BIG STORY

Unity Bank Targets Women; Launches Yanga Account

BIG STORY

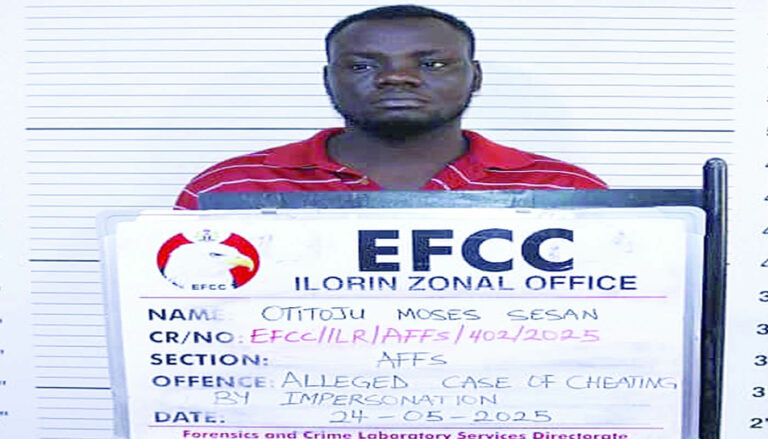

Court Jails Gospel Singer Moses Otitoju, Eight Others For Cybercrime

BIG STORY

Kogi University Lecturer Dies During Sex Romp In Hotel Room With 200-Level Student

BIG STORY

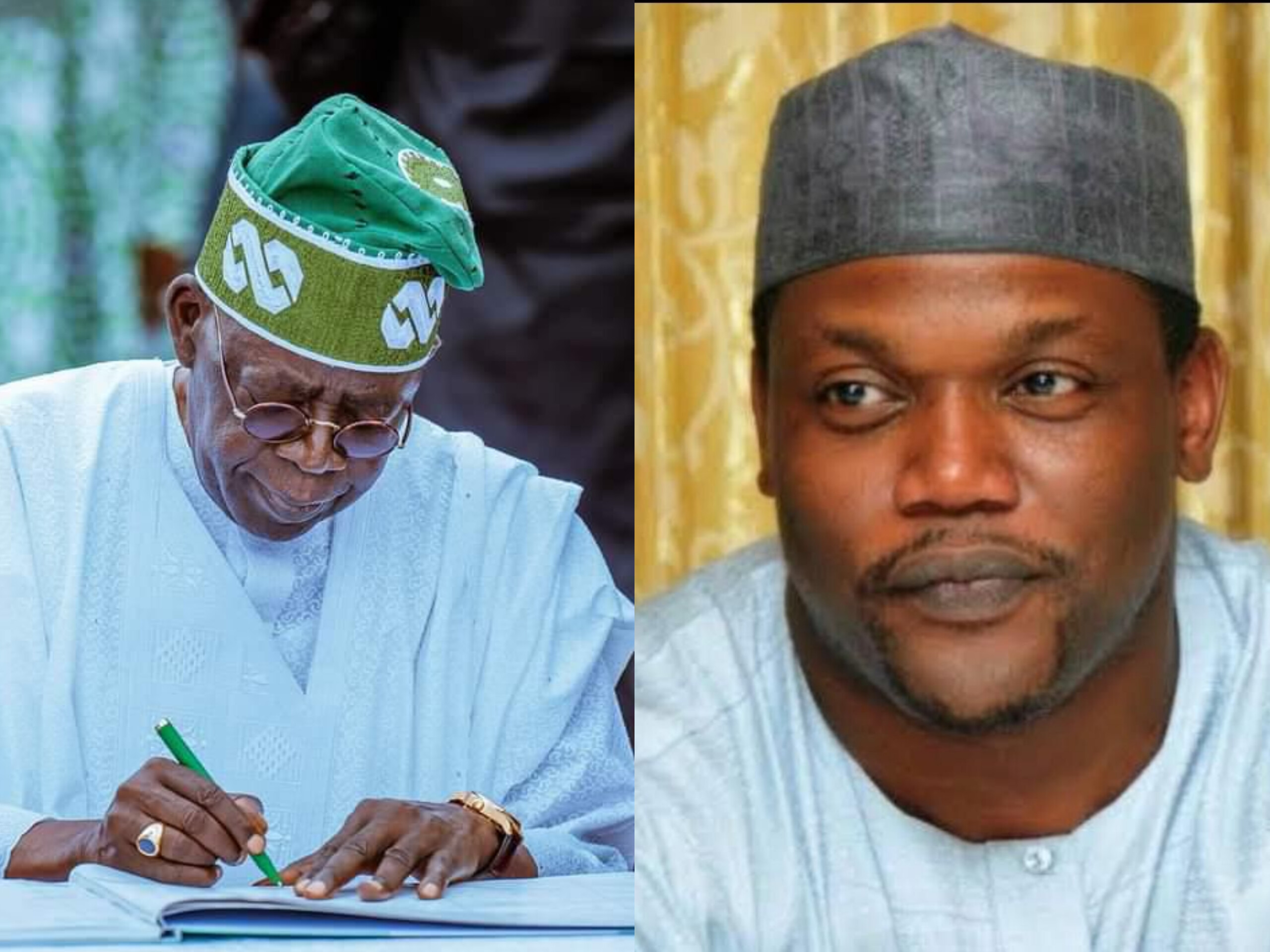

FULL LIST: Tinubu Appoints IBB’s Son, Muhammad Babangida Chairman Bank Of Agriculture, Others As Heads Of Govt Agencies

-

BIG STORY2 days ago

BIG STORY2 days agoRCCG Pastor Absconds With $8000 Church Money, Abandons Wife, Marries New One

-

BIG STORY4 days ago

BIG STORY4 days agoAmaechi Wears Turban To Buhari’s Burial In Daura

-

BIG STORY1 day ago

BIG STORY1 day agoFULL LIST: Tinubu Appoints IBB’s Son, Muhammad Babangida Chairman Bank Of Agriculture, Others As Heads Of Govt Agencies

-

BIG STORY4 days ago

BIG STORY4 days agoAliko Dangote Submits Paperwork To Build Biggest Seaport In Nigeria

-

BIG STORY2 days ago

BIG STORY2 days agoKeyamo Faults Atiku’s Use Of Coat Of Arms In PDP Resignation Letter, Says “You Left Office 18 Years Ago”

-

BIG STORY4 days ago

BIG STORY4 days agoWhat Buhari Told Me About President Tinubu After Fuel Subsidy Removal — Katsina Governor Radda

-

BIG STORY1 day ago

BIG STORY1 day agoBuhari Never Wanted To Congratulate Saraki, Dogara After Emerging Senate President, Speaker — Femi Adesina

-

BIG STORY1 day ago

BIG STORY1 day agoLagos Unveils Nigeria’s First Local Government Owned Radio Station [PHOTOS]