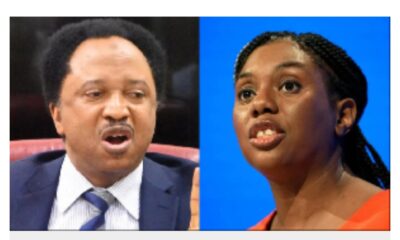

Two days after Senator Natasha Akpoti-Uduaghan was stopped from resuming her duties, the Nigerian Senate adjourned plenary on Thursday for its annual break, which will last until September 23, 2025.

As a result of the recess, the suspended Kogi senator will now complete the remainder of her suspension before the next plenary session.

Akpoti-Uduaghan was handed a six-month suspension on March 6, 2025, after being accused of misconduct and insubordination during the February 20, 2025, plenary when she refused a seat reassignment.

The Senate had cautioned that her suspension might be reviewed if she failed to offer a formal apology.

Her punishment stemmed from the findings of the Senate Committee on Ethics, Privileges and Public Petitions, which found her guilty after reviewing the complaints.

The suspension was due to end on September 6, 2025. However, the recess means she will serve the full term before the Senate returns.

Speaking to reporters on Tuesday after being denied entry into the Senate chamber, Akpoti-Uduaghan criticised the Senate’s action as unlawful and revealed plans to challenge it in court.

“Even the suspension ab initio was fraudulent—the document was faulty,” she said.

“Going forward, I will have a meeting with my legal team so they can proceed to the appellate court to seek interpretation of what just happened. I am a law-abiding citizen.”

She also accused Senate President Akpabio of exceeding his constitutional powers.

With the recess in place, the Senate will not reconvene until her suspension has lapsed.

During plenary, Senate President Godswill Akpabio announced the recess, describing it as “chamber reciprocity” since the House of Representatives had already started its break in line with the legislative calendar.

“We have started a new calendar that will take us to next year, June. And so it has fallen within this period for us to go on for a break to enable us to undertake major oversights,” Akpabio explained.

He stated that while plenary would be paused, committee activities should continue during the break.

“All necessary committees—the diaspora committee, committee on reparation, committee on interior and others—this is the best time for you to undertake visits to prisons and all that.

“Do all your reports and make them available as soon as we come back,” he directed.

Akpabio encouraged senators to carry out oversight functions across the country, emphasising that their legislative responsibilities must continue.

“You are moving from plenary for the next few weeks, but you are not stopping your legislative functions, because that’s what your people elected you to do. Members are expected to travel to Sokoto, everywhere, to observe the road repairs that are going on.

“By the time we resume, you are expected to bring your reports, committee by committee, for us to look into. I want to wish you safe travels and for all of us to return in good health,” he added.

Akpabio also announced the passing of Prof Janet Plang, wife of Senator Diket Plang.

He said arrangements had been made for senators to attend her burial in Plateau State on Friday, with a flight scheduled to leave Abuja at 8 am.

Senate Leader Opeyemi Bamidele expressed appreciation to senators for their dedication to legislative duties.

“We thank all our colleagues for all they have done to ensure that the business of lawmaking on behalf of the government and people of Nigeria has progressed smoothly,” Bamidele said.

He then proposed postponing all remaining items on the order paper to the next sitting, which was unanimously accepted by the Senate.

Natasha delayed at airport

Separately, the suspended senator was reportedly held up at the Nnamdi Azikiwe International Airport in Abuja last Thursday while attempting to board a flight to the United Kingdom.

A family source disclosed that immigration officials claimed she had been placed on a watch list by order of the National Assembly leadership.

“She was told that the leadership of the National Assembly requested that she be considered a flight risk and placed on a watch list,” the source said.

“We are wondering why they treated her that way, given there is no court order restricting her movement and she has never missed any of her court appearances.”

Eyewitnesses said Akpoti-Uduaghan looked distressed and made several phone calls before being allowed to travel after her passport was stamped.

Speaking shortly before departure, the senator confirmed the incident, saying, “The aircraft is about to take off.”

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY3 days ago

BIG STORY3 days ago