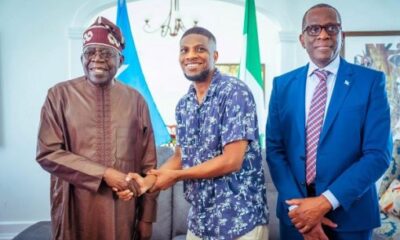

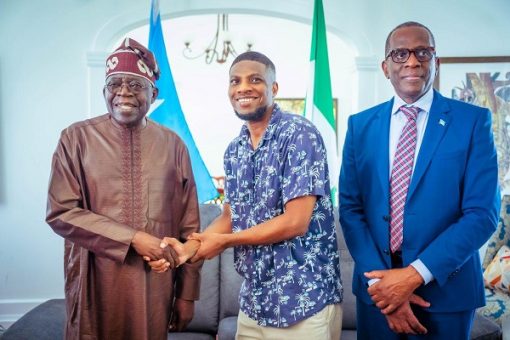

Oladapo Apara, former managing director of Alpha-Beta Consulting, has endorsed the presidential bid of Bola Tinubu, candidate of the All Progressives Congress (APC).

In an article published in ThisDay Newspaper, on Sunday, Apara said Tinubu is the “best man” to succeed Muhammadu Buhari as president.

The former Alpha-Beta Consulting MD said he picked Tinubu as the “most suitable” contestant after a “dispassionate assessment” of all the candidates in the presidential race.

In 2020, Apara, who was sacked as the managing director of Alpha Beta Consulting in 2018, accused Tinubu of owning the firm by proxy, which led to his dismissal and withholding of his share profit for the period he worked for the firm.

He also made allegations of money laundering, tax evasion, forgery, and a number of other corporate fraudulent practices against the company and its owners.

In September 2022, Apara withdrew the case from the court after reaching an undisclosed out-of-court settlement with the former Lagos governor.

“My choice of Asiwaju Bola Ahmed Tinubu as the best man for the job is based on a dispassionate assessment of his previous public office records and superlative antecedents, all writ large in Lagos state — Africa’s fifth largest economy were it to be a country on its own,” Apara said.

“My pick of Asiwaju Bola Ahmed Tinubu as the most suitable candidate for President in 2023 is also informed by a direct experience of the phenomenal Asiwaju Bola Ahmed Tinubu having worked with him for over twenty (20) years in various capacities, including at a point in my career when I worked at ALPHA-BETA Consulting, which company I eventually led as managing director/chief executive officer and honourably disengaged from in order to pursue other interests.

“I make bold to say that the great successes we recorded at ALPHA-BETA Consulting, especially the exponential increase in the internally generated revenue (IGR) of all our clients — local and international have everything to do with the capacity and competence of Asiwaju Bola Ahmed Tinubu as a colossus in public revenue generation re-engineering.

“Such was the undeniable results of ALPHA-BETA Consulting as a professional firm that many states in Nigeria across party divides discarded politics to engage ALPHA-BETA Consulting as their IGR consultants, including some West African nations.

“As a humble recipient of a cache of prizes in financial management and intermediation in Nigeria and across the world, I am convinced that at this juncture in our national journey Nigeria needs a president prudent and pragmatic in financial management like Asiwaju Bola Ahmed Tinubu.

“Asiwaju Bola Ahmed Tinubu is an extraordinary manager of human and material resources. As president, he would fix round pegs in round holes for a rapid socio-economic transformation of Nigeria into the country of our collective dreams.”

He said Tinubu is a “famous and credible name” associated with big businesses on the global stage and as president, Nigerians are poised to see more foreign capital and investment pouring into the country like never before.

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago