They appeared before Justice Christopher Boyko at the US District Court of Ohio.

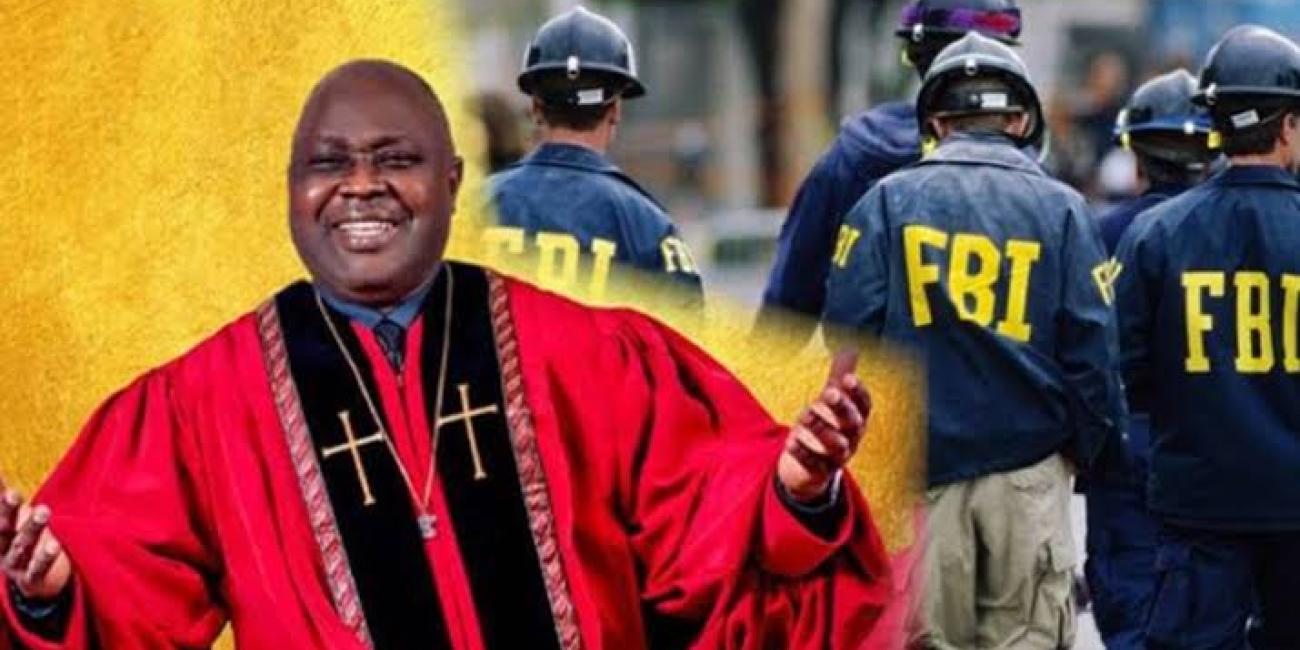

A Nigerian pastor, Edward Oluwasanmi, has been sentenced by a United States District Court to 27 months in prison for defrauding the COVID-19 relief fund.

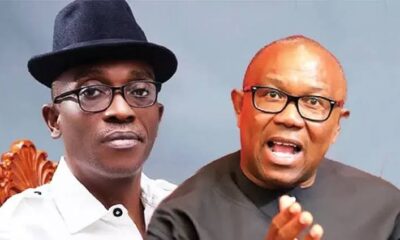

His associate, the Apetu of Ipetumodu, Oba Joseph Oloyede, forfeited his property to the US government while awaiting a court ruling set for August 1.

Oluwasanmi and Oba Oloyede were arrested in early 2024 for fraudulently obtaining $4.2 million in COVID-19 relief funds.

They were charged with 13 counts, including conspiracy to commit wire fraud, wire fraud, conspiracy to defraud, money laundering, and engaging in monetary transactions involving criminal proceeds.

They were brought before Justice Christopher Boyko at the US District Court of Ohio.

Reports indicated both men pleaded guilty to some of the charges under a plea agreement.

According to court documents, Judge Boyko sentenced Oluwasanmi on Wednesday, July 2, to 27 months on counts one, 11, and 12 of the indictment.

The sentences will run concurrently.

The court also ordered Oluwasanmi to pay a $15,000 fine and report to the U.S. Marshal Service.

The court stated, “Supervised release three years on each of counts 1 and 11-12, all such terms to run concurrently, with standard and special conditions.”

It also declared, “As a result of the foregoing offenses, defendants Joseph Oloyede and Edward Oluwasanmi shall forfeit to the United States: all property, real and personal, which constitutes – or is derived from – proceeds traceable to the commission of the wire fraud, wire fraud conspiracy offenses; all property constituting, or derived from, proceeds the defendants obtained, directly or indirectly, as the result of the wire fraud, wire fraud conspiracy offenses and any and all property, real and personal involved in the money laundering offenses, and any property traceable to such property.”

Oluwasanmi will forfeit a commercial property located at 422 South Green Road, South Euclid, Ohio. Meanwhile, the court scheduled Friday, August 1, for the sentencing of Oloyede after the monarch pleaded guilty to counts one and 13 of his indictment.

On Monday, April 21, Oba Oloyede, a US-based accountant and information systems professional crowned Apetu in July 2019, entered his guilty plea before the court.

Oba Oloyede and Oluwasanmi were accused of submitting fake applications for the Paycheck Protection Programme and Economic Injury Disaster Loans under the US Coronavirus Aid, Relief and Economic Security Act between April 2020 and February 2022.

They allegedly used falsified tax and wage documents to obtain funds intended to help struggling businesses during the pandemic.

The Act was meant to offer emergency financial relief to Americans facing the economic consequences of COVID-19 by providing loans to small businesses and nonprofits.

Oba Oloyede was alleged to have used some of his companies, including Available Tax Services Incorporated, Available Financial Corporation, and Available Transportation Company, to commit the fraud.

Following the monarch’s disappearance, the Osun State Government said it would wait for the conclusion of his trial before deciding on any action.

The state Commissioner for Information and Public Enlightenment, Kolapo Alimi, said, “A person is innocent until a court convicts them. So, we don’t want to jump the gun; let us wait for the court’s pronouncement on the matter.”

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY2 days ago

BIG STORY2 days ago