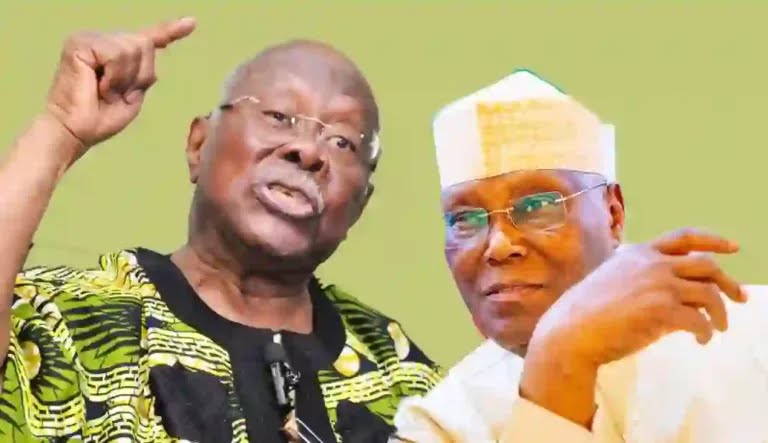

A former Deputy National Chairman of the Peoples Democratic Party, Chief Bode George, has advised former Vice President Atiku Abubakar to end his 31-year-long bid to be President.

Noting that Atiku’s bid to be President dated back to 1993, George said it was high time the former Vice President retired from such a contest, especially in the 2027 election.

Addressing a press conference at his Ikoyi, Lagos office, on Thursday, George urged Atiku to assume the position of an elder in the nation and leave his bid to posterity.

“To Atiku, my advice is this, you will be 81 years old in 2027, and you have been contesting for the presidency since 1993. This is the time for you to calm down and act like an elder. I appeal to you in the name of the Almighty Allah, that you serve, to take it easy and leave everything for posterity,” George said.

George decried that the PDP was on the verge of crumbling because people uplifted their personal interests and individual ambitions above national interest.

He criticised the “divisive, arrogant, haughty” members of the party romancing the ruling All Progressives Congress yet failing to defect from the PDP, describing them as cowards.

“We are where we are today because of a self-inflicted crisis; we should bury our individual ambitions now and not allow the PDP to crumble, please. Elders of the party should tell some of these funny characters to cool off and think of our national interest instead of their personal interest.

“Nigerians are angry and hungry. Instead of telling the APC the truth, some divisive, arrogant and haughty members are busy romancing the ruling party and they are quick to refer to themselves as elder statesmen. Instead of instigating a crisis in our party, why are they not bold enough to defect to the APC? Do they really fear God at all? No member is big enough to hold the party to ransom,” George added.

Particularly pointing to the crisis between Rivers State Governor, Siminalayi Fubara, and his predecessor and Minister of the Federal Capital Territory, Nyesom Wike, George urged Wike to immediately “cool off” from wanting to “bring down” Fubara.

George said it was worrisome that some party members, rather than bringing the two parties to mediation, further fuelled the Fubara/Wike crisis for their selfish interests.

“My advice to Wike is very simple. You are my political son. I am therefore appealing to him to cool off immediately. I know he was injured by friends during the last PDP presidential contest, but I am advising him as a father to please take it easy. Nobody is bigger than any party. Forget what happened in the past and let us work together in the interest of this party.

“I want to ask the elders at the helm of affairs of our party today, ‘What exactly is the offence of Governor Siminalayi Fubara of Rivers State?’ What exactly is the offence of this gentleman that some elders of our party are trying to throw him under the bus because of political expediency? What exactly is going on that some party members don’t feel bothered about the happenings in Rivers State? Governor Fubara was helped by Governor Wike to become the number one citizen of the oil-bearing state. The governor himself acknowledged this on several occasions.

“Must the governor now behave like a slave to his predecessor and other characters because of this concept of godfatherism which is a misnomer in our politics? Why are some party members encouraging his predecessor to bring him down? He is in Abuja; he wants to control what goes on in Rivers State.

“Did the governors before him behave this way? Why are the party leaders not eager to mediate and bring both groups to normalcy? The PDP cannot continue like this. Why can’t we learn from our past mistakes? Is our party jinxed? Why can’t we tell all these troublemakers to go and sit down if they don’t want this party to move forward?”

The National Assembly has amended the National Drug Law Enforcement Agency Act, prescribing life imprisonment for drug offenders and traffickers.

This decision followed the adoption of the harmonised report by the Senate and House of Representatives on the NDLEA Act amendment.

Presenting the report, the Chairman of the Senate Conference Committee, Senator Tahir Monguno, explained that the amendment sought to impose stricter penalties to deter illegal drug activities.

The amendment specifically stated: “Any person who unlawfully engages in the storage, custody, movement, carriage, or concealment of dangerous drugs or controlled substances and, while doing so, is armed with an offensive weapon or disguised in any manner, commits an offence under this Act and is liable, upon conviction, to life imprisonment.”

The Senate approved the recommendation through a voice vote during Thursday’s plenary, presided over by the Deputy Senate President, Barau Jibrin.

In addition to the NDLEA amendment, the Senate also passed a bill to empower the Revenue Mobilisation, Allocation, and Fiscal Commission.

The proposed legislation, known as the Revenue Mobilisation, Allocation, and Fiscal Commission Bill of 2024, sought to replace the existing RMAFC Act of 2004.

The updated law revises the commission’s composition and operational framework to ensure federal, state, and local governments receive constitutionally mandated resources to address governance and developmental challenges.

Presenting the bill, the Chairman of the Senate Committee on National Planning and Economic Affairs, Yahaya Abdullahi, highlighted the urgency of reforming the commission in light of Nigeria’s dwindling revenues and growing population.

Abdullahi explained that the bill aims to strengthen RMAFC’s mandate as the constitutionally recognised body responsible for monitoring revenue generation and ensuring its equitable distribution among the three tiers of government.

“The Act, last revised over 20 years ago, no longer reflects Nigeria’s evolving economic realities. This bill proposes additional funding and a restructured operational framework for the commission to improve its efficiency,” he said.

He further emphasised that adequate funding from the Federation Account was critical for RMAFC to perform its constitutional responsibilities effectively, noting that funding challenges had previously hindered its performance.

The Senate endorsed the bill following deliberations and a majority vote.

It now awaits President Bola Ahmed Tinubu’s assent to become law.

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY5 days ago

BIG STORY5 days ago