Africa’s Global Bank, United Bank for Africa (UBA) Plc, has collaborated with Mastercard to launch a commemorative debit card in celebration of UBA’s 75th anniversary.

This collaboration aims to honor UBA’s long-standing customer relationships and enhance their banking experience with a range of offers and discounts across multiple platforms.

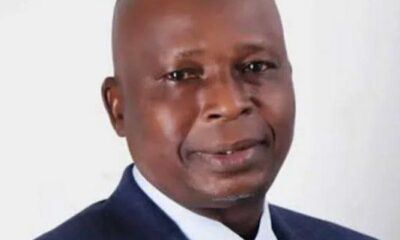

UBA’s Group Managing Director/Chief Executive Officer, Oliver Alawuba, who spoke at the unveiling, highlighted that the card comes loaded with certain benefits aimed at rewarding customers, including limited 25% off purchases on Jumia and USD75 cashback on transactions made through AliExpress.

He added that this initiative symbolizes the shared vision between UBA and Mastercard towards empowering Africans by enhancing customer experience through secure and convenient transactions.

“This new card represents the deepening of our relationship and our shared mission to empower millions of Nigerians and Africans, by providing them with access to secure transactions and new opportunities across the continent,” Alawuba said.

The GMD also disclosed the bank’s plans to unveil similar products across all its subsidiaries. “We are proud of this collaboration, and we are confident that Mastercard’s role in Africa will only grow stronger in the coming years,” he added.

Mark Elliott, Division President for Africa, Mastercard, expressed his appreciation for the UBA collaboration, emphasising its significance in supporting Africa’s digital economy. “We are excited to collaborate with UBA to celebrate this milestone and bring more value to customers across Africa. This commemorative card is more than just a product; it reflects our commitment to advancing financial inclusion and supporting Africans in accessing secure, convenient and impactful financial solutions.”

Elliott highlighted the immense opportunities within the African payment ecosystem and shared that Mastercard is eager to explore new opportunities with UBA. “Together with UBA, we are focused on delivering innovation that meet the evolving needs of the region, empowering individuals, and promoting digital growth across the continent,” he stated.

The launch of the commemorative debit card represents a significant step in UBA and Mastercard’s shared journey towards financial empowerment and innovation across Africa.

About United Bank for Africa

United Bank for Africa Plc is a leading Pan-African financial institution, offering banking services to more than forty-five million customers, across 1,000 business offices and customer touch points in 20 African countries. With presence in New York, London, Paris and Dubai, UBA is connecting people and businesses across Africa through retail, commercial and corporate banking, innovative cross-border payments and remittances, trade finance and ancillary banking services.

About Mastercard

Mastercard powers economies and empowers people in 200+ countries and territories worldwide. Together with our customers, we’re building a sustainable economy where everyone can prosper. We support a wide range of digital payments choices, making transactions secure, simple, smart and accessible. Our technology and innovation, partnerships and networks combine to deliver a unique set of products and services that help people, businesses and governments realize their greatest potential.

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago