Fresh pressure is mounting on former President Goodluck Jonathan to drop any plan to contest the 2027 presidential election, as some prominent figures in the Niger Delta intensify moves to persuade him to instead back President Bola Tinubu’s re-election bid.

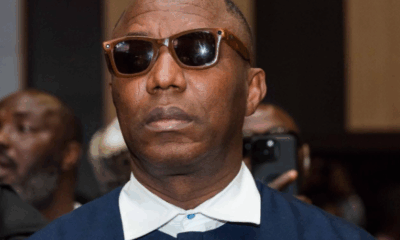

Reports have it that former militant leader, High Chief Government Ekpemupolo, popularly known as Tompolo, is spearheading the regional effort urging Jonathan to shelve his alleged ambition and rally behind the president.

It was gathered that Tompolo, accompanied by some close allies — including the Managing Director of Tantita Security Services Nigeria Limited, High Chief Kestin Pondi, and Joshua Maciver, the All Progressives Congress (APC) deputy governorship candidate in the 2023 Bayelsa election — paid a private visit to Jonathan at his Otuoke residence in Ogbia Local Government Area of Bayelsa State on October 16.

The closed-door meeting, which reportedly lasted several hours, was Tompolo’s first major public appearance in nearly a decade, indicating the weight of his mission.

Political, Not Peace Meeting

Contrary to earlier reports suggesting that the visit centred on peace and security in the Niger Delta, multiple reliable sources confirmed that the discussions were primarily political.

According to sources close to both men, the meeting’s main agenda was to dissuade Jonathan from contesting and to solicit his support for President Tinubu’s second-term bid.

A top Jonathan associate who confirmed the meeting but requested anonymity because he was not authorised to speak, told Just News:

“Yes, the meeting held. The feeling among Niger Delta leaders is that Tinubu has done quite well for the region. They pointed to projects like the Lagos-Calabar Coastal Highway, the university approved for Ogoni land, and other federal initiatives. That’s the message Tompolo brought — that Jonathan should not run but should support Tinubu.”

When asked whether Jonathan was indeed considering a return to the presidential race, the associate said:

“Yes, he was considering it, but consultations are ongoing.”

‘It Was a Historic Visit’

Another source close to Tompolo described the visit as “historic,” noting that it was the first time in ten years the ex-militant leader would personally visit any political figure.

“That alone shows how important this meeting was,” the source said.

Tompolo, who has been openly supportive of President Tinubu, currently enjoys the renewal of his multi-billion-naira pipeline surveillance contract through Tantita Security Services — a role first granted under former President Muhammadu Buhari’s administration.

He also reportedly leads a grassroots mobilisation structure known as the “PBAT Door-to-Door Movement”, which canvasses support for Tinubu across the Niger Delta.

‘Niger Deltans Prefer Continuity’

Further details obtained by Just News revealed that Tompolo told Jonathan that the “psyche of Niger Deltans” no longer aligned with a comeback attempt, warning that regional sentiment now favours continuity under President Tinubu.

“Tompolo was very blunt with him,” a source disclosed. “He said the people of the Niger Delta are no longer disposed to supporting him for another run and that the general mood favours Tinubu to continue till 2031.”

According to the source, Tompolo also advised the former president to take a cue from his wife, Dame Patience Jonathan, and Governor Douye Diri of Bayelsa State, both of whom have publicly aligned with the president’s re-election efforts.

“Tompolo reminded him that Mrs. Jonathan has already endorsed President Tinubu and that Governor Diri’s resignation from the PDP and planned defection to the APC are clear signals that the region is moving in that direction,” the source added.

‘No One Can Defeat Tinubu Now’

Another insider who attended the meeting said Tompolo cautioned Jonathan not to be swayed by political loyalists urging him to challenge the president, warning that he might not secure “home support.”

“He told him clearly that no one can defeat President Tinubu in a free and fair contest given his performance and political strength so far,” the insider said. “Tompolo argued that most Nigerians — especially in the South — are leaning toward continuity.”

The ex-militant leader reportedly assured Jonathan that he does not need to join the APC to support Tinubu, suggesting that he could maintain his status as an elder statesman while using his influence to mobilise support for the president in 2027.

Jonathan Listened, Promised to Reflect

According to sources, Jonathan listened attentively throughout the meeting and thanked Tompolo for the visit and his frank submissions.

“The former president appreciated the visit and said he would review the advice carefully,” one source told Just News. “He promised to make his position known at the appropriate time.”

Tompolo declined to speak to journalists after the meeting, but Jonathan later told reporters that the discussion focused mainly on peace and stability in the Niger Delta.

“Since I left office, we have not seen each other,” Jonathan said. “Tompolo has played key roles in the unity of our people. We discussed issues raised by stakeholders to ensure the Niger Delta remains peaceful.”

Despite Jonathan’s diplomatic remarks, insiders insist the political undertone of the meeting was unmistakable, especially as more Niger Delta elites appear to be closing ranks around President Tinubu’s re-election campaign.

‘Jonathan Remains Respected’

Meanwhile, former Labour Party governorship candidate in Bayelsa, Udengs Eradiri, dismissed reports of Jonathan’s 2027 ambition, describing them as speculative.

“I’m not aware that Jonathan is running,” he said. “Until he declares himself, it’s just rumour. And as for Tompolo’s visit, it’s normal — Jonathan remains a respected leader in the Niger Delta.”

Eradiri noted that Jonathan remains widely revered for his role in the Amnesty Programme initiated under the late President Umaru Musa Yar’Adua, saying:

“It’s natural for anyone visiting Bayelsa to pay him homage. Whether there was political persuasion or not, we can’t say, but he remains a father figure in the region.”

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY15 hours ago

BIG STORY15 hours ago

BIG STORY3 days ago

BIG STORY3 days ago