 1936, he took up an apprenticeship role under a neighbourhood tailor named Rojaye. He would spend nine years under Rojaye’s tutelage.

In 1950, he followed his uncle on a commercial trip to Cameroon. There, he learnt the ropes of thrift collection from a Cameroonian neighbour.

The special kind of microfinance banking Sir Alphaeus came to be popular for is an agelong practice in many Nigerian communities and marketplaces where clients contribute daily, weekly or monthly predetermined amounts to a thrift collector. The collector takes the first contribution as their own fee. The business is called ajọ in Yoruba, esusu in Igbo and akawo/adashe in Hausa.

After four years in Cameroon, Sir Alphaeus was ready to take his trade back home to Nigeria. He returned to Lagos to start his own thrift collection business called the Popular Daily Alajọ Ṣomolu. Not only did he safe keep the savings of individuals, he also offered loans to those he considered had proven integrity.

Photographic memory

But it was not just for his business integrity that Alajo Somolu would become legendary. Practicing at a time computer or calculator was unknown, at least in the area, Sir Alphaeus stood out for his mental acuity. He could recall transactions, their dates, and details without reference to any documents.

This unique trait endeared him to people, many of whom marvelled at his gift.

This gave prominence to the aphorism the Yoruba use in extolling the virtues of wisdom and intelligence in a person; “Ori ẹ pe bii ti Alajọ Ṣomolu, to fodidi ọọdun meta gbajo lai ko oruko ẹni kankan silẹ, ti ko si ṣowo san fenikeni” (meaning: you are as intelligent as Alajọ Ṣomolu, who collected thrift for three years, without writing down a single name, and never made a single mistake in paying back his customers)!

At first, clients approached him with skepticism, but all that soon changed after many testaments of his photographic memory gained traction. Those who dared argue with his impeccable off-the-cuff recollection of statistical details were awestruck when he opened his logbook.

He was a moving bank, ATM booth, chequebook — all in one. His brain worked like a cloud.

Trust and integrity are the capital for the business he ran, and Sir Alphaeus was integrity personified. This attracted many clients to him who trusted, loved, and respected him, making his boom.

In fact, legends suggested that not only did Sir Alphaeus pay back contributors the exact amount they were due, he also paid them back in the exact notes and coins they contributed.

They were mesmerized by this and he became the number one mobile banking choice for many traders in Sangross, Mile 12, Baba Olosha, Ojuwoye, Awolowo, Oyingbo, Olaleye, and Shomolu markets, all in Lagos.

At a time, after one of his cars showed signs of wearing out and was no longer cost-effective for his thrift collection trips, he sold off the car and bought a Raleigh bicycle. The bicycle gave him farther reach to areas that were hitherto inaccessible.

This again won him another star in the heart of people as they read that to mean he was an economically savvy businessman. That act passed as a further advertisement for his business.

Retired Not Tired

Even as he aged, his love for his trade and the trust people had in him did not wane. He continued with the business until 2010 when he was 95 years old.

Even after his children pressured him to retire, people continued to throng his house to deposit their daily contributions. This time he no longer went to them, they came to him. He had earned their trust.

As he served his clients so he did his God. He was the lay reader and treasurer for 30 years at the Ṣomolu Anglican Church he attended.

Though he lived a spartan life, he was well-to-do in his own right. He built his first house at No 10, Odunukan Street in Ijesa, and later sold it to the Deeper Life Ministry. He built another house at Olorunkemi, Owotutu Area, Bariga, Lagos.

Sir Alphaeus House built in Bariga, Lagos State.

There, he lived his last days. He died August 11, 2012, and was buried a month later at the Church of Nigeria Cathedral, Isonyin, Ijebu in Ogun State.

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY8 hours ago

BIG STORY8 hours ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

Temitope Onigbinde

November 22, 2021 at 11:54 am

Legend!!!