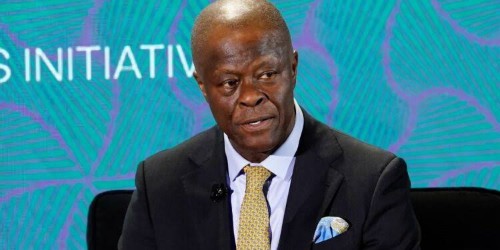

Minister of Finance and Coordinating Minister of the Economy, Wale Edun, has disclosed that Nigeria currently incurs a monthly expenditure of $600 million on fuel importation.

According to Edun, the high import bill is attributed to the fact that neighboring countries, extending to Central Africa, benefit from Nigeria’s fuel imports.

During an interview on AIT’s Moneyline program, posted on the channel’s YouTube platform on Wednesday, Edun explained that this situation prompted President Bola Tinubu to remove fuel subsidies, as the exact amount of fuel consumed domestically remains unknown.

Citing a report by the National Bureau of Statistics, Edun noted that following the removal of fuel subsidies by President Tinubu on May 29 last year, Nigeria’s petrol importation has decreased to an average of one billion liters per month.

He said, “The fuel subsidy was removed May 29, 2023, by Mr President, and at that time, the poorest of 40 per cent was only getting four per cent of the value, and basically, they were not benefitting at all. So it was going to be just a few.

“Another point that I think is important is that nobody knows the consumption in Nigeria of petroleum. We know we spend $600m to import fuel every month but the issue here is that all the neighbouring countries are benefitting.

“So we are buying not for just for Nigeria, we are buying for countries to the east, almost as far as Central Africa. We are buying. We are buying for countries to the North and we are buying for countries to the West. And so we have to ask ourselves as Nigerians, how long do we want to do that for and that is the key issue regarding the issue of petroleum pricing.”

He added that the nation must take a decisive step to tackle step the problem as it impedes it’s economic growth.

Of great importance to the government, Edun said, is the welfare of the people, particularly the vulnerable.

One of the key areas of focus is ensuring food availability and affordability.

Speaking further in the interview, the finance minister clarified that the N570bn fund release to state governments was implemented last year December.

He said, “This actually refers to a reimbursement that they received from December last year onwards and it was a reimbursement I think under the COVID financing protocol but the point is that the states have received more money. They have received more money. Mr President has charged to ensure food production in the states.”

Edun also clarified that the recent decision to raise the maximum borrowing percentage in the Ways and Means from five to 10 per cent does not imply that the Federal Government tends to rely on the Central Bank of Nigeria financing.

He said the government had rather used market instruments to manage its debts.

The minister said, “We have not gone to the central bank to say, please lend the government money to pay its debt, to pay its salaries. That’s Ways and Means. We have not gone. In fact, we have used market instruments to pay down what we owed, and that is a very, very germane aspect of having a strong economy.

“It was raised to 10 per cent, but that doesn’t mean it will be used. It’s there as a fail-safe and just gives that extra flexibility so that if a payment needs to be made and there is a mistiming or gap in when revenue would come in and expenses, we can just draw it down briefly.”

He described the approval by the National Assembly as a fail-safe measure.

The minister added, “Sometimes it just gives that extra flexibility so that if a payment needs to be made and there’s a mistiming, there’s a gap between the time at which the revenue will come in and the expenses needed, you can just draw down briefly.

“So, the aim is to keep within the letter of the law, I think that’s the main point.”

He also said the welfare of Nigerians remained a key priority for the current administration, particularly ensuring food availability and affordability.

Edun said, “There is a concerted effort to ensure that we have homegrown food available. In the short term, apart from what is being distributed from reserves, there is a window that has been opened for importation because the commitment of Mr President is to drive down those prices now and make food available now.”

He assured all that the measure would not undermine local farmers, as importation would only be permitted after exhausting local supplies.

He said, “So, one of the conditions for this importation will be that everything available locally in the markets or with the millers and so forth has been taken up. We will have auditors that will check that.”

He said these interventions seek to reduce inflation, stabilise exchange rates, and lower interest rates, thereby creating a conducive environment for investment and job creation.

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago