- NNPC quite as dealers insist government still paying subsidy, Reps probe crude shortage

- Dangote eyes foreign markets for refinery products, FG meets Kyari, Dangote over dispute

Oil marketers have projected that the monthly subsidy on Premium Motor Spirit (PMS), commonly known as petrol, has increased to approximately N707 billion, given the landing cost of N1,117 per liter. This development comes as the Dangote Petroleum Refinery is set to commence petrol production in August. However, due to the crude oil supply crisis and other regulatory challenges facing the $21 billion firm, the company might export the product instead.

Meanwhile, the Minister of State for Petroleum Resources (Oil), Heineken Lokpobiri, met with officials from the Dangote refinery, Nigerian National Petroleum Company Limited, Nigerian Upstream Petroleum Regulatory Commission, and Nigerian Midstream and Downstream Petroleum Regulatory Authority in Abuja on Monday. The meeting aimed to address recent concerns between Dangote refinery and oil sector regulators and operators.

In a related development, the House of Representatives has established an investigative committee to probe the non-availability of crude oil to domestic refineries and allegations of deliberate price hikes for profiteering. This follows the Major Energies Marketers Association of Nigeria’s announcement last Wednesday that the landing cost of petrol had reached N1,117 per liter. The Independent Petroleum Marketers Association of Nigeria (IPMAN) has also emphasized that the Federal Government is still subsidizing PMS, a situation IPMAN considers unsustainable and potentially leading to increased pump prices for petrol soon.

MEMAN also revealed last week that the landing cost of diesel was N1,157/litre, while that of aviation fuel was N1,127/litre.

While the pump prices of diesel and aviation fuel are considerably higher than their landing costs, the pump price of petrol is way lower than its landing cost.

Although retail outlets operated by the Nigerian National Petroleum Company Limited and some major marketers dispense petrol at between N617/litre and N670/litre, dealers said the ex-depot price of the commodity by NNPC is N585/litre.

Idependent marketers hardly get the product at the N585/litre ex-depot price. They mostly buy from private depot owners at higher rates findings show. This makes their pump prices much higher. Some of them dispense the commodity above N700/litre.

NNPC is Nigeria’s sole importer of petrol. Other dealers stopped importing the commodity due to their inability to access the United States dollar, required for PMS imports.

The difference between the landing cost of N1,117 and an ex-depot price of N585 is N532. This implies that every litre of petrol consumed in Nigeria is subsidised by about N532.

Nigeria consumes tens of millions of litres of petrol daily. There are different petrol consumption figures from various agencies of the Federal Government.

NNPC, Nigerian Midstream and Downstream Petroleum Regulatory Authority, and the Federal Ministry of Petroleum Resources, have stated different figures ranging from 66.8 million litres in September 2022 to 44.3 million litres in October 2023.

When the most recent daily PMS consumption figure of 44.3 million litres is multiplied by the N532 subsidy reportedly paid on each litre of petrol, it gives N23.57bn as the daily subsidy spending.

This means that in 30 days, the petrol subsidy should gulp about N707bn.

The Secretary of IPMAN, Abuja-Suleja, Mohammed Shuaibu, said though the Federal Government and NNPC had claimed that there was no subsidy on petrol, the latest figures by MEMAN proved otherwise.

He said petrol subsidy was over N700bn monthly considering the landing cost of the commodity as revealed by MEMAN.

“Petrol price is determined by the forces of demand and supply in the international market. When there is a global price increase, we should experience it in Nigeria. Therefore the N1,117/litre is not just based on our foreign exchange rate, but also the global PMS cost. The sole importer of this product is NNPC and the company is not telling us the truth.

“But data sourced by our counterparts, the major marketers, showed clearly that the landing cost of petrol is above N1,100/litre. This means that the monthly subsidy has crossed N700bn. That also means we should be prepared so that any time the price of petrol jumps, we should not be surprised because they have already told us,” Shuaibu stated.

The IPMAN official insisted that if government was not subsidising petrol, it should have allowed the full deregulation of the downstream sector.

“Of course, you know NNPC will hide this information from you. Former Kaduna State Governor, Nasir El-Rufai, stated a few months ago that the Nigerian government is not telling Nigerians the truth about fuel subsidies because they are still paying subsidies.

“If they are not paying, why is it that up till now only NNPC is importing petrol when they claim that they have liberalised the market? They should open the market to competition by allowing investors to come in and compete favourably. This will crash the price of the product.

“But where only one entity controls the importation of PMS then the sector has not been deregulated. That is why we feel NNPC is economical with the truth by saying that it is not subsidising petrol,” Shuaibu added.

In April, El-Rufai told journalists in Maiduguri that many citizens were not aware that the government had reintroduced the PMS subsidy.

“The Federal Government is now subsidising fuel; many people don’t know this. It is the right policy. I have always supported the withdrawal of oil subsidies; but in the course of implementing the policy, the government realised that subsidy has to be back; right now, the government is paying a lot of money for subsidy, even more than before.

“You start implementing a policy because you are sure it is the right policy, but in the course of implementation, you come across bottlenecks and you modify.

“The keyword in leadership, in my view, is pragmatism. You should be pragmatic. So, when you make a policy, you start implementing it, and if it doesn’t seem to work well, you should have the humility to stand back and say this is not working, and you modify it,” El-Rufai had stated.

NNPC mum

The Chief Corporate Communications Officer, NNPC, Olufemi Soneye, did not respond to an enquiry on whether the national oil company was subsidising petrol based on the latest revelation of MEMAN.

However, Soneye had earlier insisted that the national oil firm had stopped subsidising petrol.

“We are recovering our full costs from the products we import. It is important to emphasise that the subsidy is no longer in place. Contrary to allegations, the petrol subsidy has not been reinstated,” the NNPC spokesperson had stated.

Before the recent revelation by MEMAN on the N1,117/litre landing cost of petrol, the GCEO of NNPC, Malam Mele Kyari, had told state house correspondents after an audience with the President at the Aso Rock Villa a few months ago that fuel subsidy had not been returned.

“No subsidy whatsoever. We are recovering our full cost from the products that we import. We sell to the market, and we understand why the marketers are unable to import. We hope that they do it very quickly and these are some of the interventions the government is doing. There is no subsidy,” Kyari had stated.

But the Public Relations Officer of IPMAN, Chief Ukadike Chinedu, insisted that petrol prices at the pumps should be over N900/litre if the commodity was not subsidised.

“I’ve said before that the PMS subsidy had been returned, and the government said it was a lie. I said before that the government is subsidising PMS and it is on till this moment. I said before that what the government was doing was quasi-subsidy and that has not changed,” Ukadike stated.

He said the N1,117/litre landing cost for petrol as revealed by MEMAN is a clear indication that subsidy on petrol is still implemented by the government through NNPC.

Petrol export

It was also gathered that as the Dangote refinery begins petrol production in the next couple of weeks, the company might be forced to export the product out of the country.

The PUNCH reliably gathered that the company was contemplating selling its product to other countries as it failed to get crude oil from International Oil Companies operating in Nigeria.

Multiple sources within the organisation told one of our correspondents that the cost of importing crude oil from the United States was impacting the cost of production, making the product more expensive than the one imported by NNPC.

Some fuel marketers also stated that because Nigerians may not buy high-priced petrol, the Dangote Group was considering exporting PMS to countries where it would not be seen as too expensive.

Dangote refinery recently disclosed that it had exported about 3.5 billion litres of refined petroleum products, which, according to the firm, constituted about 90 per cent of its total productions so far.

A top official of the refinery, who spoke on condition of anonymity because he wasn’t authorised to speak on the matter, maintained that the much-awaited PMS might go the way of other products being exported to other countries.

“I can confirm that we will supply PMS in August. That is certain. But I don’t know if we will sell to the Nigerian market. The refusal of the IOCs to supply us with crude oil is affecting the cost of production, and that will make the product more expensive compared to what the government is selling. To avoid issues, it is better to send our PMS to other countries. We have the market out there. West Africa alone is a big market for us.

“The main issue we have is crude oil. Importing it from the US is not easy. I guess Nigerians will understand; nobody wants to sell below the cost price. Everybody wants to buy cheaper fuel, but the cost of crude import is high. If we take the product to the market and the government keeps subsidising the imported one, what do you think will happen? There is no way anybody can survive in the face of government subsidy. If we don’t get crude locally, most likely, our PMS won’t be sold in Nigeria.

“If we can stop fuel importation, we will save our dollar and reduce the pressure on the naira, but sadly, this is turning out to be the way it is,” our source stated.

The source further stated that this was why the Dangote refinery had yet to release the price of its PMS.

“We ought to have met with marketers to disclose the price of our product, but we have yet to do so because of this situation and we are not even sure if the product will be sold in Nigeria. The situation is too dicey. Alhaji (Aliko Dangote) wants to end importation of PMS and give Nigerians cheaper access to energy, but there’s a mafia who don’t want that to succeed,” the source stated.

However, when asked if there are conditions that may make Dangote refinery to export its petrol instead of selling it locally, the spokesperson for the company, Mr Tony Chiejina, simply said, “Our policy is: Nigeria first.”

Experts react

Reacting, an energy expert, Prof Wumi Iledare, said the Dangote refinery was in a free trade zone and the export of PMS should not be seen as a problem as long as regulations were not violated.

“Dangote does not necessarily have to sell to the Nigerian market if the Nigerian market does not want it. NNPC could decide to get their petroleum products and decide to sell them in Nigeria. If you look at the regulation, what they call the domestic crude supply obligation, it is willing-seller, willing-buyer; the government cannot dictate the price of crude. It is going to be a negotiation between the two of them. I think people are just being sentimental about this issue,” Iledare stated.

“If Nigerians are willing to pay for whatever other people will pay for PMS, why will Dangote not sell it for them?”

He stated that by selling the product in Nigeria, the refinery would save the cost of transporting the same product, but would not sell the commodity lower than what the Nigerian market can support.

“The gap between the cost of diesel and petrol in Nigeria is much. It’s never like that all over the world. That means something is wrong. Dangote doesn’t mind selling if you are going to pay the subsidy for him to supply to the Nigerian market.

“I don’t know if NNPC is paying subsidies or not, but somebody is absorbing the difference. You can call it under-recovery or subsidy, but the price of petrol today does not reflect the market cost of producing a litre of petrol,” Iledare disclosed.

The $20bn Dangote refinery located in Lekki, Lagos State, is expected to begin the sale of petrol in August.

The President of the Dangote Group, Aliko Dangote, had said his refinery would stop the importation of refined petroleum products into Nigeria and Africa.

However, the company has repeatedly raised concerns over the alleged refusal of International Oil Companies to sell crude to the refinery.

“It’s like the IOCs’ objective is to ensure that our petroleum refinery fails. It is either they are deliberately asking for ridiculous/humongous premium or they simply state that crude is not available. At some point, we paid $6 over and above the market price. This has forced us to reduce our output as well as import crude from countries as far as the US, increasing our cost of production,” Vice President of Oil and Gas at Dangote Industries Limited, Devakumar Edwin, stated recently.

Reps wade in

The Speaker of the House of Representatives, Tajudeen Abbas, said the quality of petroleum products imported into the country must comply with global standards.

He spoke at the National Assembly Complex in Abuja on Monday during the inauguration of the House joint investigative committee assigned to carry out a forensic investigation into the allegations of domestic production and importation of substandard petroleum products into the country.

The investigating panel, made up of the House Committees on Petroleum Resources (Upstream and Midstream), is also looking into the non-availability of crude oil to domestic refineries and allegations of deliberate hike in the cost of the product for profiteering.

Addressing the committee members, Abbas, represented by the Deputy Speaker, Benjamin Kalu, condemned the resurgence of fuel queues at petrol stations, the increasing cost of PMS, and the unavailability of feedstock for the local refineries.

He said, “The quality of petroleum products imported into Nigeria has come under scrutiny, and we must ensure compliance with global standards. The Nigerian Midstream and Downstream Petroleum Regulatory Authority and the Standards Organisation of Nigeria must guarantee that petrol imported into this country is rigorously tested in laboratories to meet the standard sulphur and octane levels.

“It is unacceptable that the petrol imported into the country contains high sulphur levels, and has low octane levels — as we notably experienced in the recent past that even led to socio-economic losses on a national scale including the knocking down of the engines of vehicles of Nigerians in their hundreds.”

In his speech at the event, co-chair of the committee and Chairman of the Committee on Petroleum Resources (Downstream), Ikenga Ugochinyere, listed the tasks before the panel to include “Carrying out a legislative forensic investigation into the resurgence of fuel queues in petrol stations, allegations of high cost of PMS, unavailability of fuel stock for downstream domestic refineries and disruption of distribution of the product.”

He added, “To ensure a thorough and transparent investigation, the committee will undertake detailed laboratory investigations at all local refineries, marketers and importers facilities, regulatory agencies, state oil companies and other players in the sector.

“We will visit various filling stations, depots and tank farms to take samples in line with international standards, verify the quality of imported products and assess the testing capacities of all refineries and all refined product handling outfits.

“The collection of samples will be done transparently and in line with global best practices and would be in specimens for independent testing in different standard, accredited laboratories. This will include that of stakeholders involved in the refining and importation of refined petroleum products.”

Ugochinyere, who represents Ideato North/Ideato South Federal Constituency, Imo State, added that middlemen involved in shady marketing of crude oil as well as indiscriminate issuance of licenses would be traced and brought to book by the committee.

He added, “The committee will also conduct a legislative forensic investigation into the presence of middlemen in crude trading, indiscriminate issuance of licenses, alleged unavailability of international standard laboratories to check adulterated products and the influx of contaminated products into the country,

“There is also the allegation of non-domestication of profits realised from crude marketing sales in local banks, abuse of the Pro Forma Invoice regime, importation of products already being produced in Nigeria and use of international trading companies to resell fuel stock to local refineries at high mark up prices,” he added.

The House of Representatives had at the plenary on July 9 adopted a motion on “Urgent need to carry out a legislative forensic investigation into the challenges affecting the downstream and midstream petroleum sectors in Nigeria and other related matters to find out a lasting solution to all challenges.”

The committee is starting its mandate barely 24 hours after Speaker Abbas led a delegation of the legislative body to Lagos, headquarters of the Dangote refinery, for the spot assessment of controversy on the non-supply of crude to the indigenous company.

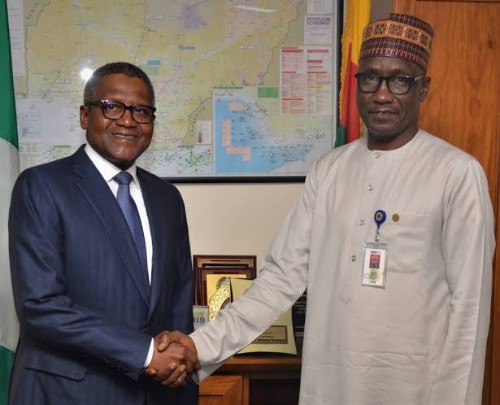

The Minister of State for Petroleum Resources (Oil), Heineken Lokpobiri, held a meeting with the leadership of Dangote refinery, NMDPRA, NUPRC and NNPC on Monday in Abuja.

Lokpobiri’s media aide, Nneamaka Okafor, said the minister convened the “high-level meeting with key stakeholders to address and resolve the ongoing issues surrounding the Dangote refinery.”

Present at the meeting, according to a statement by Okafor, were “Mr Aliko Dangote, Chairman and CEO of Dangote Group; Farouk Ahmed, Chief Executive of NMDPRA; Mr Gbenga Komolafe, Chief Executive of NUPRC; and Mr Mele Kyari, Group Chief Executive Officer of NNPC.”

The stakeholders expressed gratitude to the minister for his intervention in facilitating the dialogue.

“The meeting focused on finding a sustainable and lasting solution to the current impasse affecting the Dangote refinery, with all parties demonstrating a commitment to collaborative and proactive problem-solving.

“The minister emphasised the importance of cooperation and synergy among all stakeholders to ensure the success and optimal performance of the oil and gas sector, which is pivotal for Nigeria’s economic growth and energy security.

“This meeting marks a significant step towards resolving the challenges and underscores the minister’s dedication to fostering a conducive environment for Nigeria’s oil and gas sector,” the statement stated.

Credit: The Punch

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY12 hours ago

BIG STORY12 hours ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY2 days ago

BIG STORY2 days ago