BIG STORY

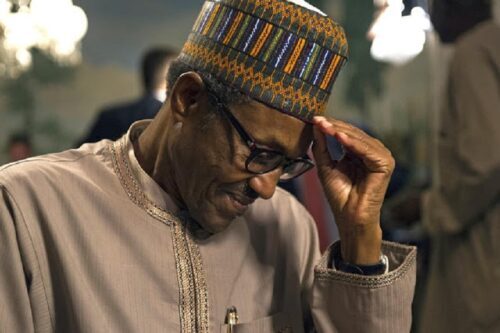

Economy: External Debt Rises By 288.18% To $40bn Under Buhari — DMO

- /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 27

https://porscheclassy.com/wp-content/uploads/2022/10/Buhari-Thinking-e1666697443183.jpg&description=Economy: External Debt Rises By 288.18% To $40bn Under Buhari — DMO', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

- Share

- Tweet /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 69

https://porscheclassy.com/wp-content/uploads/2022/10/Buhari-Thinking-e1666697443183.jpg&description=Economy: External Debt Rises By 288.18% To $40bn Under Buhari — DMO', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

-

BIG STORY4 days ago

BIG STORY4 days agoSenate Orders Nationwide Crackdown As Lead Poisoning Hits Ogijo Lagos

-

BIG STORY2 days ago

BIG STORY2 days agoWe Will Get It Right With Security —- Obasa

-

BIG STORY2 days ago

BIG STORY2 days agoNigerian Army Suspends Officer Retirements Amid National Security Emergency

-

BIG STORY14 hours ago

BIG STORY14 hours ago2025: The Year the Environment Fought Back —– Babajide Fadoju

-

BIG STORY15 hours ago

BIG STORY15 hours agoEFCC Seals Timipre Sylva’s House Over Alleged $14.8m Fraud

-

BIG STORY14 hours ago

BIG STORY14 hours agoFG Seeks Speedy Trial of Terrorists, Kidnappers, Other Violent Crimes

-

BIG STORY14 hours ago

BIG STORY14 hours agoIndia Deports 32 Nigerians Linked To Transnational Drug Network

-

BIG STORY3 hours ago

BIG STORY3 hours agoBREAKING: Gov Fubara Dumps PDP, Defects To APC