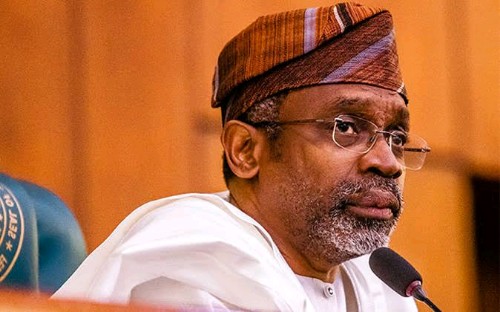

Sixty-one-year-old Olufemi Hakeem Gbajabiamila CFR is one man whose political and life story makes a long-lasting – if not a lifelong – impression. SRK

Truth be told, Gbajabiamila’s trajectory in life and politics can be intimidating but should not be enough for many of his peers in politics, and even technocrats, to covertly abhor his person, office, success and consistently seek his downfall.

Though his antecedents and emergence in the world of politics, and governance may seem like only a lofty idea to many of his peers, who are yet to phantom the secret to his continued rise, a good number of Nigerian youths look up to him as a role model, one in whom a new Nigeria can lay her foundation.

Sadly, in the realm of public discourse, politics, and sometimes governance, the lines between truth and deception can be blurry, hence, giving rise to ‘false positives,’ ‘false negatives,’ and ‘false analyses.’

Since he was appointed the Chief of Staff to President Bola Ahmed Tinubu in June 2023, tons of baseless allegations and claims have been made against the person and office of the former Speaker of the House of Representatives.

For a man of stature, who has traversed the corridors of power as Minority Leader of the House of Representatives of Nigeria in the 7th Assembly, House Leader of the House of Representatives of Nigeria in the 8th Assembly, Speaker of the House of Representatives of Nigeria in the 9th Assembly, and yet remains unblemished, one begins to wonder why the campaign of calumny and lies?

From the accusations of transgressions with an air of certitude to claims of monetary inducements to shielding select individuals and altering the fate of others, the campaign of calumny and lies keeps rearing an ugly head like that of Medusa, the most famous of the monster figures in Greek mythology.

At some point in 2023, it was alleged that Gbajabiamila formed and headed a cabal in Aso Rock, at other times, individuals seeking board appointments allegedly bribed him to have their way, and recently, he’s alleged to be interfering in the job of the Special Investigator appointed by his principal, so much so that he allegedly diverted a whopping sum of $30billion refund of loot and largesse to his private coffers.

Yet, these allegations stand unsupported by the pillars of evidence since his appointment over seven months ago.

The claims and allegations have been, categorically, found to be nothing more than malevolent fabrications orchestrated with the intent of tarnishing the reputation of a steadfast public servant.

A quick look into Gbajabiamila’s emergence and 16-year service in the House of Representatives shows no record of blemished or corrupt practices. In the house, he held the position of Minority Leader in the 7th assembly between June 2007 and June 2015, and House Leader in the 8th assembly, Gbajabiamila was not for once found wanting neither was he accused nor indicted for fraud or corruption practices.

Even as a Speaker of the House of Representatives, where he reigned for four years and controlled over 800 agencies, not for once was he found culpable of any corrupt or fraudulent practices.

Then, one begins to wonder why the campaign of calumny and lies against Gbajabiamila for accepting to continue to serve Nigeria alongside his godfather and principal, President Bola Ahmed Tinubu.

Despite being instrumental to the emergence of the current speaker of the House of Representatives, Tajudeen Abbas, he has neither instigated the administrative arm of the government against the judiciary nor vice versa. Aside from meditating on issues of national interest as directed by his principal, Gbajabiamila has stayed clear of turfs that are not within his jurisdiction. Hence, many begin to wonder, who is after Gbajabiamila so desperately that flawed claims and allegations keep rearing their heads and consistently meeting a brick wall of fact and proof.

The road to Gbajabiamila’s emergence, as Chief of Staff to the 16th President of the Federal Republic of Nigeria, has been filled with dignity, integrity, steadfastness, and unblemished records yet some corrupt individuals with ulterior motives to cause unrest and discomfort in the relationship that exists between Tinubu and Gbajabiamila to evade justice or their fate keeps throwing a spanner in the cogwheels of progress and patriotism.

On the recent claim and allegation of diversion of a whopping $30 billion, again, it is a figment of the imagination of individuals filled with bile against Gbajabiamila just as the Chief of Staff to the President has proven over time that he will neither interfere nor get involved in the process of any investigation, either instituted by his principal or security agencies.

With nothing in his cupboard to hide other than his good-looking attires, it is so obvious that many people are trying to come in between Gbajabiamila and Tinubu because he enjoys the audience of his boss and is publicly known to have the eyes and ears of the president.

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY4 days ago

BIG STORY4 days ago