FBNBank UK, a subsidiary of FirstBank Group had London, the United Kingdom painted blue as it celebrated its 40th anniversary, themed Partnership Beyond Borders, on Friday, 11 November 2022.

The event which had customers, members of government functionaries and the diplomatic community, regulators, captains of industries in attendance, was convened to appreciate the patronage and support the Bank had received since it opened its doors in the United Kingdom 40 years ago. As key stakeholders, they were instrumental to establishing the Bank as an important gateway to connect international markets in Africa, Europe and the rest of the world to the finest financial services solutions that the UK has to offer.

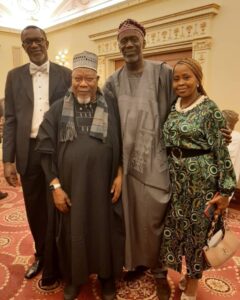

Guests at the event include Hon. Justice Olukayode Ariwoola GCON, Chief Justice of Nigeria; Oba Sen. Dr. Moshood Olalekan Ishola Balogun, Alliiwo II, Olubadan of Ibadan land; Ambassador Sarafa Tunji Isola, High Commissioner, Nigerian High Commission, UK; His Highness, Muhammadu Sanusi II, former Governor, Central Bank of Nigeria.

Other dignitaries that graced the occasion include Alhaji Umaru Abdul Mutallab, Nigerian businessman and former Chairman of FirstBank; Mohammed Indimi OFR, Chairman, Oriental Energy Resources.

Delivering his welcome address to the dignitaries and guests present, Sam Aiyere, Chief Executive Officer, FBN Bank UK Ltd said “since its establishment, our Bank has demonstrated an unmatched dexterity, serving as a gateway connecting international markets in Africa, Europe and the rest of the world to the finest financial services solution that the UK has to offer. Through its office in the UK and the Paris Branch, our Bank has continued to facilitate international trade between Africa and Europe while offering top-notch, world-class corporate, institutional, and private banking solutions to our esteemed customers.

We have recorded laudable achievement only because you stand solidly with us. Therefore, I dedicate the success of the past 40 years to all our stakeholders. Thank you for being the lever beneath our thrust”, he also added.

Appreciating the patronage and support extended to FBNBank UK, Dr. Adesola Adeduntan, CEO, FirstBank said “today we celebrate 40 years of unbroken business operations in the United Kingdom; 40 years of supporting and enabling dreams; 40 years of resilience and relevance; 40 years of trust, safety and security; 40 years of long-term value to all stakeholders; and 40 years of partnerships beyond borders. I believe the future is bright for FBN Bank UK. With our beautiful outing tonight, our Group stands out, once again, as one big and happy family of many parts.

In his speech, Godwin Emefiele, Governor, Central Bank of Nigeria highlighted that “FBNBank UK’s established presence in a leading global financial centre such as London ensures that FirstBank Group is well positioned to play an active role in the promotion of Africa as an investment destination, attract much needed capital to the continent and facilitate trade with other parts of the world. The presence of FirstBank in other countries outside Nigeria shows that the span of its impact is continent-wide. As you are headquartered in the largest economy on the continent, you have a unique role in also facilitating capital flows into other African countries and assisting their economic growth and development.

In addition, in his goodwill message, President Muhammedu Buhari, GCFR, President and Commander-in-chief, Federal Republic of Nigeria said “FirstBank has profoundly demonstrated a high level of nationalism by keeping the Nigerian dream at the heart of its business through constant evolution to birth agile financial services solution to suit the demands of its customers both home and abroad. Also, perhaps more than any other institution in its class, FirstBank has supported the Government by providing human resources at various times to booster much required professional expertise in various sectors of our economy.”

Established in the United Kingdom in 1982 as the London Branch of the First Bank of Nigeria Limited., FBNBank UK was initially established to service the UK banking requirements of Nigerian companies and FirstBank.

Later in November 2002, the Bank was incorporated in the UK as a registered and a wholly-owned subsidiary of First Bank of Nigeria Limited with offices in the City of London and has then developed into a much broader business in the gateway to Europe and beyond for African banks, companies and high net worth individuals.

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY23 hours ago

BIG STORY23 hours ago