BIG STORY

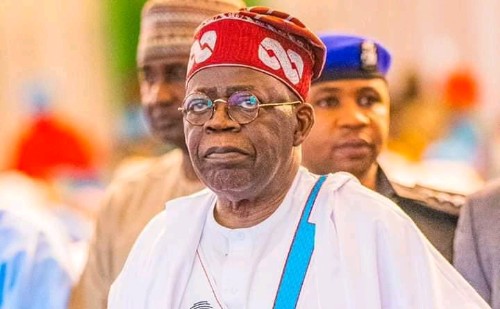

It’s Fake News, We’re Not Investigating US Case Against Tinubu — INEC

-

BIG STORY4 days ago

BIG STORY4 days agoNational Assembly Passes Life Imprisonment Bill For Nigerian Drug Traffickers

-

BIG STORY2 days ago

BIG STORY2 days agoDiscos May Move Three Million Subscribers To Estimated Billing Over Failure To Upgrade Prepaid Meters

-

BIG STORY5 days ago

BIG STORY5 days agoFG Pushes For Simon Ekpa’s Extradition As IPOB Disowns Biafra Agitator

-

BIG STORY4 days ago

BIG STORY4 days agoUPDATE: We’re Ready To Provide Evidence For Trial Of Simon Ekpa — Enugu Government

-

BIG STORY2 days ago

BIG STORY2 days agoDonors Supporting Simon Ekpa Guilty Of Terrorism — Lawyers

-

BIG STORY2 days ago

BIG STORY2 days agoBritish Court Orders David Hundeyin To Pay N200million As Damages To BBC Journalist For Libel

-

BIG STORY19 hours ago

BIG STORY19 hours agoJUST IN: Ebonyi Governor Suspends Health, Housing Commissioners Over “Gross Misconduct, Negligence Of Duty”

-

BIG STORY4 days ago

BIG STORY4 days agoMuch Ado About Meddlesome Minions, And Messengers Of Misinformation — By Tayo Williams