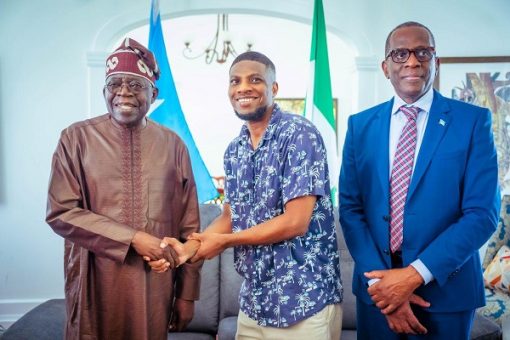

For Nigerian medical student Bob Chikwem Amadi, what started as a routine work assignment turned into an unforgettable experience with two world leaders — President Bola Ahmed Tinubu of Nigeria and Prime Minister Philip J. Pierre of Saint Lucia.

Amadi, currently studying medicine at the American International University in Saint Lucia, was part of the service team present during President Tinubu’s courtesy call to Prime Minister Pierre’s official residence on the second day of the Nigerian president’s state visit to the Caribbean nation.

Originally from Rivers State, Amadi has lived in Saint Lucia for ten years and recently completed the four-year basic phase of his medical education. He is now preparing to begin his clinical training.

Alongside his studies, Amadi also works part-time as a talent and brand manager with a local catering and entertainment company — a role that brought him close to the high-level diplomatic event.

During the visit, Prime Minister Pierre was informed by his aides that one of the staff members was a Nigerian student.

Taking a brief moment before his official engagements began, the prime minister introduced Amadi to President Tinubu.

The president, known for his engaging nature and interest in Nigerians living abroad, took time to speak with the young student, asking about his name, background, and academic journey.

Tinubu extended his best wishes and words of encouragement, praising Amadi for his dedication to his studies overseas.

Describing the experience, Amadi said it was “an inspiring moment” for him.

“Saint Lucia is an amazing island. I will describe it as a wonderful place. They are a very contented society and things are relatively calm”, he said.

The moment was capped off when Amadi was invited to join President Tinubu and Prime Minister Pierre for a group photograph — a symbolic and memorable close to a chance meeting with two major political leaders from Africa and the Caribbean.

Amadi also reflected on the strong historical and cultural ties between Nigeria and Saint Lucia.

“We have always hoped that there are many opportunities between Saint Lucia and Nigeria. We share similar food crops and culture, and the connection is deep”, he said.

President Tinubu’s visit to Saint Lucia marks the beginning of a broader diplomatic tour of the Caribbean and South America, focused on enhancing trade, cultural ties, and diplomatic collaboration between Nigeria and Caribbean countries.

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago