BIG STORY

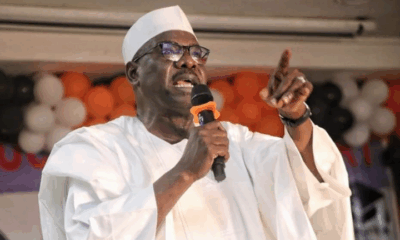

VAT Should Be Suspended On Diesel — Taiwo Oyedele, Presidential Tax Committee Chairman

- /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 27

https://porscheclassy.com/wp-content/uploads/2023/08/resize1691596462026.jpg&description=VAT Should Be Suspended On Diesel — Taiwo Oyedele, Presidential Tax Committee Chairman', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

- Share

- Tweet /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 69

https://porscheclassy.com/wp-content/uploads/2023/08/resize1691596462026.jpg&description=VAT Should Be Suspended On Diesel — Taiwo Oyedele, Presidential Tax Committee Chairman', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

BIG STORY

Resident Doctors Give Federal Government Four Weeks To Meet Demands

BIG STORY

Lagos Couple Stages Self-Kidnap To Raise Funds For Husband’s US Return Ticket, Arrested With N10m Ransom

BIG STORY

Police Arrest Six For ‘Hacking Telecoms Firm To Divert N7.7bn Airtime’, Recover 400 Laptops, 1000 Mobile Phones

-

BIG STORY4 days ago

BIG STORY4 days agoJUST IN: Defence Headquarters Finally Confirms Coup Attempt Against Tinubu, Indicted Officers To Face Military Trial

-

BIG STORY4 days ago

BIG STORY4 days agoNo Party Or Person Can Defeat President Tinubu In 2027, Atiku’s Son Declares

-

BIG STORY4 days ago

BIG STORY4 days agoBREAKING: Soludo Closes Onitsha Market For One Week Over Sit-At-Home Defiance

-

BIG STORY4 days ago

BIG STORY4 days agoJUST IN: NLC, FCTA Workers Protest At Industrial Court, Demand Wike’s Removal [PHOTOS]

-

NEWS1 day ago

NEWS1 day agoReimagining Urban Spaces: The Forward-Thinking Public-Private Collaboration in Obalende’s Transformation By Babajide Fadoju

-

BIG STORY2 days ago

BIG STORY2 days agoReturn To Work Immediately Or Face Legal Action, Wike Tells FCTA Workers As Court Orders Strike Suspension

-

BIG STORY3 days ago

BIG STORY3 days agoAlaafin, Soun Absent As Makinde Kicks Off Oyo 50th Anniversary

-

BIG STORY4 days ago

BIG STORY4 days agoLeave Me Out of 2027 Running Mate Permutations, Tinubu Will Decide What’s Best —– Dogara