Nigeria, Africa’s most populous nation and a beacon of potential on the continent, continues to navigate a complex landscape of economic reforms, security threats, climatic vulnerabilities, and global pressures as of late 2025. President Bola Ahmed Tinubu’s Renewed Hope Agenda, launched with ambitious goals of economic diversification, security restoration, infrastructure revival, and social welfare enhancement, remains the guiding framework for national progress. Yet, two and a half years into the administration, tangible outcomes in several critical sectors fall short of the urgency demanded by citizens facing daily hardships, from blackouts and food shortages to rampant insecurity and untapped cultural wealth.

The average Nigerian believes the buck stops at the table of the president, they are half right. There are the buck bringers, the ministers who work closely with him and this is addressed to them. This opinion, grounded in fact and data looks at performance in four pivotal ministries: Art, Culture, Tourism and Creative Economy; Defence; Power; and Humanitarian Affairs, Disaster Management and Social Development. The intent is constructive: to highlight gaps not for blame, but to propel actionable reforms.

Harnessing Nigeria’s Vast but Underutilized Soft Power

Under Honourable Hannatu Musa Musawa, the ministry’s merger of tourism, arts, culture, and creative economy was visionary, aiming to position these sectors as pillars of non-oil revenue and job creation. Nigeria’s assets are unparalleled: over 1,000 annual festivals, two UNESCO World Heritage Sites (Osun-Osogbo Sacred Grove and Sukur Cultural Landscape), 14 tentative listings, vibrant Nollywood (second-largest film industry globally), Afrobeats dominating international charts, and natural wonders like Yankari National Park, Obudu Cattle Ranch, and the Idanre Hills.

Yet, as of November 2025, performance remains disappointing. International arrivals hover below pre-COVID levels, with World Bank data showing stagnation around 1-2 million annually, far behind Kenya (over 2 million) or Rwanda (rapid post-pandemic recovery). Tourism contributes less than 5% to GDP, compared to 10-15% in peers like Thailand or Kenya. Revenue projections for 2025 are modest at $3-5 billion, per Statista and WTTC estimates, despite potential for $10-15 billion with proper harnessing. Domestic tourism, vital amid economic constraints, lacks aggressive promotion—Lagos’ “Detty December” generates millions but remains localized.

In just 365 days, under the astute leadership of Aare (Dr.) Abisoye Fagade, the National Institute for Hospitality and Tourism (NIHOTOUR) has done what previous administrations feared to even attempt: it has fully activated the NIHOTOUR Establishment Act 2022. Where others saw lawsuits and entrenched interests, Dr. Fagade saw a sacred mandate. He moved decisively to enforce registration, certification, grading, and regulation of practitioners across hospitality, travel, and tourism.

The physical transformation is breathtaking. From a mere six campuses and zonal offices, NIHOTOUR has exploded to twenty-nine locations across the federation in under twelve months.

This is not just brick-and-mortar expansion; it is a deliberate democratisation of skills and opportunities. Thousands of youths, women, and previously excluded practitioners now have access to internationally benchmarked training in culinary arts, tour guiding, hotel management, and customer service excellence. E-learning platforms have been scaled, curricula modernised, and partnerships with international bodies initiated. Perhaps most revolutionary is the regulatory courage displayed. Dr. Fagade’s three-phase strategy stakeholder dialogue, systematic implementation, and unapologetic enforcement (with security agencies where necessary) has forced compliance from powerful operators who had grown comfortable in the shadows. Hotels, travel agencies, restaurants, and event centres are now being graded and certified. Standards are no longer optional. Revenue that previously disappeared into private pockets is beginning to flow properly to government coffers and, more importantly, service quality is rising. Youth unemployment is being attacked at its root through genuine skill acquisition. Investors can now see a regulated, professional sector worth betting on. In one year, NIHOTOUR has become the brightest spot in Nigeria’s entire tourism ecosystem.

Few days ago, the Honorable Minister of Art, Culture, Tourism and Creative Economy, Hannatu Musa Musawa, in an act that can only be described as inexplicable, announced the immediate suspension of all NIHOTOUR enforcement activities nationwide. The very agency that has delivered the most tangible progress under the Renewed Hope Agenda; the one actually implementing President Tinubu’s diversification agenda while the ministry itself has remained largely invisible, has been deliberately crippled.

Challenges persist: insecurity deters visitors, visa processes are cumbersome (despite e-visa improvements), infrastructure at sites is poor (e.g., poor roads to Sukur), and marketing is fragmented. Initiatives like the D30 Data Platform (launched for creative economy insights) and collaborations with NIHOTOUR show intent, it should not be extinguished. Nollywood exports grow organically, yet government support for formal distribution and IP protection is inadequate. The creative sector employs millions informally but suffers from piracy and limited funding.

Comparatively, Rwanda’s “Visit Rwanda” campaign (Arsenal sponsorship) boosted arrivals 20-30% annually post-2018, generating billions. Kenya’s Magical Kenya brand and visa-free policies for Africans drove 32% growth in 2023-2024. Thailand’s integrated cultural-tourism strategy (festivals + eco-sites) yields over $60 billion yearly.

For the longest time, one project i have expected from the ministry has been a VR guided tour of the wonders of Nigeria; Old Kano city, The Ife sculpture, Benin walls, Igboukwu Terracotta carvings. Ease visas as Rwanda did, turning arrivals into millions. Fund creative hubs like Korea’s Hallyu wave, exporting Nollywood to billions. Certify sites for safety, involve communities as Benin kings once did their guilds. This is the chance to unlock 20 million job to rival the glory of oil.

Defence in an Age of Shadows

In the tales of old, Ogun, god of iron, forged weapons for justice, not tyranny. The Oyo Empire’s cavalry swept vast lands; Kanem-Borno’s knights repelled invaders across deserts. Leaders like Sunni Ali Ber of Songhai protected caravans, fostering peace for trade. Yet when shields cracked, empires fell to hubris.

Nigeria stands at such a monumental moment in our history, Hannibal stands at our gate, infact, to put it into proper context, Hannibal has already crept through the crevices. Boko Haram’s resurgence, bandits in Zamfara’s forests, Lakurawa’s terror in the northwest. In 2025 alone, over 2,266 killed in the first half, surpassing all of 2024. Some villages have been sacked overnight, hundreds killed. The schoolgirls of Chibok are in our rearview mirror, Just a few days ago, another school was ransacked, and school students were carted away again. Kidnappings haunt highways; 33 million face hunger partly from untended farms.

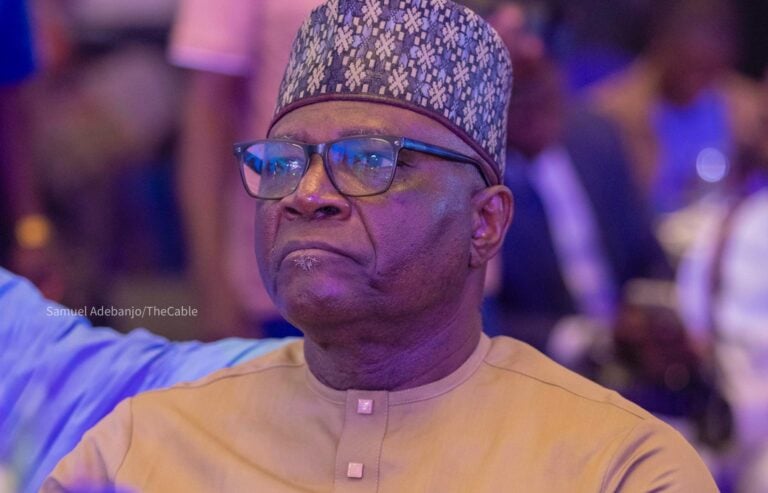

Honourable Mohammed Badaru Abubakar, the defense minister, is supposed to stand guard against these marauders; however, that has not been the case. To see real gains, we must seal loopholes that leak information to the insurgents, shift to population-centric counter-insurgency (COIN) and protect civilians first (Colombia model vs. FARC). Night operations, mobility upgrades; reduce special forces over-reliance. The need for oversight is needed; AI/drones for real-time surveillance. Community intelligence networks will be better.

Security is the lifeblood of investments; we cannot say foreigners or even local investors should come and put their money where insecurity reigns. Mohammed Badaru needs to tighten his belt. The military must come back to working for the people, not their own selfish agenda and ambition.

Powering Nigeria’s Path to Industrialization

Reliable electricity is the lifeblood of modernization. Under Honourable Adebayo Adelabu, the Ministry of Power has pursued reforms like tariff adjustments and the Siemens deal for grid upgrades. Yet, in 2025, challenges endure: frequent grid collapses, estimated losses of over N10 trillion annually to businesses from unreliable supply, and only about 4,000-6,000 MW generated against a demand exceeding 20,000 MW.

Public frustration is palpable; tariff hikes without corresponding service improvements have sparked outcry from labor unions. While privatization aimed at efficiency, distribution companies (DisCos) struggle with metering, theft, and collection. Rural electrification lags, exacerbating poverty.

Progress includes some mini-grid initiatives and renewable pushes, but the gap between policy and delivery widens hardship amid inflation. There have also been a number of power grid issues this year. To see more gains, there must full implementation of constitutional allowances for states to generate and distribute power. Support models like Lagos and Rivers’ independent projects. Aggressively pursue solar and hydro, targeting 30% renewables by 2030. Partner with private firms for off-grid solutions in rural areas, akin to Kenya’s M-KOPA success. Also the ministry should look into establishing an independent regulator with citizen representation to oversee tariffs and performance, ensuring hikes tie directly to service improvements.

A Compassionate Response to Vulnerabilities

With overlapping crises,displacement from insecurity, floods affecting millions, and economic shocks, the ministry (post-reshuffle under new leadership) manages safety nets like school feeding and cash transfers.

Yet, 2025 projections are grim: 33 million in acute food insecurity, up significantly, with Emergency levels nearly doubling. Floods submerged farmlands, cholera outbreaks surged, and aid access remains blocked in conflict zones. Past scandals eroded trust, though reforms aim to clean up.

This ministry is one on which there are weights of expectation and a lot of eyes look to. In a bid to revamp soiled reputation, transparency must be the order of the day. The ministry must work on integrating disaster management with agriculture for flood-resistant crops and early warning systems in partnership with states. Empower state emergency agencies and NGOs for faster response, reducing bureaucracy.

Nigeria’s challenges are surmountable with leadership that embraces feedback. To the Honourable Ministers of Art, Culture, Tourism and Creative Economy; Defence; Power; and Humanitarian Affairs: this is a professional appeal to redouble efforts. The Renewed Hope Agenda can shine brighter with innovative, inclusive, and accelerated implementation.

We, as patriotic Nigerians, stand ready to support through dialogue, expertise, and partnership. Let us move from critique to collaboration, for a secure, prosperous, and vibrant Nigeria.

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY22 hours ago

BIG STORY22 hours ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY4 days ago

BIG STORY4 days ago