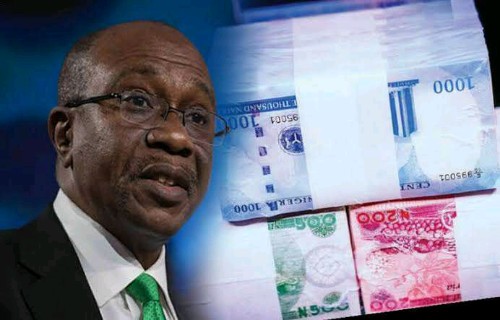

Banks are to blame for the scarcity of new naira notes, Central Bank of Nigeria (CBN) Governor Godwin Emefiele said yesterday.

He said some of them have not complied with a directive to only load the new notes on Automatic Teller Machines (ATMs).

Emefiele said instead, the banks have been handing out bundles to individuals who spray them at parties.

Cash-strapped Nigerians have been toiling to withdraw money from ATMs across the country.

Banks have stopped issuing the old notes, which will cease to be legal tender on February 10, but the new notes have been scarce.

Emefiele, who clarified that old notes can still be deposited after the extended deadline, said anti-graft agencies have been sent after erring banks and officials.

The CBN governor spoke when he appeared before the House of Representatives Adhoc Committee on the New Naira Redesign.

He was accompanied by Deputy Governors Aisha Ahmed (Financial System Stability), Edward Adamu (Corporate Services), Ade Shonubi (Operations), and Kingsley Obiora (Economic Policy).

The House and the CBN agreed that a time limit will not apply to the validity of old naira notes after the February 10 deadline, in line with the law.

After apologizing for his inability to honour previous invitations, Emefiele said the CBN met many times with the banks and provided them with guidance notes on the collection and processing of old notes and the distribution of new ones.

He said: “These include specific directives to the banks to load the new notes into the ATM nationwide to ensure equitable and transparent mechanisms for the distribution of the new notes to all Nigerians.

“We wanted to be sure that as the currency is issued, the banks must go through a process that is equitable and transparent, not treating some customers as a priority and some as less important.

“They were told to load this currency into the ATM. The ATM is a robot. People can only collect a maximum of N20,000 or N40,000, whether they are priority or not priority customers.

“I addressed the bankers on Sunday and I expressed to them my disappointment and in fact, the disappointment of the President and that of leaders with the way this has gone.

“Many of us have unfortunately seen the new naira, instead of being used for the purpose it’s meant, is used in parties, in celebrations.

“Some said, maybe, it’s money from the ATM and I said no, money from the ATMs is already broken. They (the ones spread at parties) are in leaflets.

“What we saw being stamped on people at parties were packages of the new naira notes, which means they (banks) had breached certain aspects of the guidance note we gave to them.”

The CBN governor said the Economic and Financial Crimes Commission (EFCC), the Independent Corrupt Practices and other Related Offences Commission (ICPC), the Nigerian Financial Intelligence Unit (NFIU), and the Department of State Services (DSS) have been directed to go after the violators.

“When I met President Buhari, I told him that we have met with the EFCC, ICPC, and NFIU to join us in monitoring the flow of this currency to our people.

“I am delighted that even yesterday (Monday), I read that the DSS had even started, which is what we want.”

Emefiele said while the old notes will cease to be legal tender on February 10, Nigerians can still take the old notes to the bank and exchange them for new ones or deposit the old notes.

Section 20(3) of the CBN Act 2007 provides that the apex bank should continue to accept the old notes until they go out of circulation.

Emefiele agreed with the House on the provisions, assuring Nigerians that they will not lose their money after February 10.

The CBN governor said: “You will not lose your money even when it loses its legal tender.

“You can take it to the bank and pay it into your account. But we should please, allow this policy to succeed.

“Section 20(3) of the CBN Act says even after the old currency has lost its legal tender status, we are mandated to collect those monies. I stand with the House of Representatives on this.

“What does that mean? The old notes would have lost its legal tender status, which means we have moved on.

“But, if you have the money that you have not been able to send into the bank, we will give you the opportunity to bring it back into the CBN to redeem it.

“Either you pay into your bank account or you want to exchange it, we will give it to you. It is your money. That’s the assurance I give to Nigerians.”

According to Emefiele, there have been noticeable benefits.

He said: “Inflation last month did not rise. We are expecting that it will continue to moderate and the exchange rate will be stable. We hope that with this exercise, the naira can even get stronger.

“We were able to support our security agencies. The incidence of banditry has reduced during this period. So, what we have done here is for the good of Nigerians.”

Emefiele apologized for the pain Nigerians have been subjected to in the last few days.

He said: “At these initial stages, there will be a few hitches and glitches. We apologize.

“But I want to say that the overriding interest is the economy – to make it stronger and better.

“We know in the process that some will be hurt, I will say temporarily. But it’s a pain that I will appeal to all of us to please, show some understanding.

“The overriding benefit to Nigerians is what we are interested in, which is about making our economy stronger and combatting the high incidence of insecurity.

“Yes, we saw a few failings on the part of the banks and we appealed to EFCC, ICPC, and NFIU and they are currently working with our officials nationwide to make sure that this process goes on seamlessly.

“We are happy that the exercise has achieved a success of over 75 percent in our villages, etc.

“It is on the basis of that we now have a 10 days extension for more and more of this to be collected.”

Chairman of the Committee and House Leader, Alhassan Ado Doguwa, said communication was essential.

“It is only when you interface that you have an opportunity to understand the policy of the government. So, this is a welcome submission but unfortunately at a belated point.

“If you (Emefiele) had communicated this much earlier, this crisis would not have come up at all. Nigerians would go home to sleep without any fear at all.

“I thank you for coming up with this submission, especially on the position of the law, that the bank will at all times respect the position of the laws of the land.

“It’s clear and written in black and white. I want to thank you on behalf of the committee for admitting the position of the law.”

Doguwa told the House during plenary that the CBN governor agreed to consider another extension of the validity of the old notes should there be a need for it.

Uncategorized2 days ago

Uncategorized2 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY3 days ago

BIG STORY3 days ago