At the 2024 Medic West Africa Event, organised by ABCHealth in collaboration with Informa Markets, Access Bank reaffirmed its dedication to fostering positive transformation in healthcare across Africa.

The event, which served as a platform for stakeholders across industries deliberate on the theme ‘Healthcare Investments in Africa: Mobilizing the Private Sector to Drive Healthcare Investments in Africa,’ aimed to chart a path through which corporates can leverage innovative financing models and strategic partnerships in fostering the achievement of the United Nations Sustainable Development Goals.

The discussions also explored strategies for strengthening healthcare infrastructure, leveraging technological advancements, as well as enhancing community health initiatives.

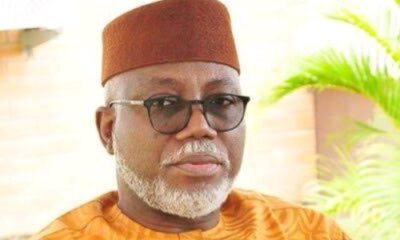

Lending his voice to the conversation, Ralph Opara, Group Head, Commercial Banking Division at Access Bank Plc, stressed that, “The government can’t carry the burden of the health sector alone. Hence, it is imperative that the private sector explores and implements innovative financing models and strategic partnerships to bridge the healthcare investment gap.”

Opara noted that collaborative effort between the public and private sectors is not only crucial but essential to driving innovation, improving healthcare accessibility, and ensuring sustainable development across the continent.

Walking the talk on partnerships, Access Bank partnered with the Private Sector Health Alliance of Nigeria (PSHAN), to launch the Adopt-A-Health Facility Program (ADHFP) with the primary aim of delivering, at least, one global standard Primary Healthcare Centre (PHC) in each of the 774 Local Government Areas (LGAs) in Nigeria. So far, the initiative has resulted into over 180 PHCs adopted across the country.

Other notable participants at the event include Mories Atoki, CEO, ABCHealth; Jane Ike-Okoli, Head of Specialised Sectors Business & Commercial Banking, Stanbic IBTC; Odunayo Sanyo, Executive Director, MTN Foundation; Ibironke Akinmade, Group Head, Health Finance, Sterling Bank, and Zouera Youssoufou, MD/CEO, Aliko Dangote Foundation.

Access Bank, a wholly owned subsidiary of Access Holdings Plc, is a leading full-service commercial bank operating through a network of more than 700 branches and service outlets spanning 3 continents, 21 countries and over 60 million customers. The Bank employs over 28,000 thousand people in its operations in Africa and Europe, with representative offices in China, Lebanon, India, and the UAE.

Access Bank’s parent company, Access Holdings Plc, has been listed on the Nigerian Stock Exchange since 1998. The Bank is a diversified financial institution which combines a strong retail customer franchise and digital platform with deep corporate banking expertise, proven risk management and capital management capabilities. The Bank services its various markets through three key business segments: Corporate and Investment Banking, Commercial Banking, and Retail Banking. The Bank has enjoyed what is arguably Africa’s most successful banking growth trajectory in the last 18 years, becoming one of the continent’s largest retail banks.

As part of its continued growth strategy, Access Bank is focused on mainstreaming sustainable business practices into its operations. The Bank strives to deliver sustainable economic growth that is profitable, environmentally responsible, and socially relevant, helping customers to access more and achieve their dreams.

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY19 hours ago

BIG STORY19 hours ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY2 days ago

BIG STORY2 days ago