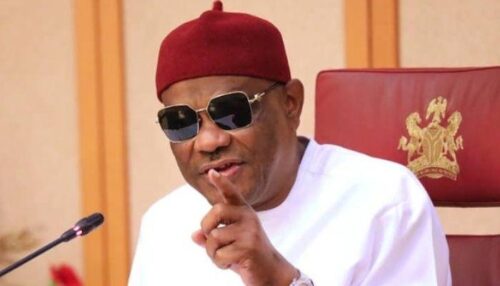

The Minister of the Federal Capital Territory, Nyesom Wike, on Tuesday warned striking staff of the Federal Capital Territory Administration to return to work immediately or face legal action, following a National Industrial Court ruling ordering an end to the strike that has disrupted public services in Abuja for over a week.

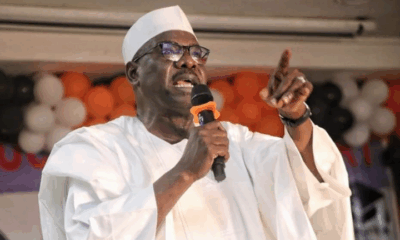

Briefing journalists shortly after the court’s decision, Wike insisted that the rule of law must prevail and accused political actors of exploiting the industrial action for motives unrelated to workers’ welfare.

“The administration was already in the process of mediation when some politicians hijacked the strike,” he said, adding that several of the workers’ demands were “frivolous” and either unreasonable or already addressed.

Wike said the FCTA approached the court after determining that the strike had been “hijacked by politicians,” despite ongoing dialogue and attention to a substantial number of workers’ concerns.

He highlighted the administration’s efforts to support staff welfare, including salary payments and reforms within the civil service.

The minister disclosed that more than N12bn had just been approved for the payment of January salaries to FCTA workers, describing the move as evidence of the government’s commitment to its workforce.

Pointing to improved revenue performance under his leadership, Wike noted that the FCT had generated over N30bn in internally generated revenue, a significant increase compared with previous years.

He urged workers to recognise reforms implemented by the administration, including the establishment of the Civil Service Commission and infrastructure investments across the territory.

“Workers are largely responsible for the lack of development in states, including the FCT,” he said.

Wike dismissed circulating reports suggesting he had been forced out of his office during protests linked to the strike.

“I was never chased out of the office,” he said, explaining that he had merely stepped out to see President Bola Tinubu off at the airport.

Adopting a firm stance, the minister warned against further disruptions of government operations.

“Anyone who dares to lock the gates again will be made a scapegoat, because the law must be obeyed.”

He alleged that some senior civil service officials had played a role in sustaining the strike, claiming that certain directors were instigating the action, but said this would not prevent the administration from pursuing the right course.

Wike emphasised that engagement between workers and the government did not require direct access to him personally.

“Seeing me in person is not a right,” he said, noting that workers’ representatives had been in discussions with management throughout the dispute.

He concluded by warning that staff who failed to comply with the court order and resume duties immediately would face legal action, signalling a tougher enforcement phase as the FCTA seeks to restore full public services.

Workers of the FCTA, operating under the Joint Union Action Committee, had embarked on an indefinite strike on January 19 over unresolved welfare concerns.

The National Industrial Court issued an interlocutory injunction stopping the strike after an application by Wike.

Justice E.D. Subilim granted the order on January 21 and adjourned the suit to March 23, 2026, for hearing of the substantive case.

Delivering his ruling on Tuesday, Justice Subilim said the defendants’ right to strike was not absolute.

“The defendant’s right to an industrial action is not absolute, but as circumscribed by law,” he said. He prohibited workers from participating in the strike once a dispute had been referred to the court and ordered that any ongoing strike must cease pending determination.

“An order of interlocutory injunction is hereby granted, restraining the defendants and respondents, their agents, representatives… together with all other members of the Joint Unions Action Committee … from further embarking on any industrial action, strike, picketing, lockout, or any other form of obstruction against the claimant, parastatals, and political appointees,” the judge added.

Counsel for the claimants, James Onoja (SAN), hailed the court’s decision, urging the unions to obey the order and return to work while allowing room for mediation.

“We commend the court for making an order for the stopping of the strike… I think this is commendable because it will allow the parties to discuss. Our plea to the Union is to allow industrial harmony. They should go back to work and allow for mediation,” Onoja said.

Counsel for the respondents, Maxwell Opara, described the workers as law-abiding citizens and said he would advise the unions to respect the court order.

“The workers are law-abiding citizens. We are going to advise them to respect the court. The one good thing is that the court has also mandated that we commence mediation, not as a matter of advice, in line with the law… we must comply with it,” Opara said.

JUAC President, Rifkatu Iortyer, confirmed that workers would comply, call off the strike and immediately return to work while continuing to “push for other things.”

“We are law-abiding citizens, and because they have said we should return to work, we are returning to work, pending our next appearance,” she said.

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY2 days ago

BIG STORY2 days ago

POLITICS2 days ago

POLITICS2 days ago

POLITICS2 days ago

POLITICS2 days ago