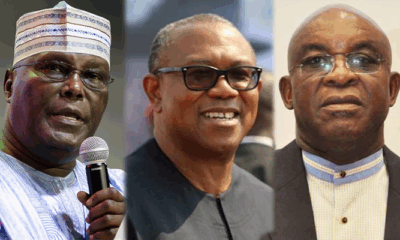

Interim National Chairman of the African Democratic Congress, Senator David Mark, said in a statement on Tuesday that the new coalition had no “favourite presidential candidate” amid reports that former Vice President Atiku Abubakar, 2023 presidential candidate Peter Obi, former Minister of Transport, Rotimi Amechi, and others were “frontrunners” for the party’s ticket in the 2027 election.

In the statement issued by his media team in Abuja, Mark stressed that all party members were “equal stakeholders.”

ADC’s 2023 presidential candidate, Dumebi Kachikwu, had accused the Mark-led interim leadership of the party of being biased toward Atiku, with concerns mounting that the ambitions of the three contenders could “divide the party.”

In response, Mark assured Nigerians that the party would operate with “complete transparency” under his leadership.

Mark said the ADC had “no preferred or favourite presidential aspirant” but was focused on “putting out a platform that would be attractive and acceptable to majority of Nigerians.”

He added, “We are doing this because we do not want this great ship called Nigeria to sink because if we do not rise up, and now, they will sink all of us.”

“I don’t own this party more than any of our members and I urge all members to prepare to show Nigerians that ADC is a different party.

“A different party that is ready to properly run democracy in our country. All Nigerians must come together and take ownership of the ADC.”

But President Bola Tinubu’s Special Adviser on Information and Strategy, Bayo Onanuga, on Tuesday claimed that opponents of Nigeria’s development are conspiring to oust the President.

Onanuga stated this in a post on X on Tuesday, which was later deleted.

He described the Tinubu administration as “the most focused and transformative in Nigeria’s history.”

He referenced a 2022 warning by the Emir of Kano, Muhammad Sanusi II, who cautioned that any leader promising effortless prosperity was being dishonest.

Quoting Sanusi, Onanuga wrote, “Emir Sanusi warned Nigerians what to expect from President Tinubu’s reforms. ‘It’s not going to be easy.’ If anybody tells you it would be easy, don’t vote for him.”

The presidential aide then alleged that “haters of Nigeria’s progress are banding together to overthrow an administration that has been the most focused, most transformative in our history.”

This comes as more members of the opposition and even the ruling APC pledged loyalty to the coalition on Tuesday.

The fresh wave of defections swept across Borno, Gombe, Jigawa, Ondo and other states, with notable politicians abandoning their former parties to join the ADC ahead of the 2027 general elections.

In Borno State, home of Vice President Kashim Shettima, the ADC witnessed a mass influx of former PDP and APC stalwarts.

Among them are the PDP Borno Central Senatorial candidate in the 2023 election, Mohammed Kumalia; Deputy Governorship candidate, Saleh Kida; and former PDP national treasurer, Ali Wurge.

Others are House of Representatives candidate in Maiduguri Metropolitan Council, Babakura Yusuf; PDP candidate for Bama, Ngala, Kala Balge federal constituency, Abdulrazaq Zanna and other House of Representatives candidates.

A former governorship aspirant, Idris Durkwa, and a youth mobiliser, Sheriff Banki, also defected to the coalition.

Speaking on Tuesday, Banki attributed the defections to the failure of the APC under President Bola Tinubu and the compromised leadership of the PDP.

He said, “I am happy to inform you that the massive defections and resignations by prominent members of opposition parties, including the ruling APC, as recently witnessed in Borno State, mark the beginning of better things in the state’s political landscape and the country at large.

“Nigerians, especially at the grassroots level, were promised a Renewed Hope Agenda by President Tinubu. Unfortunately, two years into the APC-led administration, the reverse is the case. People can no longer sleep with both eyes closed, and they are grappling with economic hardship due to poor policies and programmes.”

In Gombe, Abdullahi Ataka, a former APC State Organising Secretary and youth mobiliser, explained that his decision to join the ADC came after months of reflection and engagement with stakeholders.

Ataka spoke on the heels of an expanded caucus meeting in Gombe on Tuesday.

Ataka said, “The decision wasn’t made lightly. It followed extensive consultations across political and civic platforms.

“We see, in the ADC, a fresh energy, a sense of direction, and an openness that is lacking in the current system. We’re not just coming with numbers; we’re coming with structure, strategy, and a clear sense of purpose.”

He expressed confidence that the new coalition has the momentum to disrupt the status quo.

“This is the movement the people have been waiting for. The ADC represents that new voice – the voice of ordinary Nigerians,” he stated.

Speaking during the expanded caucus meeting, the ADC state chairman, Auwal Barde, described the coalition as “a timely alliance driven by the need to offer Nigerians a credible alternative.”

“This is not just a merger of political interests. It’s the beginning of a genuine movement to rescue Gombe State and Nigeria at large from political stagnation,” Barde said.

“We have officially opened our party registers in all 114 wards and across the 11 LGAs of the state to welcome new members who believe in change rooted in accountability and inclusiveness.”

He called on citizens disillusioned by the current political establishment to find a home in the ADC.

“We are calling on those who have been politically displaced or discouraged — youth, professionals, and interest groups — to come on board. ADC is a platform for real transformation,” he added.

The gathering also featured members of the coalition, including a former minister, Abdullahi Umar, who emphasised that the alliance was not just about defeating the APC, but about providing solutions to Nigeria’s growing challenges.

“This coalition is not built on bitterness or ambition alone. We are uniting to tackle the economic hardship and leadership failure affecting ordinary Nigerians,” Umar explained. “It’s about rebuilding institutions and restoring hope. We’re inviting all well-meaning citizens to be part of this mission.”

In Jigawa, the ADC dissolved its executive council and inaugurated a new state exco led by former Deputy Governor in the state, Ahmed Gumel.

This comes on the back of former Jigawa Governor Sule Lamido, a PDP chieftain, recently joining the coalition.

In his inaugural speech on Monday at the ADC Jigawa headquarters in Dutse, Gumel said, “The coalition aims to reshape Nigeria’s political landscape and provide an alternative to the APC-led government.”

A meeting of the ADC also held in Akure, the Ondo State capital, on Tuesday, where the state coordinator of the coalition and former member of the House of Representatives, Prof. Bode Ayorinde, state that several chieftains of the PDP in the state were already part of the coalition.

Ayorinde, a former PDP chieftain, claimed that governorship candidates of the party in the 2020 and 2024 elections in the state, Eyitayo Jegede and Agboola Ajayi, were part of the coalition.

He added that the senator who represented Ondo South, Nicholas Tofowomo, a former chairman of PDP, Tola Alabere, and former spokesman of the party, Kennedy Peretei, were already part of the coalition in the state.

Ayorinde stated, “I’m happy that our number is increasing; we must work together. Ondo State will first take advantage of the ADC in the next governorship election. Let all leaders at the ward levels play politics of inclusion.

“We started with 25 members at our first meeting, but now we are over 300. It shows the failure of the ruling party. Eyitayo Jegede and Agboola Ajayi are also part of us. It is a state coalition, we are united.”

Also speaking, Peretei said, “You heard Prof. Ayorinde. He mentioned names – big names. But it’s not even about the big names. It’s about the situation that we find ourselves in. Initially, there were people who were saying that the national problem does not affect, does not translate to collapsing party structures, the PDP structures, into the ADC.

“In Ondo State, I know two local governments that have already collapsed their structures into the ADC. So, PDP doesn’t exist anymore. It’s the ADC that exists. And you see it here.

“The biggest fear that was expressed in the last two months in the country was that Nigeria was going to be a one-party state? Nobody’s talking about that now. And those that are in the villa are attacking us, attacking personalities. That will tell you how much heat is on the APC in one week. So, what happens if it becomes six weeks?

“In those states, after today, I’m sure there will be ripples. There will be a lot of ripples.”

PDP kicks

But speaking with The PUNCH, PDP National Vice Chairman (South-West), Kamorudeen Ajisafe, said he was not aware of the purported defection of Jegede and Ajayi.

Ajisafe said, “I am yet to confirm the said exits of Eyitayo Jegede and Agboola Ajayi. Have you seen their resignation letters online? They have not resigned to the best of my knowledge. I don’t know the source; it might be hearsay. I will have to do my verification; other than that, it is still under the realm of hearsay. It is not verifiable by me. And, the chairman of the party in Ondo State has not called me to tell me such.”

Ajisafe, however, said the PDP South West had scheduled a zonal caucus meeting to boost the confidence of members in the party and halt any defection amid the current ADC momentum.

“The South West Zonal Caucus meeting on Friday is to boost the morale of members amid events ongoing and developments in the polity.

“The ADC is gaining momentum because it’s a new movement, but not at the detriment of the PDP in the South West. You might have pockets of defections here and there, but PDP remains very strong in the South West,” Ajisafe added.

The Gombe State Publicity Secretary of the PDP Abdulkadir Dukku, sais members who joined the coalition didn’t resign formally.

He said, “Our party is not threatened. We equally had a meeting with our leader asking us to remain in the PDP and we have accepted to remain in the party. You know politics is a matter of choice, wherever you chose to stay is okay.

“There are rules guiding every party, at least you need to tender your resignation before switching to the other political party, those who didn’t tender resignations are not going to represent the PDP, they are on their own. Most of them we didn’t see their resignations formally, whosoever goes there went on his own.”

The PDP also expressed strong optimism about winning the February 2026 Area Council elections in the Federal Capital Territory, claiming there was no coalition in the FCT.

The party stated this on Tuesday during the issuance of certificates to the party’s chairmanship and councillorship candidates in Abuja.

Represented by the PDP National Vice Chairman (North Central), Abdulrahman Mohammed, the party’s acting National Chairman, Umar Damagum, emphasised that the PDP was not part of any coalition and continues to maintain a solid political presence throughout the FCT.

“There is nothing like a coalition in the FCT, and there is no attempt by anyone to defect to another political party. Our structure is intact,” he said.

“We know the FCT is the home of PDP, and PDP belongs to the FCT, in shaa Allah.”

Damagum urged party officials at all levels from ward to state to recommit to the party’s mission, emphasising that there was no longer room for political complacency.

“It is no longer business as usual,” he warned.

“We have disciplinary committees at both state and local government levels. Any executive found engaging in anti-party activities will be disciplined. If you’re not ready to work for the party, kindly step aside so the vacuum can be filled immediately,” he said.

He warned PDP members against associating with opposition parties, labeling such behavior as an act of betrayal.

“It is shameful for any executive to be seen campaigning for or collaborating with other political parties. That is anti-party, and I will not allow it in the FCT anymore,” he said.

Damagum pledged that the national secretariat would offer complete backing for the elections and promised to safeguard the credibility of the results.

‘Tinubu not distracted’

Meanwhile, the Federal Government has reaffirmed President Tinubu’s commitment to his administration’s reform agenda, stating that he remined focused on delivering economic transformation and national development, despite mounting political discourse ahead of the 2027 general elections.

This was contained in a statement issued by the Minister of Information and National Orientation, Mohammed Idris, on Tuesday.

“Amid ongoing political discourse and increasing media speculation regarding the 2027 elections, it is necessary to reaffirm that the administration of President Bola Tinubu remains firmly committed to its core mandate: delivering meaningful reforms and real economic growth for the Nigerian people.

“Even as we affirm the right of all Nigerians to freely exercise their constitutionally guaranteed freedoms of association and of speech, it is also important to underscore that President Tinubu’s administration will not be sidetracked by politicking or political distractions,” Idris said.

The minister was responding to media reports and political commentary concerning the formation of a new opposition coalition.

He insisted that such developments would not derail the government from pursuing its “bold and transformative mandate,” anchored in the Renewed Hope Agenda.

“The clamour in the media about the emergence of a new political ‘coalition’ is understandable, but Nigerians entrusted President Tinubu with a bold and transformative mandate, anchored in the Renewed Hope agenda,” Idris said.

According to the minister, the administration’s reform agenda is already producing tangible outcomes across various sectors.

He cited progress in tackling crude oil theft, restoring investor confidence, stabilizing the naira, and easing inflation. He also pointed to several initiatives designed to support ordinary Nigerians.

“Millions of Nigerians — households, students, artisans, small business owners—are benefitting from initiatives such as student loans, access to consumer credit, CNG vehicle conversions, and improved government services and infrastructure,” Idris stated.

The statement also highlighted the President’s recent policy actions, including the signing of four tax reform bills into law. The laws, set to take effect in 2026, are part of what the government calls one of the most ambitious fiscal overhauls in the country’s history.

“These reforms are expected to significantly boost prosperity for households and businesses nationwide” Idris said.

On agricultural development, the minister noted the recent launch of the Renewed Hope Agricultural Mechanisation Programme, which he described as “the single largest mechanisation drive ever undertaken in Nigeria’s history.”

“This is just one of several high-impact agricultural mechanisation programs being undertaken to guarantee food security,” he added.

Addressing the growing political opposition and speculation surrounding the next election, Idris said, “It is not surprisingly, emerging coalitions and opposition political groupings do not want a sustained focus on the progress Nigeria is making. The administration however refuses to be drawn into distractions engineered by those who would prefer stagnation over reform.”

He concluded by reaffirming the government’s focus, “The Tinubu administration remains undeterred, focused, and committed to building a more prosperous Nigeria for all.”

‘ADC chasing shadows’

Meanwhile, the APC accused the ADC of chasing shadows and spreading falsehoods through its coalition efforts to challenge President Bola Tinubu in the 2027 election.

In a statement on Tuesday, APC National Publicity Secretary, Felix Morka, called on the ADC to provide evidence of its claim that the Federal Government officials held a secret meeting with the party’s North East and North West leaders to destabilise it.

On Monday, the ADC alleged that President Tinubu was working to undermine opposition parties in a bid to create a one-party state.

In a statement by its National Publicity Secretary, Bolaji Abdullahi, the ADC claimed that the Tinubu administration was deliberately targeting its leaders in the North East and North West to weaken the newly formed opposition coalition.

In response, the APC stated that neither President Tinubu nor the ruling party has any reason to waste time or effort creating confusion in the ADC, which is already deeply troubled by internal chaos caused by those who have taken over the party.

Morka stated, “Days after its dreary unveiling, the African Democratic Congress is, unsurprisingly, already trudging the beaten path of lies and deception like its opposition counterparts, the Peoples Democratic Party and Labour Party.

“Beyond the rash of poorly imagined accusations, the statement did not offer substantiation of any kind. Its vague reference to officials of the Federal Government only belies the mischievous intent of its makers to whip up sentiments, manipulate public opinion, and distract Nigerians from the patent hopelessness of their political phishing expedition.

“Otherwise, why is it so impossible for ADC to provide Nigerians the details of the alleged “secret meeting at which its senior party officers were coerced and intimidated. Rather, the party cites nonsensical credible intelligence as basis for its devious allegations.

“Clearly, there was no such meeting, and certainly, no one could have been coerced or intimidated at a meeting that never was. This could have happened only in the warped imagination of masters of deception and marauding invaders of the ADC.”

The APC said the ADC offers no real alternative for Nigerians, adding that it was only driven by bitterness and excessive presidential ambition.

Morka added, “There is no reason for Mr. President or APC to expend valuable time and energy trying to sow confusion within ADC that is already mortally wounded by confusion delivered by its invaders.

“The ADC needs no help from our great party to unravel as it must from its own internal dissonance, contradictions and discord of self-serving and vainglorious personalities that executed a gestapo-like takeover of the party to the chagrin of bonafide leaders and members of the party.

“The ADC’s statement is just a calculated preemptive excuse for its evident ill-fated future of disintegration, like Humpty Dumpty whose great fall could not be put back together again. It has placed on public display the incompetence and inability of its leadership to manage its impending internal crisis, in the same way they proved incapable of managing the internal affairs of opposition parties they have plundered serially before the ADC.

“And what good can possibly come out of a coalition of our country’s most inept politicians and architects of misrule, corruption, poverty and underdevelopment who are now congregated in ADC? What else can be expected from a coalition of failed and restless presidential contenders determined to bring down the roof on the altar of their inordinate ambitions?”

Morka said the ADC’s only strategy seems to be attacking the APC and discrediting President Tinubu’s unmatched record of economic recovery and national transformation.

The statement read in part, “The ADC and its leaders may be convinced of their ability to lie their way to presidential victory but they have a highly intelligent and discerning Nigerian electorate to contend with.

“They say one thing, mean another and do yet another. From Mr. Peter Obi’s desperate vow to serve a single term of four years if elected as President, and his pledge to fly only commercial airlines as President, even though he campaigned with opulence in private jets throughout the 2023 election season; to Mallam El-Rufai who failed spectacularly in comparison to mind-blowing transformation of Abuja by the award-wining incumbent Minister of the Federal Capital Territory, Nyesom Wike; to Ogbeni Rauf Aregbesola, whose lacklustre performance as Minister of Interior is now so glaring in the face of the innovation and super efficiency introduced by the current minister, Olubunmi Tunji-Ojo.

“None of the proponents of the coalition has the vision, the courage, competence, credibility, track record, zeal and patriotism to serve Nigeria better than President Bola Tinubu is already doing.

“While the opposition wallows in self-inflicted confusion, the Tinubu-administration and our great Party remain undistracted and will continue to build a virile and vibrant country for this and future generations of Nigerians.”

97 lawyers

Meanwhile, the ADC has announced that at least 97 lawyers are ready to represent the party in the ongoing court case.

In a statement issued by its media unit on Tuesday, the party accused the APC of sponsoring a lawsuit using the names of individuals who are not members of the ADC to challenge the party and its interim leadership.

On Monday, three members of the ADC – Adeyemi Emmanuel, Ayodeji Victor Tolu, and Haruna Ismaila –filed a suit at the Federal High Court in Abuja, seeking the removal of Senator David Mark as the party’s interim leader.

They contested the legitimacy of Mark and others serving as interim leaders, arguing that the transfer of the party’s leadership to those involved in the coalition arrangement may have violated an existing court judgment.

In the case marked FHC/ABJ/CS/1328, the ADC is listed as the 1st defendant, with the Independent National Electoral Commission and the party’s immediate past National Chairman, Ralph Nwosu, named as the 2nd and 3rd defendants.

Senator Mark (Interim National Chairman), former Osun State Governor Rauf Aregbesola (Interim National Secretary), and ex-Minister of Sports Bolaji Abdullahi (Interim National Publicity Secretary) are listed as the 4th, 5th, and 6th defendants, respectively.

In response, the ADC claimed that the individuals whose names were used by the APC to file the suit are not listed in the party’s physical or digital membership records in either Kogi or Nasarawa State.

The statement read in part, “The ADC accused the APC of deceiving Nigerians by using the names of non-ADC members to file a suit against the party and its interim leadership.

“The party alleged that the names which the APC used to file their suit were neither in the ADC physical nor does digital register in Kogi or Nasarawa states.

“It smacks of desperation that a party elected in charge of the lives of no fewer than 200 million people can engage in shopping for the names of its citizens in pursuit of Machiavellian politics.”

Also, the National Legal Support Group for ADC has expressed its readiness to represent the ADC in the courts over the matter filed against the party and its interim officers.

Making this revelation in Abuja, the leader of the group, Mohammed Sheriff, said “no fewer than 97 Lawyers have indicated their preparedness to stand for the party.”

Credit: The Punch

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY3 days ago

BIG STORY3 days ago