BUSINESS

Heritage Bank MD, Others Parley On Corporate Governance.

- /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 27

https://porscheclassy.com/wp-content/uploads/2016/05/MD-TALK-e1463637930686.jpg&description=Heritage Bank MD, Others Parley On Corporate Governance.', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

- Share

- Tweet /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 69

https://porscheclassy.com/wp-content/uploads/2016/05/MD-TALK-e1463637930686.jpg&description=Heritage Bank MD, Others Parley On Corporate Governance.', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

-

BIG STORY3 days ago

BIG STORY3 days agoAnthony Joshua Returns To UK, Pays Tribute To Deceased Friends In Emotional Post [PHOTOS]

-

BIG STORY2 days ago

BIG STORY2 days agoCIG Motors Fires Director Jubril Arogundade Over Financial Misappropriation, Abuse Of Office, Refers Case To EFCC

-

BIG STORY3 days ago

BIG STORY3 days agoLagos Police Commissioner Orders SCID To Probe Pastor Okafor Over Multiple Sex Scandal Allegations

-

BIG STORY2 days ago

BIG STORY2 days agoUS Military Has Marked Me For Elimination As A Boko Haram Member —– Sheikh Gumi

-

BUSINESS4 days ago

BUSINESS4 days agoFirstBank Hosts Nigeria Economic Outlook 2026, Leads Conversation on Economic Growth

-

BIG STORY2 hours ago

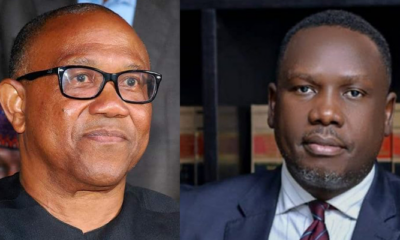

BIG STORY2 hours agoBREAKING: Peter Obi’s Ex-Running Mate, Datti Baba-Ahmed Declares Presidential Ambition

-

BIG STORY1 day ago

BIG STORY1 day agoAnthony Joshua Seriously Considering Retirement From Boxing After Car Crash —- Uncle

-

BIG STORY1 day ago

BIG STORY1 day agoPeter Obi Will Be Denied 2027 Presidential, VP Tickets In ADC —– Bwala