BIG STORY

EFCC Arrests Wanted Socialite Aisha Achimugu At Abuja Airport

- /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 27

https://porscheclassy.com/wp-content/uploads/2025/04/Screenshot-2025-04-28-183829.png&description=EFCC Arrests Wanted Socialite Aisha Achimugu At Abuja Airport', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

- Share

- Tweet /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 69

https://porscheclassy.com/wp-content/uploads/2025/04/Screenshot-2025-04-28-183829.png&description=EFCC Arrests Wanted Socialite Aisha Achimugu At Abuja Airport', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

-

BIG STORY3 days ago

BIG STORY3 days agoFrom Harvard With Love: Why Ijebuland Is Blessed With A Strong Choice

-

BIG STORY4 days ago

BIG STORY4 days agoJUST IN: Five Feared Dead As Bandits Attack National Park In Oyo

-

BIG STORY4 days ago

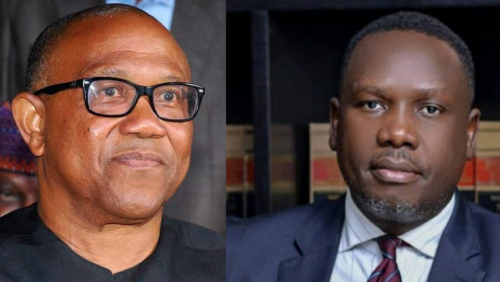

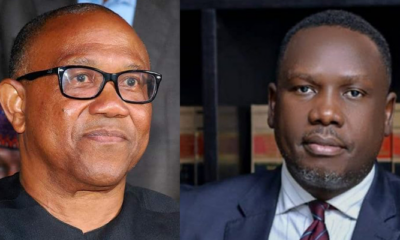

BIG STORY4 days agoBREAKING: Peter Obi’s Ex-Running Mate, Datti Baba-Ahmed Declares Presidential Ambition

-

BIG STORY3 days ago

BIG STORY3 days agoBREAKING: Chimamanda Adichie Loses 21-Month-Old Son

-

BIG STORY4 days ago

BIG STORY4 days agoTax Reforms Will Support Sustainable Growth, Not Targeted At Opposition Figures —– NRS Chairman Zacch Adedeji

-

BIG STORY1 day ago

BIG STORY1 day agoPeter Obi Is A ‘Character-In-Chief’, I Know The Junction Where Madman Who Advised Him Stayed In Anambra —- Bwala

-

BIG STORY4 days ago

BIG STORY4 days agoBREAKING: Malami, Son, Wife Granted N500m Bail Each

-

BIG STORY4 days ago

BIG STORY4 days agoPolice Arrest 20-Year-Old Emmanuel Akpama In Lagos Over ‘N1bn International Romance Scam’