The Economic and Financial Crimes Commission (EFCC) is intensifying its efforts to combat money laundering by turning its focus to the real estate sector, which it has identified as a key channel for laundering illicit funds.

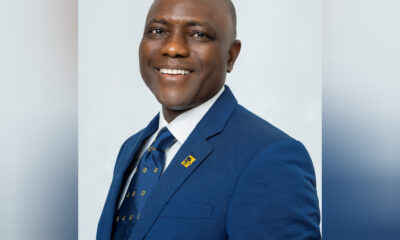

According to the Commission’s Chairman, investigations have commenced into the ownership and funding of numerous estates across Nigeria.

Ola Olukoyede said: “What we have been able to find out is that most of these estates are funded by civil servants who have stolen money.”

He shared this while speaking in Abuja at a “policy dialogue on critical issues affecting Nigeria’s real estate ecosystem” hosted by the Law Corridor, an Abuja-based legal firm.

Olukoyede revealed that the EFCC had already secured the interim forfeiture of 15 estates linked to suspicious activity.

He noted that many of these properties are left abandoned once the flow of illicit funds stops, with some buildings remaining incomplete for decades.

He advocated for activating the Beneficial Ownership Register to unmask the individuals behind companies and real estate investments.

He said: “I have set up a team. We will start visiting all the housing estates, not just in Abuja, but across Nigeria. We want to know who owns what.

“It will shock you that some of these estates have been abandoned for between 10 and 20 years.

“They just take the construction to a certain level and abandon it, and nobody knows what is going on.

“What we have been able to find out is that most of these estates are funded by civil servants, who have stolen money.

“So, the moment they leave public service and the money is no longer coming, they abandon the estates.

“The developer will now begin to look for investors to support them in completing the projects.

“That is one of the things we have discovered in some of these abandoned estates, and we have taken steps to begin to move against some of those estates.

“In recent times, we have had cause to file for the forfeiture of about 15 of them. We have got orders of interim forfeiture,” the EFCC chairman said.

Alongside Olukoyede, Nigerian Bar Association (NBA) President Mazi Afam Osigwe (SAN) and Bureau of Public Procurement (BPP) Director-General Dr. Adebowale Adedokun pushed for comprehensive reform of land administration.

They attributed the sector’s vulnerability to money laundering to outdated systems and poor regulation.

The three stakeholders called for immediate reform, recommending the use of technology to enable transparent and accountable transactions in real estate.

The policy dialogue centred on three major themes: “Tackling illegal property sales, fake developers and unlicensed agents; Investment compliance and anti-money laundering, and Access to legal remedies.”

Olukoyede further stated: “What we have discovered is that the issue of money laundering is very rampant among estate developers. It is extremely rampant.”

He attributed this to the lack of affordable financing options, which makes the sector attractive for laundering stolen money.

“There is no one who will go to any bank in Nigeria today and borrow money to invest in real estate and make a profit.

“Real estate development takes time; sometimes you are on a project for five years.

“So, if you have gone to a bank to take a loan at over 30 per cent interest, how do you survive?” the EFCC Chair said.

He emphasized that the absence of regulation and accessible single-digit interest loans will continue to fuel money laundering in the sector.

“Let the government set aside special funds for real estate, from which loans could be given at a single-digit interest rate.

“Government organisations like the Federal Mortgage Bank, Aso Savings and Loans should be made to play this role,” he said.

Olukoyede urged Nigeria to move away from a cash-heavy economy, which he said hinders the fight against corruption.

He said: “A thousand EFCCs will not be able to scratch the surface of our corruption problem if we continue with our cash-based economy.

“We have to do something about this credit transactional system. We can’t move forward.

“We should look at countries where this system works and replicate it here.

“You want to buy a car, it is cash. You want a house, it is cash. Everything you do in Nigeria is by cash. We can’t build an economy that way. I once told them this at the National Assembly.”

He also disclosed that societal pressure has driven some public servants to admit to misusing public funds.

“Some will come to you and say: ‘Yes, I did it. There is no other way to pay my children’s school fees; there is no other way to survive. Please, I am at your mercy.’ At that point, the investigator will become helpless.”

Olukoyede encouraged EFCC staff to use services offered by the Federal Government’s Credit Corporation and advised real estate players to practice due diligence to avoid legal trouble.

Osigwe highlighted systemic flaws and advocated for more robust regulation of the industry.

He pointed out the cumbersome land ownership verification process in Nigeria.

“I can sit down here and, with the payment of the appropriate fees, confirm the ownership of a property in the United Kingdom. But, I can’t do that here,” Osigwe said.

He criticized the outdated land administration system and called for the adoption of technology to improve efficiency and transparency.

“We must tell ourselves that the present system is not working and cannot work.”

Adedokun explained that many real estate projects are publicly funded, and stressed the need to monitor how those funds are used.

He urged strict oversight of procurement and execution processes to prevent the siphoning of funds.

He said: “What we are doing now in collaboration with the Corporate Affairs Commission (CAC) is to say that, if you are awarded a contract, we want to measure that contract with actual performance.

“What is to be done to prevent diversion of public funds is by tightening the procurement process and how projects are implemented, because the difference between the actual cost of the project is what leads to people having funds to launder.

“That difference that we cannot account for is what gives people funds to launder. Since they cannot store such funds in banks, they have to look at an alternative way to store the money.

“And today, because the real estate sector is poorly regulated, it is very easy for anyone to throw money into it.”

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY4 days ago

BIG STORY4 days ago