Transnational Corporation Plc (“Transcorp” or the “Group”), Nigeria’s leading, listed conglomerate with investment in the Power, Hospitality, and Energy sectors, has announced impressive Q1 financial results for the period ended March 31, 2024.

In its Q1 2024 unaudited results, Transcorp reported significant year-on-year growth, with revenue rising to N88.6 billion from N32.4 billion in 2023, representing a 173% increase.

The impressive results are largely driven by a remarkable 209% year-on-year revenue growth within the power business, highlighting significant strategic progress as part of Transcorp Group’s implementation of its integrated power strategy.

The hospitality business recorded a 68% year-on-year growth in revenue, driven by an increase in occupancy rate from 75% to 82% compared to the previous year.

The results show substantial growth across all financial indicators, reinforcing its market leadership and strategic positioning.

Highlight of Transcorp Group Results:

• Q1 2024 Revenue was N88.6 billion, a significant increase of 173%, compared to Q1 2023.

• Operating income increased by 479%, from N8.5 billion in Q1 2023 to N49.1 billion in Q1 2024.

• Operating expenses saw an increase of 40% year on year to N8.2 billion in Q1 2024, reflecting the impact of inflation and cost of operations.

• Net finance cost increased by 14% to N3.7 billion in 2024 from N3.2 billion in 2023 due to a slightly higher interest rate review in line with MPR.

• Profit before tax from ordinary business of the Group surged by 1110%, amounting to N34.7 billion in Q1 2024, compared to N2.9 billion in Q1 2023 in the same period last year.

• Profit before tax inclusive of extra ordinary income was N45.7 billion in 2024 compared to N2.9 billion in 2023.

• The Group recorded extra ordinary income of N11 billion during the period from the realised gain from the sale of shares.

• Profit after Tax including the extra ordinary income improved 1832% year-on-year to N35.9 billion in Q1 2024, compared to N1.9 billion in Q1 2023 in the same period last year.

• Earnings per share of the Group was N61.12k in Q1 2024, compared to N2.58k in Q1 2023.

• On the balance sheet, total assets grew by 8.3%, from N530 billion in December 2023 to N574 billion in Q1 2024 due to the increase in operational activities.

• Shareholders’ funds increased by 20% from N187billion in December 2023 to N224 billion at the end of Q1 2024 due to profit accreted to retained earnings.

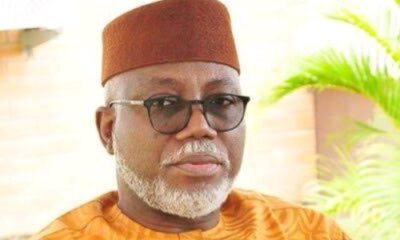

In response to the results, Dr. Owen D. Omogiafo, President/Group Chief Executive Officer of Transcorp, commented, “Our Q1 2024 results demonstrates Transcorp Group’s resilience and commitment to excellence. Despite the challenges, we achieved growth across all major indices, focusing on operational efficiency at both our power plants, and maximising opportunities within our hospitality business, showing our ability to adapt and succeed in changing markets. We will continue to deliver sustainable growth, operational efficiency, and value for our shareholders.”

This robust achievement is a further demonstration of the Group’s strategic focus and effective execution. Transcorp is dedicated to its transformation agenda, emphasising sustained growth and a relentless pursuit of long-term value for shareholders.

About Transnational Corporation Plc (Transcorp Plc)

Transnational Corporation Plc (Transcorp Group) is a leading, listed African conglomerate, with strategic investments in the power, hospitality, and energy sectors. Driven by its mission to improve lives and transform Africa, Transcorp has built a longstanding reputation for sector transformation, operational excellence, and exceptional financial performance, delivering value to its shareholders.

In the power sector, Transcorp’s businesses – Transcorp Power Plc and Transafam Power – provide over 16% of Nigeria’s installed power capacity. Through its investments in the energy sector including OPL287, Transcorp is developing Nigeria’s domestic energy value chain. The Group’s listed hospitality business, Transcorp Hotels Plc, owns the iconic Transcorp Hilton Abuja, Nigeria’s flagship hospitality destination, and Aura by Transcorp Hotels, a digital hospitality platform enabling travellers to book accommodation across Africa.

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY2 days ago

BIG STORY2 days ago